Macro Picture

Stocks ended the week higher for the first time in four weeks but did give up the majority of their gains on Friday afternoon. The Friday jobs report killed the strong rally from the start of the week where the S&P rose 5.6%, the best two-day advance since 2020. The VIX is still above 30 at the moment but did drop 2 points on the week to 30.7.

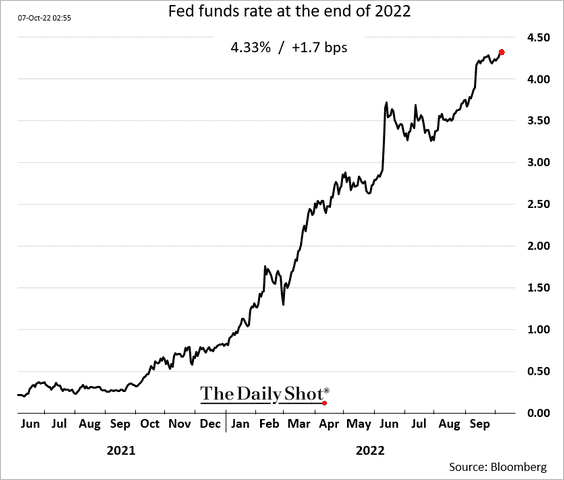

Some key economic data came out this week. We noted the jobs report on Friday which killed the rally on the week. Jobs for September came in at +315K, a bit better than expected which caused the market to believe that a pivot was farther away than expected. In other words, the chances of the Fed stopping to raise rates or even cutting is further out in the future.

Good news is bad news and bad news is good news in this market as it drives Fed policies.

On Monday, we had the Bank of Australia raised rates by less than expected and some Fedspeak saying that perhaps they would pause in December to assess the impact of the rate hikes already conducted. We also had the ISM manufacturing gauge come in at 50.9, which was below expectations (bad news) and it hit the lowest level since 2020.

It is quite clear the US is heading into recession at this point. The question will be when will it affect the labor market.

The bond market finished higher despite yields rising during the week. The 10-year yield rose to 3.89%, from 3.74%. We also had the 2-year yield is back above 4.0%. The big gainer on the week was oil which rose a massive 17.3% as OPEC+ voted to slash production by 2mm barrels per day citing an expected slowdown in global demand.

Lastly, the International Monetary Fund warned this week that open-ended funds that hold illiquid assets could pose a risk to financial stability.

This week, we get the all-important inflation report on Thursday. The forecast is for the headline to rise 0.2% m/m and +8.1% y/y. A slight improvement from +8.3% y/y in August. Energy prices helped mitigate some headline inflation. But Core Inflation is likely to be up 0.5% m/m.

Then we get retail sales on Friday which is a big driver of GDP forecasting and gauge of consumer spending.

Tuesday: NFIB Small Business Index (SEP)

Wednesday: Producer Price Index (SEP), Treasury Budget (SEP), FOMC minutes

Thursday: Consumer Price Index (SEP), hourly earnings (SEP), average workweek (SEP), Weekly initial and continuing unemployment claims

Friday: Retail sales (SEP), business inventories (Aug), export/import prices (SEP), University of Michigan Sentiment (Oct)

CEF Market Review

Discounts tightened up a bit last week following the large widening we have witnessed over the last couple of weeks. You can see though we are still much wider than we were four weeks ago. Discounts today are still relatively wider compared to historical observations with taxables and muni CEFs resting in the 80-90th percentiles going back to 1996.

The best sectors were those in the highest beta areas of the CEF market. With oil up 17%+ on the week, clearly MLPs and energy/resource funds were the top performers rising over 5%. The worst performers were real estate and preferreds and other longer-duration assets.

Preferreds and loans remain two of the cheapest income sectors with z-scores below -1.3. We still believe these are two of the best areas of the CEF market today.

Keep reading with a 7-day free trial

Subscribe to Yield Hunting to keep reading this post and get 7 days of free access to the full post archives.