Weekly Commentary | January 8, 2023

Summary

January Effect/ Tax loss snapback trades listed.

We continue to advise people to be defensive despite the rally on Friday.

Macro Picture

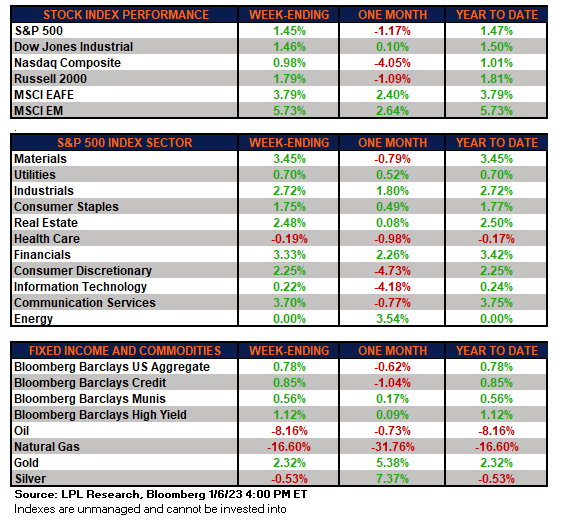

The markets jumped on Friday after the December jobs report was released helping the major indices to start the year off on a strong positive note. Slower job growth and moderating wage gains gave market participants the Goldilocks-type report they wanted to help ease concerns about a overly aggressive Fed.

We saw a number of economic reports that all had the market react in similar fashion- a focus on the Fed's thought process on the numbers that favor slowing growth and inflation over strong GDP growth.

Since mid-December the S&P 500 has remained in a tight channel between 3,764 and 3,906. The jobs report gave hope to investors that a soft landing was possible. Wages were up +4.6%, much below the +6.0% in the report figure three months ago. That should help put a lid on inflationary pressures but it's still a bit warm for the Fed's liking.

ISM data this week showed manufacturing activity contracted for the second straight month, falling to the lowest level since May 2020. ISM services activity joined manufacturing in contraction territory this month falling to 49.6. This data is some of the best for forecasting a recession.

Interest rates continued the downward trend of the last month with the 10-yr falling 30 bps on the week.

The market continues to see just 0.25% increases in the next two meetings, on Feb 1 and March 22nd. The terminal rate would peak at 5% and then start coming down in November and by year-end, stand at 4.75%. The Fed is insisting that they won't cut but the market doesn't believe them.

I do think the market is overestimating the start of the drop in rates. Essentially, they think a hard landing is coming and that's going to force the Fed's hand to start cutting.

At ~3,800, we're in neutral territory. I wouldn't be selling equities nor would I be buying any.

Sentiment looks fairly neutral as well with no excesses or overly bearish indicators.

The Fed minutes this week showed that the Fed was unhappy with the market's reaction to recent data.

Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee's reaction function, would complicate the Committee's effort to restore price stability.

Personally, I have been seeing a lot of comments that the recession is priced in. That last year's decline was the market pricing in that recession and this year prices will stabilize and may rally, even if a recession is technically triggered at some point in 2023.

I would fervently disagree and say 2022 asset price performance was not the pricing in of a recession but the pricing in of lower cash flows from higher interest rates.

CEF Market Review

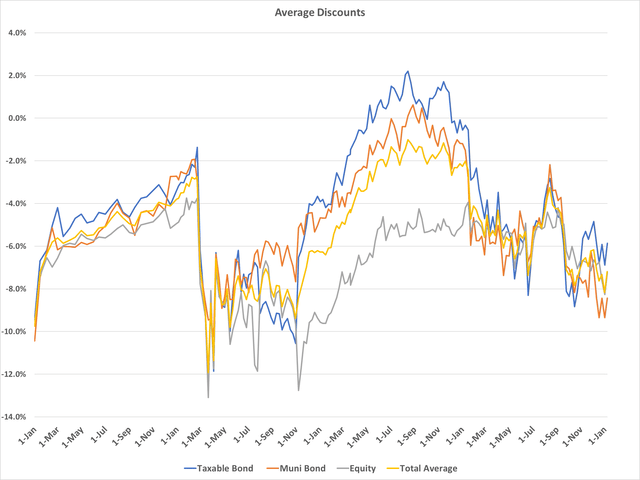

Discounts tightened up last week from some of the widest levels of the last five years. Taxable bond discounts closed by a whole point from 6.9% to 5.9%. Muni CEF discounts closed by 0.9% to -8.4%. Muni discounts were in the 96th percentile but have since moved back to the 83rd percentile on the rally this week. January Effect!

While discounts were strong, NAVs were stronger. Muni CEF NAVs were up 2.2% on the week. That is huge. The biggest tailwind is from rates falling during the week. The 10-yr yield was down significantly providing levitation for bonds- especially long-dated bonds like munis.

Other long-duration areas of the income markets were strong on NAV this week too. Preferreds were up 2.7% on the week with real estate and taxable munis up 2.3% and 3.1%, respectively.

High yield rallied strongly as well with the average NAV in the sector up 2.6%, although discounts were wider narrowly.

The largest discount tightening came in the real estate and utilities sectors. In aggregate total, real estate CEFs were up over 5% between NAV and discount returns.

CA muni CEFs saw the most discount widening, by over 3.4%, thanks primarily to PCQ, PCK, and PZC. Those are the PIMCO CA munis that massively cut distributions last week resulting in substantial selling pressure. PCQ was down 25%, while PCK was down -7.7% and PZC down -7.2%. (more below)

The other PIMCO munis were down large too. PMX and PYN were down -13.3% and -21.9% on the week.

These are crazy declines and some that we expected and warned about just last month.

Keep reading with a 7-day free trial

Subscribe to Yield Hunting to keep reading this post and get 7 days of free access to the full post archives.