What Are The Best Distribution Retirement Strategies? Part I

Welcome to the jungle of retirement planning and going from an accumulator investor to a distribution one. This is probably the most difficult shift for an individual to do. At the same time, most financial advisors do not have an answer to the predicament we face.

Professional wealth managers today face the most difficult task in the last 100 years. We have a bulge of the population that is approaching or just entering retirement (baby boomers). Today, most boomers are squarely in the red zone (aged 55-70) which is the most dangerous for your retirement nest egg.

Coupled with that, we have a market that is near record highs after running over 300% since the March of 2009 bottom. In fixed income, yields, while off the all-time lows set in mid-2016, are still very low from a historical context. If your financial advisor hasn't warned you of this, then either they want to hide you of this fact or worse, they are oblivious to it.

Millions of retirees today are working with an advisor who plans to hold a portfolio of mutual funds and/or ETFs and make systematic withdrawals on a regular basis by selling shares. This is the easy way out. The probability of success with this type of strategy and a withdraw rate above 4% is likely very low. The ultimate success of the retirement strategy with two identical portfolios can vary significantly, even without changing the underlying holdings or adding risk. It comes down to the distribution strategy- how you withdraw from which bucket, which asset classes, and in what order.

The problem many investors face is an early retirement market plunge causing their portfolio to enter a death spiral. Consider a retiree in late 2007 with $1,000,000 and a 4% withdrawal rate (a common strategy). If their diversified 60/40 portfolio fell by 28% in 2008, PLUS they withdrew $40,000 for lifestyle spending, their portfolio ended 2008 at $680,000. If their portfolio rebounds by 20% in 2009, and they still take the $40,000, their portfolio is still at $776,000.

This is called sequence of returns risk and we have been focusing on it for the last year plus. Having to make withdrawals in the early years (<65 years old) can send the portfolio down into a death spiral. Investors need to understand that having flexibility in the portfolio to combat these dangers is imperative today.

The challenge for financial advisors is the answer on how to combat and introduce that flexibility as planning is different for each retiree. This is a failure of the business model. Advisors like to be able to scale so having to customize each clients' portfolio AND distribution strategy can be cumbersome and inefficient. It's substantially easier to throw all their clients into similar portfolios and use similar withdrawal strategies and move on to gaining the next new client.

We discussed several times over the past years about investing in traditional 60/40 portfolios (made up of mutual funds and/or ETFs) where the advisor has a systematic distribution plan by selling shares, you should seek a second opinion. For most retirees, they are unlikely to have large enough portfolio balances whereby this strategy is the most appropriate.

If you do not work with a financial advisor and are a do-it-yourself planner, than early preparation is key. A recent article in the NY Times titled, "Countdown To Retirement" laid out a lot of the topics that should be considered. They recommend starting to plan at least five years before you cut the cord with employment.

Put aside some time this year to contemplate what retirement will actually mean for you. Sure, you want to travel a bit, and maybe you imagine going someplace warm for the winter months. Nearly everyone wants that. But what about your day-to-day existence? What will you do with yourself?

“People often fail to consider how they will feel once they’re removed from the work force,” says Andrew Russell, a fee-only financial planner in San Diego. “While work can be stressful, it can also be rewarding to feel important and a sense of accomplishment.”

Mr. Russell suggests taking classes, joining a social group or exploring hobbies you enjoy while still working. “This can help keep you engaged in activity even once you’re retired,” he says.

Investors should be asking themselves a few things:

What are my goals/objectives?

Do we have enough capital to meet them even under the most pessimistic assumptions?

What mix of stocks/bonds/other is appropriate for me?

What should I/we be doing NOW in order to prepare for retirement?

So What Assets Do You Sell In Retirement?

Most of the time, we see investors and advisors alike simply rebalance the account and in the process, raise cash for distribution purposes. Very little importance is placed on valuations or where we are in the cycle. In a prior life, I can recall moving a 60/40 client to 40/60 in 2007 as they were approaching retirement and the yield curve at just inverted. In a subsequent review meeting- after the market rose another 8%- the client was upset that we were now "market timing" his account.

Were we? Absolutely not. It was about risk management and mitigating pitfalls like sequence of returns risk as they entered retirement. Some advisors/investors may call that market timing, but we believe it to be prudent risk management ahead of the cessation of his working years.

Cullen Roche of Orcam Group calls this Counter-cyclical investing which is great terminology. A static asset allocation doesn't fully incorporate the changing risk landscape of the cycle. A 60/40 portfolio in 2009 has a much different risk profile than in 2018 or 2007. That is because the later and deeper into a market cycle you get, the 60% allocated to stocks becomes inherently more risky.

As we've noted previously, if an advisor doesn't account for your changing circumstances (you are approaching retirement) and the market/economic cycle's, then we believe they are not doing an adequate job for you.

So what do you do?

One way to distribute from your portfolio would be to sell the most appreciated assets. Instead of simply trimming pro-rata from each asset class, cutting back on the asset classes that have had a good run can be a good strategy. It helps to mitigate risk and capturing the assets at their highs. As we noted above in the counter-cyclical investing strategy, selling cyclical assets, especially in the second half of a bull market, is a logical course of action. It has the effect of reducing your stock allocation as you progress through the market cycle while leaving your safer investments (bonds and cash) alone to remain as the ballast to the portfolio.

One can make this more quantifiable or more qualitative to make it relatively low maintenance. On the latter, if stocks are up over the prior two years, then sell stocks for your distribution. If they are down, sell your bonds or utilize your cash bucket.

Don't Touch The Principal!

The most common withdrawal strategy is too simply withdraw a percentage of the portfolio each year. We often hear of the 4% rule- where 4% is withdrawn each year. As long as the portfolio generates more than 4% total return, the principal balance doesn't fall. However, there are sequencing of returns problems in addition to future investment returns likely being lower, imperiling that strategy. It's is certainly not a bulletproof strategy.

Most experts believe the 4% rule in terms of sustainability is closing in on 2%, eliminating it as a possible choice for many retirees without large enough portfolios to meet their spending needs.

We believe given where we are in the cycle that an ideal withdrawal rate from one's portfolio is one where principal is not touched. We call this cash flow investing or a no withdrawal portfolio. It is not for everyone as many investors will not have large enough portfolios to create such a strategy. In essence, we want to generate yield from multiple sources to meet our spending needs while still having exposure to stocks for long-term capital appreciation and an inflation hedge.

There are many different flavors on how to achieve this. But an overall yield of 4-6% can provide most investors with enough income to meet their needs. If their need is greater, than the need in relation to wealth likely has to be re-assessed.

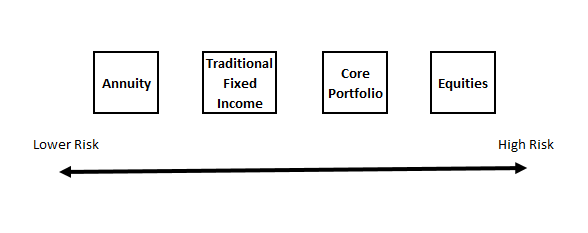

One way for this to work is to combine several different buckets to diversify risks. Below is a framework for this structure.

Annuities

income annuity can provide a defined benefit-like pension helping create additional base income on top of their Social Security. Annuities are likely to increase substantially in popularity especially as they become more transparent with regard to fees. We have discussed some of the advantages of income annuities in prior reports ("Some Possible Solutions That Not Many Advisors Are Discussing- Part III"). If an investor doesn't want to purchase an annuity, they maybe can use accumulated cash value within their life insurance policy as a tax-friendly source of withdrawals.

Income annuities provide very stable income streams and some provide you the ability to participate in rising rates. The downside is that capital is "used" and you no longer have access to it.

Traditional fixed income would be comprised of 1) individual investment grade bonds, 2) intermediate duration core mutual funds, and 3) Separately managed bond portfolios. This is a fairly safe bucket of high quality investments tied more closely to PIMCO Income (PONAX) or iShares iBoxx Corporate Bond ETF (LQD).

The Core Portfolio

The Core Portfolio is our foundational income portfolio aimed at generating a higher yield than traditional fixed income. The current yield is just under 8% and we typically advocate holding less than 35% of the total portfolio in this segment. Our goal is to generate almost equity-like returns with substantially less risk than the S&P 500. So far, we have done that.

Lastly, there is the equity bucket. While being risk averse and managing stock market exposure in retirement is typical, you do need something in that segment in order to produce long-term growth. This is your inflation hedge and mostly permanent capital. In other words, money that we shouldn't need to touch, ever.

For most people, it is a plug. We determine our annual income need from the portfolio. Allocate certain percentages to the annuity, traditional fixed income, and Core Portfolio based on risk tolerance and other factors. The leftover can (but doesn't have to be) placed into the equity bucket. This helps put a cap on risk by requiring the investor to place enough in the "safer" buckets before allocating to equities.

In order to increase your risk tolerance, you could simply hold more cash. Another strategy could be to set aside up 1 - 3 years worth of cash based on spending need. By segmenting that cash, you do not have to sell shares during bear markets impairing the portfolio. In down markets, you draw down your cash bucket until the market recovers. The negative aspect of this strategy is 3 years' worth of cash is a substantial sum and the opportunity cost of holding it in pure cash can be significant, especially over 25+ years of retirement.

Managing Sequence of Returns Risk

We have discussed this topic fairly regularly over the last two years. We believe this risk is one of the most pressing for investors, especially as the yield curve flattens, signalling a growth slowdown. In our Weekly Commentaries to our members, we routinely highlight the yield curve as a way to toggle our risk tolerance and guide our overarching investment policy.

During the prior downturn, when the yield curve inverted, we did overlay certain portfolio protections in order to reduce our exposure to the market. While portfolios still fell, the moves helped to mitigate the losses and provide the foundation for a rebound, all the while generating enough income for distribution investors.

Any non-correlated asset class that houses enough capital and liquidity to draw on during down markets can be used to mitigate risks. Above we used pure cash, which is certainly an option. But the opportunity cost can be high. Other options include cash value life insurance, which can be safe bucket cash that can be tapped for income replacement in lean times. We discussed this in our report, "How To Create A (Nearly) No-Risk Fixed Income Portfolio That Won't Go Down."

Cash segmentation

Cash value life insurance

Line of credit

BulletShares ETFs.

Lines of credit can be another mechanism for meeting income needs without selling shares. Most brokerages allow for margining of investments up to a certain level at fairly decent rates. Interactive Brokers has some of the lowest rates (around 3%) but Fidelity, depending on the amount, is up around 8%. Having a line of credit (margin) setup ahead of time can be a good idea. It can also be used in conjunction with a pure cash account in order to reduce the opportunity cost of that strategy.

Lastly, we recently discussed another strategy of using an ETF bond ladder of high-quality bonds for the cash segmentation ("Avoiding Sequence of Returns Risk With Easy Laddered Bond Portfolios"). These ETFs yield just over 3% on a net basis. The investor simply places the present value of the need into the appropriate year ETF.

Conclusion

Simply having a 60/40 portfolio of stock and bond funds and systematically selling shares as you need it over time is fraught with peril. In order to navigate what we believe is the most precarious minefield for retirees in generations, advisors and investors are going to need to mitigate the most amount of risk possible. Most of these risks center on sequence of returns and stopping work just as the market sees another substantial decline. The last two recessionary bear markets produced S&P 500 declines of 50% or more. This time around, interest rates are lower and will not provide as much ballast as in prior years.

We go through some strategies investors can use as they prepare for retirement. People between the ages of 55 and 70 are in the "danger zone" and will need to caution with their portfolios and make sure they are properly prepared. Creating a full income plan for retirement is essential and should be done year in advance. There are numerous ancillary variables that must be considered. For example, will you downsize the home? Will you work part-time? What about long-term care policies? Is your will up to date? Is a reverse mortgage right for you?

As we move forward, we will spend more time on strategies, focusing on certain products in the mutual funds, closed-end funds, and annuity spaces with deeper dives into these securities and examples of portfolios. One area we believe financial advisors and investors should focus on is tax alpha, the ability to grow your portfolio through savings on your tax bill. The new tax law institutes numerous changes that should be parsed for areas of opportunity.