Weekly Commentary | Aug 28, 2022

Macro Picture

Equities suffered their worst one-day loss since the days immediately following the May CPI release in early summer. The market's reaction was somewhat puzzling since the long-awaited speech by Powell at Jackson Hole, WY was simply a repeat of the message that a chorus of Fed speakers has been giving in the run-up to Powell's: that market expectations for a near-term policy pivot were premature.

The good news in all of this is that unless we see a very big CPI surprise report in 2 weeks time, hawkish Fed risks should begin to subside in the coming weeks. That's due to the fact that Powell has achieved the majority of his objective of moving market expectations closer to the Fed forecasts.

Markets are now baking in a peak 2023 US policy rate of 3.78%, which is higher than the Fed estimate on the dot plot for next year. There is still some room for rate futures to move higher in the last months of the year but they would be small adjustments relative to what happened in August. In other words, Fed risk from here is likely to be reduced substantially in the coming months.

So is the current rally a dead cat bounce or the start of a new bull market? Hard to say obviously. Things from a risk perspective seem to have faded a bit as we have Fed risk peaking, the Citi Macro Surprise Index rising (instead of falling during the last dead cat bounce in March), and still vastly underweight US equity positioning. The setup here could be constructive but highly dependent on the CPI reports and other factors coming in: namely the labor market.

In my view, the larger probability event of a down draft in stocks comes not in the US but in Europe. Now, European contagion could spill over to the US but likely with a lower beta. Europe's impending energy crisis and other number of headaches portends more problems going forward.

Still, come this winter, the US will be facing a recession as well and could see another decline to markets.

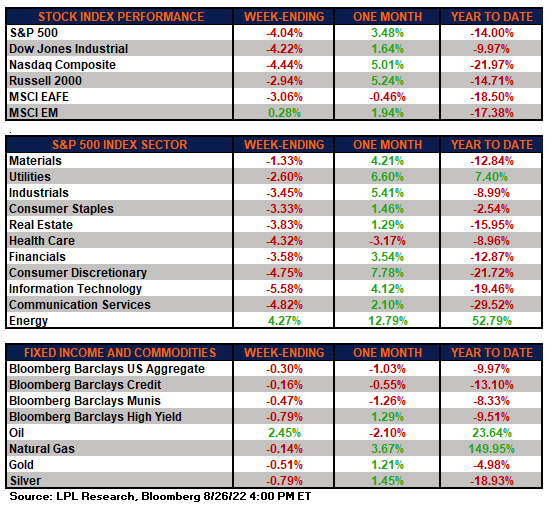

For the week, equities lost about 4%, with international actually outperforming. EM actually managed to eke out a gain. Bonds fell on the week as interest rates moved higher. Oil was up 2.5%.

CEF Market Review

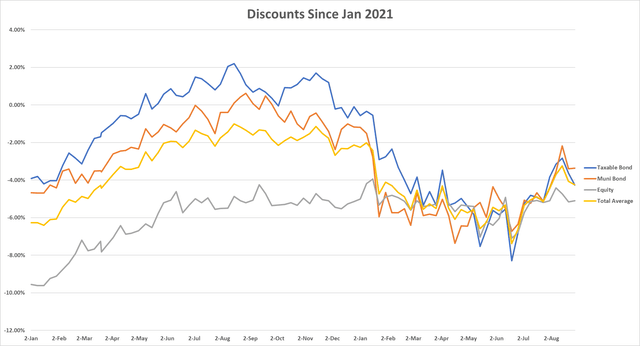

Discounts have widened out a bit in the last week and are now 1.5 points wider on taxables in the last two weeks. Munis were flat last week but are also a point wider over the last two weeks. Equity discounts are flat over the prior couple of weeks.

In terms of sector performance, just two managed to produce gains this week: MLPs and Natural Resources/Energy, which is not surprising given the gains in energy. The worst performers on NAV were Real Estate and Tax-Advantaged. EM was close to a gain.

Preferred CEFs saw the most discount widening in the last week with global equities also showing some valuation weakness. But real estate and utilities saw the most discount tightening in the last week.