Why Use Closed-End Funds to Boost Your Monthly Income!

For a limited time, subscriptions are 20% off!

Take advantage of this offer now!

Closed-End Funds Provide A Way To Access Institutional Leverage - Sometime For FREE!

Closed-End Funds (CEFs) can borrow short term and invest "long" to earn that spread on the borrowed funds. As a percentage of net assets, leverage costs today are primarily sub-1% (depending on the type of leverage employed).

So even if they are investing in generic high yield bonds at 4.34%, they are earning a healthy spread of at least 3.4%.

So how do you get that for free you ask?

One of the number one questions I typically receive from novice CEF investors are those concerned about fees. Expenses have been marketed to death by the likes of Vanguard and Blackrock to push their ETF businesses. But just because something is cheap doesn't necessarily mean it's better.

The problem with some 1940 Investment Company Act reporting is that CEFs need to include interest expense as part of the annual expense ratio. Thus, I typically get a question like "Why does this fund charge 2.23%! That's ridiculous!"

The management fee may be about 1.0% (which is a bit higher than open-end bond mutual funds) but may be paying 1.0% on the borrowed funds and another 0.23% for other expenses. The 1.0% management fee, while higher, is not egregious.

In fact, we think the CEF wrapper provides such superior value compared to an open-end bond mutual fund that the added fee is easily made up.

For the 1.0% management fee, you can offset that too by purchasing at the right time. When you purchase a fund at a discount, you are subsidizing your yield. A fund trading at a 10% discount is likely producing about 10% more in income than if it were trading at NAV (like open-end and exchange traded funds do). That extra 10% in yield can be more than the 1.0% management fee resulting in you getting the fund's portfolio management for free!

The interest expense may indeed be an expense but one that is a huge advantage... TO YOU!

If you are paying 1.0% for interest expense in a fund that borrows $20M to apply some leverage, that is $200K per year in expense borne by the shareholders. However, if that $20M is invested earning 4.34%, then the fund is producing income of $868K for a profit on those borrowed funds of $668K. If the fund's size is $100M (with 20% leverage), and that capital is invested in the same securities, you are producing $4.34M in income (4.34% yield) plus another $668K from the leverage for total income of $5.01M.

The yield becomes 5.01%. Add in a 10% discount and your yield is now 5.51% compared to a fund without leverage of 4.34%. That is 27% more income for "free"!

This is why CEFs tend to provide more value than open-end mutual funds or ETFs on the bond side. In our opinion, there's virtually no reason to own passive bond funds or ETFs. Even active bond mutual funds are suspect here except as hiding out places while you look for opportunities in closed-end funds.

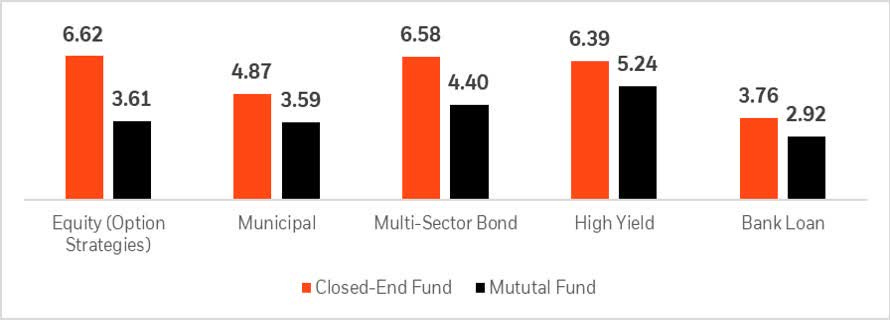

This is illustrated by the following table which compared CEF vs mutual fund returns in select bond categories over the last five years.

With central banks keeping interest rates low for the next several years, interest expense should remain well below 1% for an extended period of time. This could be one of the best opportunities in the CEF market in years.

Yield Hunting Premium Subscription

For a limited time, subscriptions are 20% off! Take advantage of this offer now!

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 8+% yielding portfolio.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 8% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor. Current yield 8.53%.

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.46% (some tax-free muni income).

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability. Current yield of 4.96% (mostly tax-free).

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securities where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.