Yield Hunting Newsletter February 2021 | A GameStop Market

Summary

The markets were on track for their fourth winning month in a row and eight of the last nine until the last week. The VIX is up substantially as well.

While January was a decent month for discount tightening it was less than what I expected. A lot of externals likely weighed on sentiment and prevented further tightening.

CEF valuations remains "okay" but are now getting to the richer side of average with the latest moves. Munis remain the most attractive after loans had a great month.

There is a lot going on in the equity side of things and it wouldn't surprise me if that volatility spilled over to the bond side.

No Core trades this month.

“The term mania describes the frenzied pattern of purchases, often an increase in prices accompanied by an increase in trading volumes; individuals are eager to buy before the prices increase further. The term bubble suggests that when the prices stop increasing, they are likely – indeed almost certain – to decline.”

-Charles Kindleberger

“This over eagerness to buy is a classic sign of a bubble.”

-Unknown

Website: www.yieldhunting.com

The GameStop Market

Who would have thought some little known video game retailer that was teetering on bankruptcy would be the centerpiece of our markets in January. I've been a member of Wallstreetbets for many years and honestly, never thought much of it.

One of the more sophisticated members (u/DeepF*ckingValue) who would post his research on 'deep value' names using a Ben Graham model, posted one on a company called GameStop (GME). In December, this person bought 50K shares of GME plus 1,000 call options that expired April 2021 at a $12 strike for $0.20 each. At the time the shares were trading around $9. The total cost of his investment was $450K for the shares and $200 for the options.

His thesis was that the company was changing its business model given the shift in consumer buying behavior of video games; that it had enough cash on hand to survive a couple of years, and the new management team was stellar. Oh, and he noted how the short positions was so large that even a small move higher would send the shares cascading up and inflict some real damage to the short sellers which were mostly hedge funds.

The reddit followers slowly joined in and soon it turned into an entire crusade to take down the hedgies. With millions of little guys joining together each buying a few hundred shares they drove the stock up to $500. The reddit poster continued to hang on to his position. His $200 options bet alone turned in a $16.5M position.

Then Robinhood got stuck between a rock and a hard place. To keep this as simple as possible, as a broker and a clearinghouse they were forced to come up with cash each time a Robinhood trader bought GME on margin. And when there's a large mismatch between buyers and sellers, the broker needs to come up with the collateral. Robinhood is a small broker and didn't have that kind of financing. It drew down all its credit lines and asked for a loans from other entities.

So the CEO restricted the buying only of GameStop and others that were being pushed on Reddit. And now, the investors that use Robinhood think the hedge funds got to Robinhood and made them restrict it. Robinhood is going to face massive lawsuits and user flight. It is likely not going to survive.

It's hard to know how this all will play out. Goldman put out a note saying that if the short squeeze continues it could mean a lot of volatility and pain for the broader markets.

Our service was created to move away from all stock investing. This could hit the equity markets (or it could just peter out in the next couple of weeks). But I was encouraged to see bond CEF prices and NAVs hold up well when the Dow Jones was down 650 points on Friday and more than 3% on the week. At the same time, our Core Portfolio was essentially flat (-0.18%) over those same five days.

For the month, the Core was up 0.60% while the S&P 500 fell over 1%. The ending yield for the Core was 7.4% and the current discount -3.64%, from -3.61% at the start of the month.

This drama is definitely something to watch.

Introduction | New Portfolio Models | Please Read!

We are happy you are with us for another year and will continue to strive to improve your fixed income returns going forward while keeping a firm eye on risk. The Google Sheets are getting an upgrade but we want to keep it from getting out of hand in terms of the amount of information. Our goal would be to get it to a point where there are 3 tabs of "lists" of CEFs and other securities that fit within our purview .

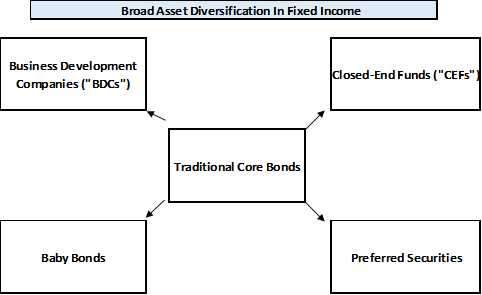

Our goal is to cover three of the satellites as well as the " traditional core" in the middle. We will continue to offer up options for members in each of these buckets outside of BDCs. The breakdown of the asset allocation among these buckets really depends on you, your situation, and your risk tolerance.

As such, for those that may need a bit more hand-holding, we developed three model portfolios that can be followed in the fixed income part of your portfolio. There is a lower risk, moderate risk, and aggressive risk allocations with underlying portfolio holding options. This is something that will be buy-and-rent with the objective of making only one or two trades per month in each portfolio.

Remember, we are only talking about the bond side of your portfolio. The equity side is outside of this service and you can access it very easily with today's tools.

What are traditional "core" bonds?

We classify those the way investors accessed the bond market for most of the last 30 years- traditional multisector bond funds that mimic the moves of the Barclays US Aggregate Bond Index ("AGG"). The AGG is about 37% US treasuries, 16% agency MBS, and 46% corporate bonds of investment grade quality. The future return of the index is going to be very low, likely below 2% for the next 5-plus years (see below).

However, most multisector bond funds are 90%+ bonds with little in the way of treasuries. So they carry more credit risk than interest rate risk. That is by design as interest rates are extremely low at the moment and offer up little in the way of income.

We have a list of traditional bond mutual funds on our peripheral tab near the bottom. We currently use the following for this space:

Guggenheim Total Return (MUTF:GIBLX)

Thornburg Limited Term Income (THIFX)

Columbia Mortgage Opps (CLMAX)

Fidelity Total Bond (FEPIX)

Performance Trust Strategic (PTIAX)

Angel Oak Multi-Strategy Income (ANGLX)

The greater the amount allocated to the traditional core bond sector, the less risk your portfolio will have. Of course, the less income and total return you are likely to achieve. Its a delicate balancing act that each investor needs to come to grips with.

Most can just use the Core Portfolio for their CEF allocations. I try and cover all the bases there with sector and sub-sector diversification. But others may want to add some of the optional substitutes and/or peripheral choices. That is fine. Just be mindful of the total exposure to leveraged products like CEFs in the portfolio.

For preferreds, I'm mostly buy and hold until they get called away from me. The income stream is most important here. I like to buy below par ($25) but that's not always the case. In some instances, I buy near $26 and the yield-to-call may be marginal. So you're taking a bit of a bet here that the issue will not be called at least right away.

Baby bonds are much the same thing as preferreds. They are exchange traded debt of mostly the high yield variety. Essentially, they are the easiest bonds to buy by retail investors. You purchase just like a stock unlike most OTC debt which much be purchased through dealers.

Business development companies ("BDCs") are similar to CEFs but they tend to be less liquid and a bit more on the spectrum of risk towards equities. I like them here given the discounts but just be careful. Do not expose yourself to a single BDC by more than 2% of your portfolio.

Smaller Bubbles Are Around But No Mega One

'Bubble' is now a common word when discussing financial markets. Anytime investors think markets are expensive, the word bubble comes out. I don't subscribe to the notion that we are in a bubble. There are very small pockets of the markets that are frothy like SPACs (special purpose acquisition vehicles), bitcoin, and some heavily shorted names (GameStop, Tesla, to name a couple).

However, in general, equites are a bit rich relative to earnings and baking in a large rebound for 2021 and 2022, but they are not a bubble.

We discussed areas of the market that do look better in our article "What Worked In 2017 Will Likely Work In 2021". In it we said investors should focus on the left behind areas of the market including but not limited to:

Value stocks using something like the Russell 1000 Value (IWD), Yacktman Fund (YACKX)

Bank stocks like the SPDR S&P Bank ET (KBE)

International developed markets using Lazard Global Total Return (LGI), Clearbridge Int'l Growth (LGGAX), Fidelity Int'l Cap Appreciation (FIVFX), or Calamos LS Equity Dynamic Inc (CPZ).

Emerging markets, both debt and equity. For equity, using Artisan EM (ARTYX), Templeton EM (EMF), Emerging Markets Internet & Ecommerce (EMQQ) or Matthews Asia Growth (MIAPX). For debt, I like TCW EM Debt LC (TGINX).

From JP Morgan:

Our Global Equity strategists addressed rising investor concerns over the bubble potentially forming and the consequent risk for broader equities. They point to a very hot IPO market with record volumes and performance, the demand frenzy for SPAC vehicles, surge in retail participation and dramatic runs in areas ranging from cryptocurrencies to disruption stocks. They argue that whether or not we are in a bubble, excess liquidity will stay at records as balance sheets of key central banks will move outright below only in 2022. In addition, they believe that central banks are sufficiently worried about the Japan scenario that they might end up visibly falling behind the curve. Tapering could start from/after Q4, with risk markets not pricing it in before the 2H of the year. For the overall equity market, P/Es are currently 2-8 points higher than norms, but they are not unreasonable. Relative equity - bond & credit yield gap remains very attractive, and the stage of the cycle is a help. This is not to say that the “hot" areas of the market might not get much more volatile, and be subject to bouts of profit taking. However, they believe that periods of weakness on the back of this, should be ultimately used as opportunities to add exposure

The Bond Challenge Going Forward

We've discussed this a lot in the last two years. With little income remaining in the treasury market and very high quality corporate bond market, bonds will not be the ballast they once were. In the last few years, many people including myself have called for an end to the 60/40 portfolio as new lows continue to be reached in interest rates.

But in 2020, the AGG returned over 7.4% which is close to the long-term average. So maybe not so dead yet?

But interest rates fell from nearly 2% to 0.37% in the first few months of 2020 as the Covid recession hit. The duration of the index is over 9 meaning that a 1% drop in the index equates to a roughly 9% gain in value.

With little income left to get to zero, investors are right to question the benefit of holding them going forward. Now, we aren't saying the same thing about the traditional core bond funds mentioned above. The is a little down the spectrum of risk as they have little in the way of treasuries and even hold some non-investment grade debt and other riskier asset classes to get their return.

So are bonds worth holding any more? They clearly won't be the hedge to equity risk that they once were. In fact, you may just want to hold the '40' in cash as a downside buffer.

AQR recently lowered the 60/40 forecasted returns for the next five to ten years again. They see the 60/40 returning just 1.4% after inflation or 3.4% before it. The long-term average is near 7% gross and 5% net of inflation.

Negative real cash returns are now expected in all major markets with the exception of Canadian dollar.

Most troublesome for us, the projected return for the high-yield bond sector has more than halved in the last year.

AQR has been pounding the table for a few years now that investor return objectives are going to be harder and harder to meet with these prospective returns. The thesis remains that rich equity prices and low interest rates combine to make this the hardest investing environment of all time.

The table below shows the cumulative total return for the 10-yr treasury bond by decade. But with the 10-yr at 1%, the forecasted return for this decade is a mere 11%- cumulative.

The analysis shows that rates would need to go decidedly negative for investors to earn the return they did in prior draw downs including the Financial Crisis and Dot-com bubble. Fed Chairman Jay Powell has said repeatedly that negative rates are not a tool the Federal Reserve is likely to use.

If we use Japan as a template, then there may be one more "crisis" left in the AGG with about a 15% return if the 10-yr went to negative 50 bps. And that is an optimistic scenario.

However, the potential downside is higher certainly if inflation picks up significantly and the copious amounts of fiscal borrowing gets out of control. You don't need much rise in interest rates to completely wipe out 5 years' worth of income from treasuries.

So the challenge for investors who do not want 100% of their portfolio invested in stocks is: what to do? This is why we came up with this service in the first place and have evolved it over time. We believe the future of the 60/40 portfolio will be incorporating "hybrid" assets that DO carry more risk but offer up much better return prospects and help investors meet their return hurdles.

So what's the answer? Gold? Currencies? Option strategies? More stocks?

The answer to the problem is accept more risk or accept lower returns. That is really the only choice. We've documented the prospect for lower returns many, many times (ad nauseum). And we've noted that many investors are already taking more risks- a la' increasing their equity allocation or replacing bonds with dividend paying stocks.

This is an option but investors should realize the amount of additional risk that they are taking in making that move. Stocks have far more volatility (about 5x) than bonds and do not have a terminal value in the same sense. Bonds are essentially a loan, and unless the company defaults, you get that principal back. A stock is valued by the market without a terminal value. In other words, you can have a permanent capital loss.

Preferred securities, CEFs, and baby bonds can exhibit a lot of volatility at times thanks to those markets being much smaller than the traditional bond market and the equity markets. But typically they rebound when liquidity returns. And you can produce up to 3x the yield than you would from traditional bonds and bond funds.

This is why we created this service and the new portfolio models. For many of the more sophisticated members they have their own plans, risk tolerances, and strategies of coping with this problem. The downside beta to equities for the strategies we promote should not be ignored. During a "crisis", the correlations of these securities tend to rise substantially. This is why we are always discussing the emotional and behavioral aspects to investing. Markets fall and markets rebound. Not making mistakes during the fall and during the rebound is imperative.

This is why we like the LDI (liability driven investing) approach to retirement income planning. If you live off the income produced by the securities then you don't have to worry about ever having to sell down.

The bond challenge is going to create a retirement crisis in the coming years. Not just for individual investors but even larger concern would be for pension funds. Most public pension funds use wholly-unrealistic return assumptions on their assets. For instance, the state of Colorado assumes a 7.75% rate of return with their 50/50 allocation. Perhaps they have 50% in bitcoin and 50% in Gamestop. Not sure. Otherwise, that is not happening.

So I want each member and investor to ask themselves, do I want 2% or less from my bonds or do I want to take a bit more risk and get to 5%+.

The Core Portfolio | Update January

CEF discounts have come full circle from a year ago. The average taxable fixed income CEF today is -3.50% compared to -2.90% at the end of January 2020. Taxable fixed income CEF discounts topped out at -1.3% on the third week of February before the Covid crisis his. Could they get there again? Certainly. I'm actually surprised they haven't already but that is likely to do with the amount of volatility in the equity markets acting as a weight.

I do think discounts can tighten a couple more points in the taxable space and perhaps as much as five points on the muni CEF side. The average muni CEF trades at a -5.8% discount today. A year ago that was -3.3%. At their tights in mid-February, discounts reached -2.4%. Just to get there would mean an additional 3 points of tightening.

Outside of MLPs, convertibles were the best performing sector in January rising 5.9% on price but only 2.7% on NAV. So we saw a lot of discount tightening in that space as the NAVs continue to do well. Most of the tightening was in BCV and ECF which have been big winners for us but are now kind of expensive. I like CHI, CCD, and NCZ better here.

Preferreds had a negative month on price by -1.6% while the NAVs were down slightly. We recently updated our view on preferreds (HERE) saying they are looking a bit better here but not overly cheap yet.

Munis continue took attractive at the fund level with decent discounts to where we think they should be. NAVs are expensive as muni prices move ever higher. We still like them a lot.

High yield has done well but we continue to limit our exposure preferring to get that from the senior loan space. That move has paid off as the high yield sector was up 0.8% in price and 0.55% on NAV in January but loans were up 3.5% on price and 2.4% on NAV.

Investment grade remains unattractive here given the low yields and the dearth of opportunities within the CEF sector. We would be limiting our exposure here simply because real yields are negative. It was the only other fixed income sector that was down in January.

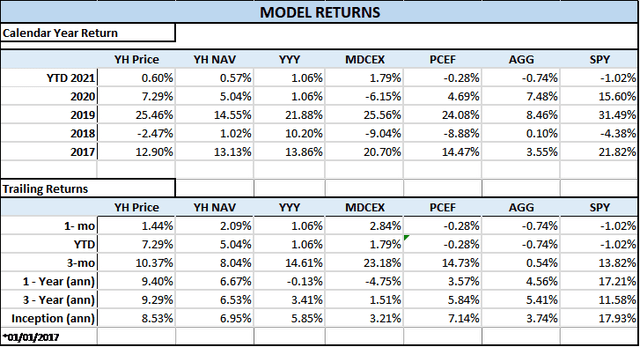

Here are our returns for the month against the most appropriate benchmarks:

Trade Summary:

No trades this month.