Weekly Commentary Nov 6, 2022 | Income Portfolios Down Big- Will They Ever Recover?

Macro Picture

Slower, longer, and higher. That is what I have concluded is likely to be the case from the Fed over the next year. The Fed raised rates by 0.75% on Wednesday but indicated that there would be no pivot, and likely no pause. Those hoping for that were smacked in the face and the market reaction was fierce.

The Fed statement was initially taken as dovish commentary but that was quickly reversed as comments by Chair Powell dashed any hopes of a dovish shift in monetary policy.

The reason the statement was taken as being dovish was that they stated there were lagged effects of monetary policy. The market took this to mean a pause was coming as the Fed would want to wait and see if they have tightened enough.

However, Powell said in the press conference that followed that it is "very premature" to consider pausing rate hikes. You don't get more explicit than that.

Shortly thereafter, the market was down 2.5%. This was the first down week in five weeks and could be the bear market rally killer. Next week's CPI, if another poor report (i.e. not showing signs of softening) could be the nail in the coffin for this rally.

The S&P is now 5.25% off the lows, despite last week's drop. New lows could be in store if the CPI report is worse than expected. That would mean that the terminal rate, or the rate at which the Fed stops hiking, is much higher than is implied by the market. That would also mean that risk assets, would need to be sold.

Tech shares were hurt particularly hard as growth stocks declined more so than value. In fact, value now has a cumulative outperformance to growth since the start of the Covid pandemic. No one would have guessed that for 2022.

In my mind, the Fed will likely keep rates higher for longer, and higher than implied by the market. In other words, the terminal rate could be closer to 6.0% than the current 4.9% implied by the markets. That means more pain to come.

CEF Market Review

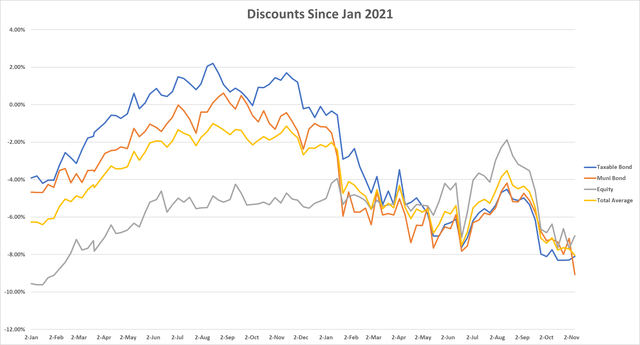

Discounts were largely unchanged on the week and remain fairly wide (77th percentile for taxables and 93rd percentile for munis). Muni CEFs at this point are nearing their 'wides' for the cycle. The last time they were this wide was December 2018 (where they reached the 99th percentile). If you bought then, you made approximately 14% annualized until the Covid crash in March 2020 and 12% annualized until December 2021.

In terms of sectors, looking at what they have done so far this year, all are down double-digits except MLPs (which are up 30%!). The best have been Utilities, covered calls, mortgages, and then multisector which are down between 15% and 19%. The worst are real estate, taxable munis, EM equity, and convertibles.

In the past week, EM equity did the best on the China rally jumping +7.8%. US equity tax-advantaged fared the worse at -2.7%.

In terms of the cheapest sectors today, it has moved squarely towards equities. I noted several months ago that equity CEFs were severely overpriced. Since then, they have slowly widened out and are now near the 50th percentile (up from 6th percentile).

All the cheapest sectors save for national munis are international equity or global growth.

In the last week, we've seen senior loans (floating rate) move up in valuation (finally!). The average fund in the group took off approx 35 bps from their discount. This had been one of the cheapest sectors, surprisingly, but has since found some love as distributions are being raised in the face of cuts nearly everywhere else.

Keep reading with a 7-day free trial

Subscribe to Yield Hunting to keep reading this post and get 7 days of free access to the full post archives.