Weekly Commentary | June 26, 2022

Macro Picture

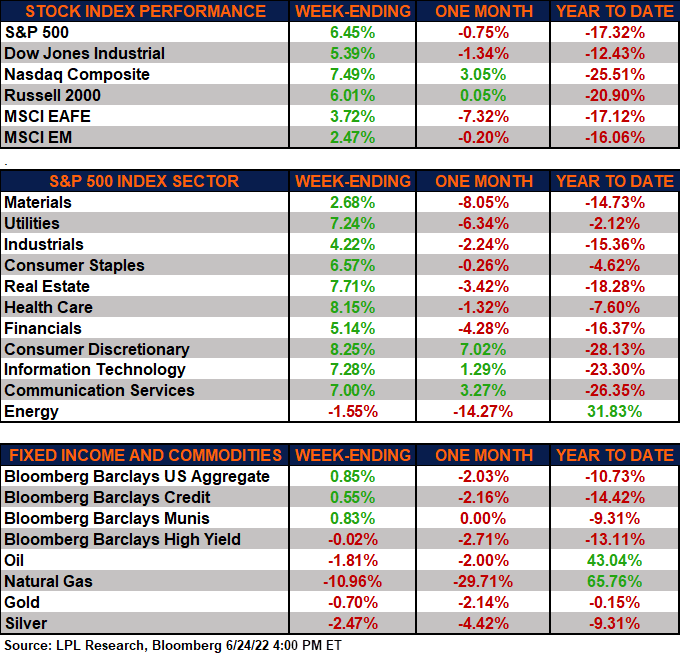

Equities posted a sharply higher week as investors shifted their focus from inflation to the risk of recession. Softer economic data and a decline in commodity prices may be foretelling a peak in inflation. That caused investors to modestly trim central bank rate-hike expectations. That is demonstrable in the 10-yr yield which peaked at 3.49% intraday two weeks ago and now rests at 3.09%.

All sectors but energy recorded gains for the week. Bond prices were up too with everything but high yield increasing. I think it's telling that high yield couldn't muster gains on a week that equities rose 6.5%.

Powell came out and admitted the difficulty in achieving a 'soft landing' in his testimony on Capitol Hill. He noted that the Fed is not trying to push the US economy into a recession but that one is certainly possible as the Fed tightens policy aggressively to combat high inflation. He restated the Fed’s unconditional commitment to fighting inflation, commenting that allowing inflation to become entrenched would be more painful for the economy than a recession. A paper published this week by the Fed put the odds of a recession in the next 12 months at 50% and the probability of one over the next two years at 66%.

The baseline for July's FOMC meeting has moved from 75 bps to 50 bps, which explains why the market moved the way that it did. So what is driving the 50 bps probability? Unclear but the market is betting that we are nearing peak inflation and that economic growth as slowed enough for significant demand destruction to occur which should right the inflation ship over time.

Flash purchasing managers’ indices ("PMIs") for the US and eurozone showed that the pace of economic growth in developed economies slowed notably in June. The US manufacturing PMI decelerated to a 23-month low- the eurozone to a 22-month low. The services readings in both regions fell to levels not seen since the Omicron wave five months ago, although all the readings remain above 50, the level that separates growth and contraction.

This looks like a dead-cat bounce as the markets are reacting to very little data other than a small drop in rates. But we've seen this before. The only difference today would be inflation expectations are starting to come down- as well as commodities, which could be that precursor for inflation data peaking and dropping.

CEF Market Review

Discounts broadly tightened across all asset classes but saw the most tightening in the taxable bond category. That space saw the average discount go from -8.25% to -6.75% in the week. Muni CEFs closed by 35 bps on the week with equity CEFs tightening by 30 bps.

Taxable CEFs were in the 90th percentile at the start of last week but with the discount tightening, finished around the 80th. That is a significant move in a week. Most of the discount tightening occurred in the multisector category with the PIMCO funds experiencing strong tightening. For example, PIMCO Dynamic Income (PDI) went from a -2.3% discount to a +3.8 premium for a capital gain of 6.1% on the week. Not bad. Just need about a dozen more of those!

And yet that is not the best of the PIMCOs, check out these returns: