Weekly Commentary | Sept 25, 2022

Macro Picture

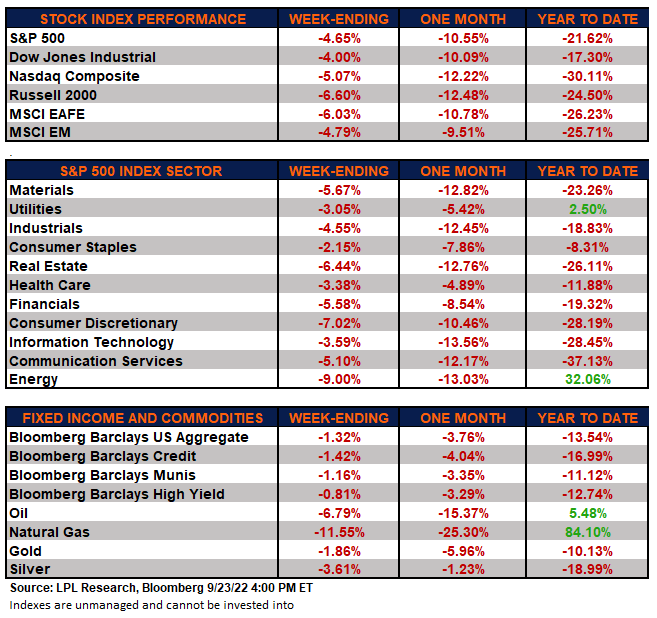

Stocks suffered a brutal week falling nearly 5% as the Fed raised rates 0.75% and signaled that there would be no pivot forthcoming. A narrative shift is underway as the market is now pricing in a higher-for-longer scenario. That means cuts to short-term rates will not be coming any time soon.

In fact, we may see rates stay high for another year or more as the Fed needs to make sure that inflation continues its downward trajectory. That means we may have to contend with a harder landing scenario in which the economy has to contract farther in order to hit inflation as much as they need to.

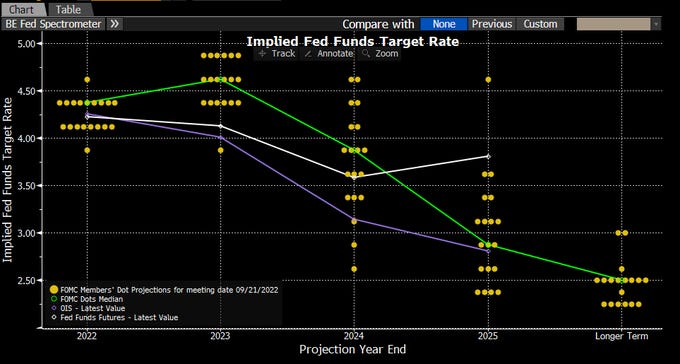

Fed funds is now at 3.0% - 3.25%, the highest since March 2008 when the Fed was cutting rates. The dot plot released this week shows a wide disparity in forecasted rates by Fed Governors. They see a small recession next year with slowing growth and rising unemployment but they note that they can cut rates in 2024 so they have options to fix that problem.

The issue is that the FOMC tools are very blunt instruments which amount to doing surgery with a wood club. They do not have that kind of precision to accurately assess data real time and adjust to soft land a $20T economy. No chance.

I noted late last year that raising interest rates doesn't fix the supply chain issues. While those are slowly repairing and adjusting to the new normal, the only thing the Fed can really do is on the demand side. They can raise rates and reduce the balance sheet- both of which have the effect of increasing borrowing costs and slowing money creation.

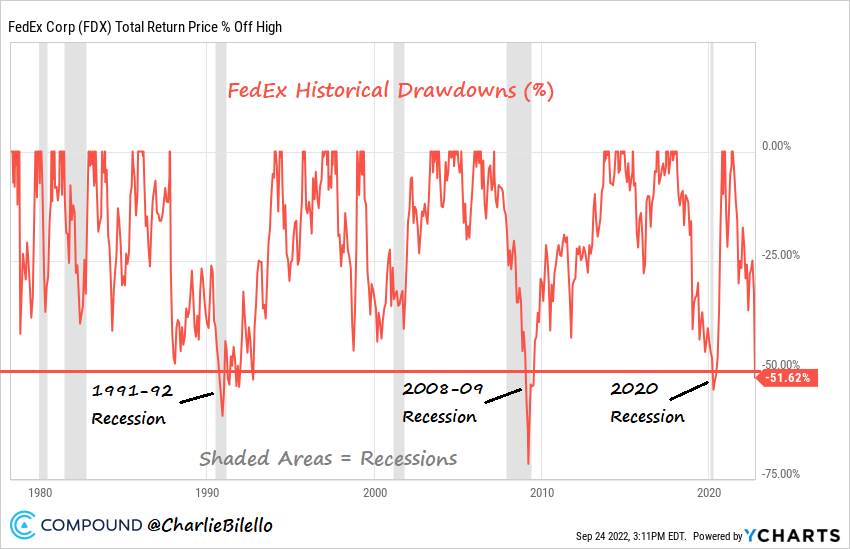

FedEx discussed this in their earnings call a couple of weeks ago noting that demand was drying globally and that they see a recession coming. The problem for the Fed is it takes time to show up in the economic data. FedEx has point-of-sales tools and real-time analytics in a very key industry of the global economy. They have been data to make the assessment of the health of the economy.

Charlie Bilello notes here that in the three prior 50%+ drawdowns in FedEx stock, we had a recession:

I think there is zero doubt we have a recession. The market, retesting the June lows, clearly agrees now. How much further do we have to drop and how much is priced in becomes the real question. I do think we have further to fall and that the fourth quarter could be ugly.

The VIX rose above 30 for the first time since late spring but remains below that 35 level that it hit several times this year.

Bear markets since WWII have averaged about one year with an average decline of 32.7%.

What comes next?

To me we see more pain and perhaps a higher interest rate regime from here. I continue to think we are far closer to the end of the rise in the 10-yr than the beginning.

Moderating inflation should help the Fed but it won't come for several more months. However, when it does it will come with a weakening labor market which should reduce wage growth and ultimately, bring down inflation faster.

This will eventually allow the Fed to pivot but again, we are about a year away from that right now. When that comes, we will want to be in long-duration assets as well as moving towards equity risk. The twelve months following the last rate hike tend to be good one's for the stock market. That is because the market is forward looking and by then, the market has, or come close to, bottoming.

CEF Market Review

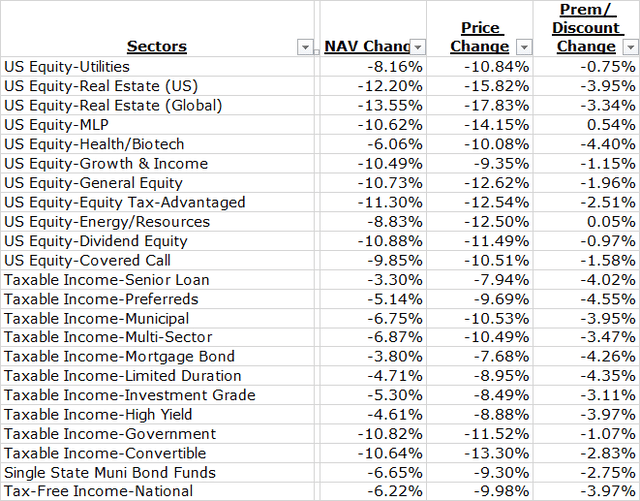

We are FINALLY seeing the discount blowouts we had been expecting. In just the last five weeks, taxable bond CEF discounts have gone from just -2.8% to -8.1%. That is a 2.5 standard deviation move and nearly 3x in less than a month. Muni CEFs widened by 3 points to -6.9% and equity CEF discounts are finally moving to where they should be at -6.2%.

We may be seeing the capitulation in discounts at least, that we've been waiting for.

Muni CEF discounts are still shy of the 90 with the sector being at the 79th percentile as of Thursday. The average discount is -6.2%.

My issue is that high yield spreads still have not widened out materially like I would have expected- especially given the price discovery and narrative shift of the last week. At 4.91% (and that data is through Friday), the high yield bond market is showing little signs of a recessionary event at this point. This is puzzling to me especially since the price of oil has fallen so much recently.

After peaking at $118/bl on WTI back in June, we are down below $85 as of this writing. That is a huge deflationary driver but it is also a key catalyst for high yield bonds since a large segment of the high yield bond market is from energy players. Of course, $85/bl oil is hardly a problem for the drillers. We really need to see oil fall to sub-$50 before they start really feeling pain.

Among sectors, no one was spared. Most income sectors were down between 1.5% and 3.5% but some were down significantly more like converts (which span the hybrid area between income and equity). Most equity sectors were down 6-7%+. Ouch.

On a trailing month basis, we are down much more (see table below), although on a relative basis senior loan NAVs were 'only' down -3.3%. Equity sectors and interest rate sensitive sectors fared the worst losing double-digits. And now discounts are finally additive to that NAV change

Trailing Month Sector Returns/NAV Change/Discount Change:

On the week, we saw real estate experience the most valuation change losing, on average, about 3.5% of discount. Utilities were not far behind at -3.4%. Real estate now shows up among the cheapest sectors by one-year z-score.

We saw very few funds actually increase their valuation this week. In fact, just 7 saw their discounts tighten and premiums rise. That was a broad-based decline across the entirety of the closed-end fund marketplace.

High valuation funds saw the most valuation adjustment in the last week. PCM Fund (PCM), a fund I've been railing about to sell, sold off by 9.5% more than its NAV. DMB is another that I've railed on as well as being ridiculously overvalued. GOF, HIX, RCS, and RIV I've been saying are expensive and should be swapped out of.

Despite being sold off, I wouldn't be buying any of these funds here, especially when considering the risks.

Cheaper funds that should be considered and perhaps even nibbled upon would be:

XAI Octagon FR & Alt Inc (XFLT), yield 14.24%, discount -6.8%.

Flah & Crum Preferred Securities (FFC), yield 8.53%, discount -7.6%.

C&S Tax-Adv Pref Sec and Inc (PTA), yield 8.64%, discount -13.7%

First Trust Inter Dur Pref & Inc (FPF), yield 7.97%, discount -12.6%

Invesco Sr Income (VVR), yield 10.4%, discount -12.7%

VVR recently increased its distribution by 23%. Going into the raise, the fund was earning about 107% of the distribution with about 1.8c of UNII. The fund is leveraged by 31%. The average price of the loans in the portfolio is 90 giving a bunch of capital appreciation potential.

The long-term NAV has been a very strong performer ranking 3rd over the last three years and second over the last five years. Over the last decade, it is the number one fund by NAV total return for the loan sector.

The current discount is in the 90th percentile of where the fund has traded in the last ten years. At the same time, the fund is in a sector which we think is one that you can own in this market, the floating rate sector.

It's a good setup for an investor looking to start adding risk here.

Commentary | Safe Bucket

I received a few questions and one of my best subscribers sent me a message this am asking the following:

"What do I do with my safe bucket holdings that are down double digits this year and yield only 2% or so? Sell to harvest the loss for taxes and buy IG bonds? 1 yr treasuries? I realize the safe bucket is for income as much as capital preservation, but I had hoped it would have been a safer bucket. "

This is a great question and one that deserves a 10,000 word response. No would have expected short-term very high quality bonds to be down as much as they are. But let's review quickly.

In the following chart, we see the nearest funds to cash have weathered the storm quite well. These are mostly commercial paper, very short-term government and government agency debt, and other short-maturity, investment grade bonds. While they have little risk, they also have little return unless short rates can fall. Until about 5 months ago, there was no were for them to fall to as they were close to zero.

Moving out a bit on the risk spectrum, we can look at a few higher-quality multisector, intermediate duration, actively managed, bond funds.

As we add more risk and more duration (a type of interest rate risk), the losses are greater. Some of these funds even have a small blend of junk bonds within their portfolios. The spread among the funds has to do with the amount of duration each fund contains. The Guggenheim fund has the longest duration of the group at 5.2 (in January) compared to the Lord Abbett fund which is down only slightly.

We can then look at other areas that are sometimes used for a hedge or safety areas. Here we look at agency mortgages (very close to risk free), gold, intermediate maturity treasuries, and TIPs (treasury inflation protected).

The one thing these all have in common is interest rate risk. As I discussed in the Macro Picture, interest rates hit new highs this week and continue their upward march. Short-rates are also adjusting up to embed a higher-for-longer narrative into their pricing.

The two-year yield is now at 4.13%. This is a security with little interest rate risk and no credit risk. Essentially, if you hold to maturity, you have a risk-free 4.13% annual rate of return. But if you look at the SHY ETF above, it is down -4.5% so far in 2022. Despite the low duration, it still has duration at 1.84 years.

We have entered an unprecedented bond bear market. But it isn't the movement in rates that has been so substantial. It is just how fast rates have moved in such a short amount of time.

The good news (and its hardly good) is that eventually this will reverse course. As I've noted several times, interest rate risk is a temporary phenomenon. Interest rates are up because inflation is up. But the Fed is attempting to kill inflation which will then mean that interest rates will no longer need to be up.

The question is how long will that take?

Hard to know but I continue to think in a year or so we'll get the Fed pivot that we need in order to see investment grade, high-quality to really work. In the meantime, we simply don't know how much more rates will rise from here. I continue to think we are closer to the end than the beginning which means legging into duration may make sense here in certain areas.

However a barbell approach is probably the best strategy. That means locking in some longer-duration high-quality assets to 'lock it in' if rates are indeed topping out. The rest can be in shorter-duration assets. Shorter duration means that you are not locking it in for as long and are taking the risk that when those securities are repaid, you will reinvest at a lower yield.

But we can never know for certain.

In terms of safe bucket, I continue to invest in these assets. Most are down less than -10% and will be a great source of dry powder when the time comes. While a safe bucket is meant to be 'safe' it doesn't mean it cannot go down. But if you look at it on a relative basis, most of these safe bucket assets are down a very small fraction of the equity market as well as the Barclay's US Aggregate Bond Index.

We continue to think if you look out two years, the yields you are buying today will look like a perfect present. These yields could evaporate fairly quickly if we head into a more moderate recession and the market starts pricing that in with the 10-yr falling from 4% to 2% in short order.

Continue to keep a lot of dry powder in these safe bucket assets so that you can avoid further draw downs in other areas.

CEF News and Corporate Actions

Distribution Increase

Invesco Sr Income (VVR): Distribution increased by 23.1% to $0.032 from $0.026.

Distribution Decrease

N/A

Liquidation/Dissolution

First Trust/abrdn Emerging Opp (FEO): The fund announced that it intends to liquidate and distribution net assets to shareholder based on the recommendation of its investment advisor, First Trust Advisors LP. The board believes it is in the best interest of the fund and its shareholders to liquidate. The fund intends to terminate on or around December 7th, 2022.

Secondary Offering

Reaves Utility Inc (UTG): The fund entered into a new distribution agreement on Sept 19 with Paralel Distributors LLC to sel up to 8mm common shares, through an at-the-market offering.

Rights Offering

Virtus Total Return (ZTR): The fund issued another 20.3mm shares of its common stock from the recently completed rights offering. Total proceeds, net of the offering, are expected to be $140.6mm. The subscription price is $6.96, which is 95% of the average of the last reported sales prices of the fund's common shares on Sept 16th, and the proceeding four days.

Repurchase Program

DWS Muni Income (KTF) and DWS Strategic Muni Inc (KSM): Each Fund may continue to purchase outstanding shares of beneficial interest in open-market transactions over the twelve-month period from December 1, 2022 until November 30, 2023 when the Fund’s shares trade at a discount to net asset value (“NAV”).

Statistics

Sector:

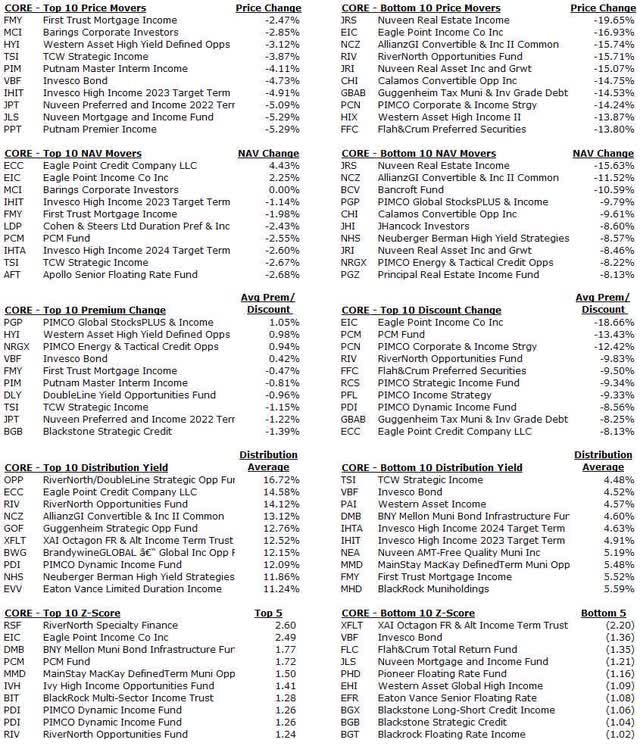

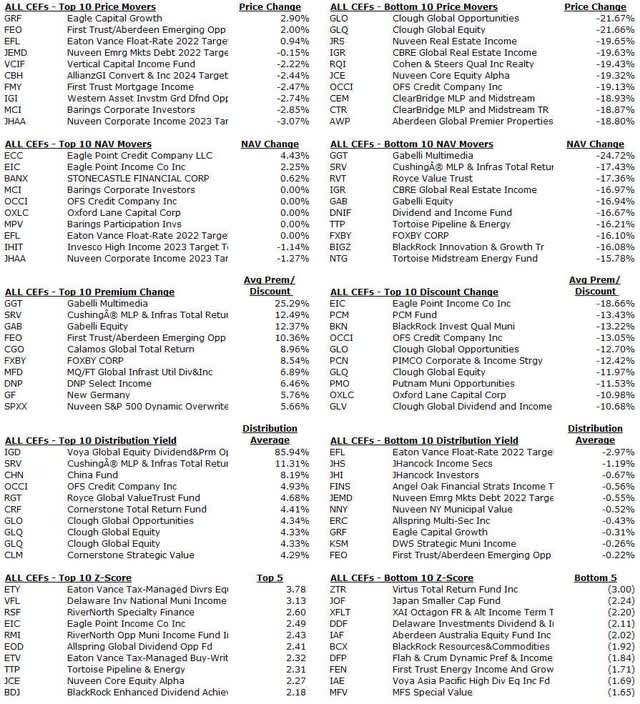

Core:

All CEFs:

----------------

Contact Us:

Admin@Yieldhunting.com

Latest Newsletter:

Google Sheet Models and Fund List

Model Portfolios (in progress- will post soon)

-----------------

Yield Hunting FAQ and Getting Started:

(A place to start for new subscribers)

-----------------

Data:

-----------------

What do you think of RLTY ? I love the stocks it holds, discount is crazy, am i missing something?

Maybe because it IPO not long ago everyone is setting on a looser and more likely to sell?

Seems like a great buy to me.