Weekly Commentary | September 15, 2024 | Muni CEF Rally, Preferreds CEFs!, FMN Tender Starts

Summary

Stocks rebounded strongly, with the S&P 500 up 5% and Nasdaq nearly 6%, driven by technology stocks, despite slightly higher core inflation.

CEFs have been on a tear, especially taxables, but future discount returns are likely nominal; consider holding unless valuations misalign with economic outlook.

Significant distribution increases across various funds, with notable moves in MLPs and preferred CEFs; Flah & Crum funds are tightening, suggesting potential buys.

Upcoming tenders and rights offerings present opportunities; hold off on tendering Federated Hermes Muni Income shares and consider participating in Blackrock Municipal Income tender.

Macro Picture

Stocks rebounded after last week's sell off (the worst weekly decline in over a year) for one of the best weeks of the year. The S&P 500 rose 5% and the Nasdaq was up nearly 6%. Growth stocks outpaced value shares by a wide margin, helped by strong performance from technology stocks.

Core inflation was slightly higher than expected and seems a bit stuck around 3% while headline inflation is now +2.5% y/y. Housing (shelter) remains the piece of puzzle that cannot be solved as it showed a modest increase in the CPI.

The ECB lowered its deposit rate for a second time this year, announcing a 0.25% cut to 3.5% that was in line with expectations. The move came amid signs of weakening economic growth and slowing inflation in the eurozone.

Futures markets continue to price in at least a 25-bp cut with a 50% chance a 50-bp cut, with valid arguments for either move. I continue to think we will see a series of 25 bps moves. There are seven meetings between now and the end of the second quarter and I believe we could see an incremental move in each, lowering the base rate from 5.5% to 3.75%.

That is, unless something in the data materially changes. And that's the key.

CEF Market Review

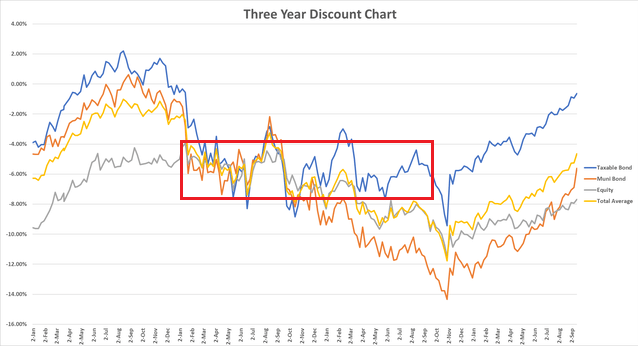

The discount chart tells it all. You can see the absolute tear that CEFs have been on for the last nearly year. Taxables have been moving hard all year and never really saw the same level of widening that equities and muni CEFs did (the red box above). Thus, they started from the a higher level when the rally began.

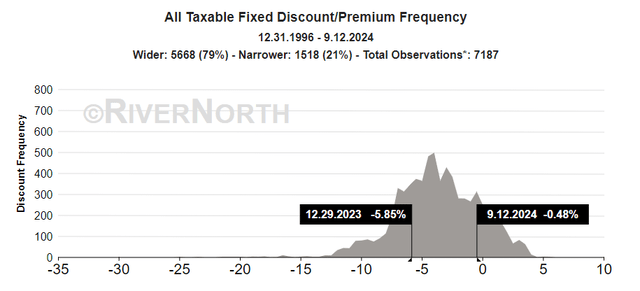

Taxables today are down to the 21st percentile. We are clearly on the right side of the distribution. The amount of discount return going forward is likely to be nominal.

Does that mean you sell out?