Macro Picture

The major indices had their best week since March after having their worst week since January. New highs were recorded on both the S&P 500 and the Nasdaq but on low volumes. Oil prices reached their highest levels since October 2018. Utilities and real estate continues to lag.

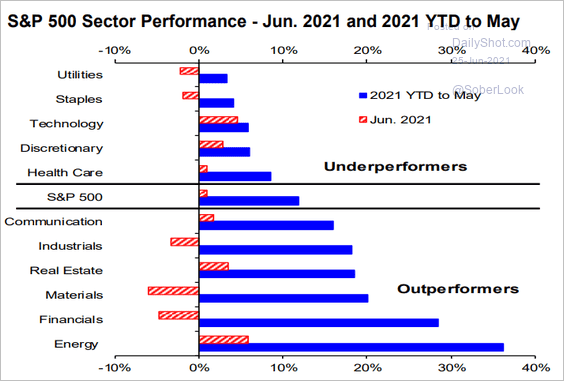

Performance in energy continues to do well as oil prices reach ever higher levels. This will last for awhile until rigs and production catch up. Drillers are still reluctant to commit new capital to projects given the pain they received last year when oil tumbled below $30 a barrel.

The market is being driven by fears of inflation, tapering, and the first rate hike. The time line looks to be getting clearer which could be helping the equity markets. There are moderating inflation fears as there are some signs supply chains are easing, especially in commodity areas like lumber, are helping.

On Thursday, Bloomberg noted that used car prices may have peaked and that retail vehicle prices might soon follow. Those two variables contributed one-third of the increase in consumer prices in the last quarter.

Still, inflation rising to the fastest level since 2008 will continue to be an overhang to the market until later this year when the CPI yoy effects start rolling off.

I continue to hold Invesco Small Energy ETF (PSCE) in my account which was up 10% in the last week and 21% in the last month. I think the value/cyclical trade should continue to work for the remainder of the summer- at least. For value stocks my two go to investments has been Yacktman Fund (YACKX) and iShares Value ETF (VLUE) for larger cap equities. For small cap, I mostly use Vanguard Small Cap Value (VIOV).

I did add to some of my individual equities buying up some Crowdstrike (NASDAQ:CRWD), Spotify (SPOT), ZOOM Video (ZM), and Teledoc (TDOC).

Commentary

Discounts were again up on the week with taxables getting near their interim highs at +0.70%. Munis continue to power higher as well closing at their tightest levels in several years at -0.68%. Munis are, by far, my largest CEF allocation but I understand due to personal circumstances, they are not for everyone.

Taxable munis look okay here too. The risk, of course, is that rates jump back higher. However, I don't own munis for the market value changes- but for the income streams. Long-term, I've noticed the market value changes tend to offset. Blackrock Taxable Muni (BBN) is my favorite in that space near par.

The muni side of things - taxable or not- are becoming more expensive by the day. They now reached the top 5 z-score threshold with a +1.7 and single states at +1.9. But remember, these are one-year numbers and a year ago investors were worried about rising interest rates hitting NAVs.

I still think the muni space is heading to..............

-----------------------------------------------------------------------

Yield Hunting Premium Members received a full list of funds in each sector- which funds we like here, and which to avoid...

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 8+% yielding portfolio.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 8% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a couple of trades per month- making it very easy to follow even for the novice investor. Current yield 8.3%.

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.4% (some tax-free muni income).

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability. Current yield of 4.9% (mostly tax-free).

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securities where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. It is the perfect place to start for new subscribers!

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance of our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Substack and Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.