Weekly CEF Market Report - July 3, 2021

Macro Picture

A string of better than expected economic data helped the indices hit new highs for the year. But small caps and international were lower. Growth led value for the second straight week though value did well. The S&P 500 added 1.6%, Nasdaq was up 1.8%, the Russell 2000 was down 0.95% and the MSCI EAFE was off 0.95%.

The mostly favorable economic data included the Conference Board's index of consumer confidence which reached a 16-month high and beat expectations. On Thursday, we got ISM and PMI data which was still generally strong. On Friday, the labor dept noted that we added 850K of new jobs in June, though the unemployment rate rose slightly.

The worries of the Delta Variant are supplanting inflation worries as the number one issue for investors. The Fed and other "experts" have been highlighting why inflation should be transitory based on the underlying pieces of what drove that index higher. It appears that many have agreed with this thesis. Now, the Delta Variant is the number one worry- investors always have to worry about something.

This week we heard from health officials who stressed the effectiveness of the current vaccines against the variant. The US saw an increase in cases of Covid, mostly from the Delta variant, but it was primarily concentrated in states with low vaccination rates.

Treasury rates were lower on the week ending at 1.43%. JP Morgan noted that it was likely technical in nature due to month-end/quarter-end rebalancing.

Commentary

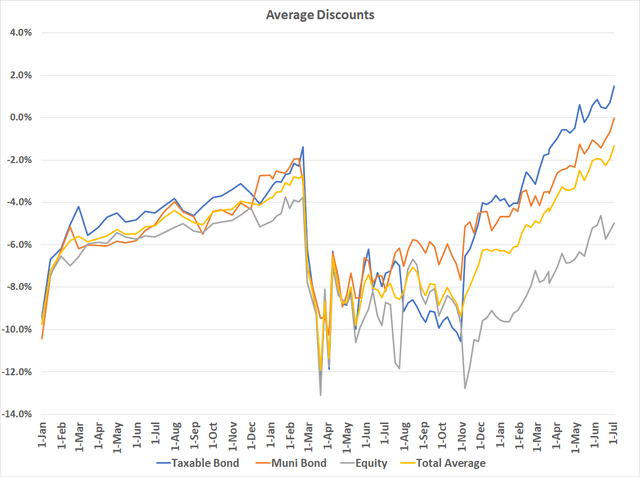

Fixed income discounts are going almost parabolic here and are now at their tightest levels going back two decades. Since 1996, discounts have only been tighter in 9% of observations across all CEFs. For munis and taxables, they have only been tighter 8% of the time. We are clearly on the right side of the bell curve.

With interest rates falling a bit more, NAVs being up on the week, we are seeing the last vestiges of value being stripped from the market. Obviously the risk is to the downside. With both high yield spreads and discounts/valuations being at their extremes, there continues to be significant risk out there.

Taxable CEFs are up about 10% -20% on NAV with the average fund up about 17% since that time. Prices are up slightly more than that. Those are pre-Covid to today figures. Taxables have returned just over 1% per month for the time period - which encapsulates a full cycle.

So while these funds took a big dive in March 2020 (as everything did) they recovered very quickly. This makes the case for buying and holding, or at least being perpetually invested in an allocation of closed-ends to fund your spending for retirement. Remember, even with extreme valuations you are still collecting that same income stream and by selling out and going to another asset type (ETFs, mutual funds, etc) you are taking a drastic reduction in income.

Average yields are still juicy, right around 7%. That is no where near the 9% we saw roughly a year ago but that is still a great number. As Chuck Jaffe said in a recent podcast, "you can't eat discounts."

For individual preferreds, the situation is the same or even more extreme. And don't even get me started with dividend paying stocks! Paying 25x earnings for a 3% dividend growing a 2% per year, with very little earnings growth make ZERO sense to me. But then again, I'm old school and learned my equity analysis from a value investor, not Cathie Wood.

So the primary tools for income are extremely rich. So the question of what to do is nearly impossible to answer. You have to assess yourself what you want more: a defensive posture with little in the way of income, or an income stream that contains overvalued assets.

Finding esoteric opportunities like we did this week is likely to be the only source of alpha available in these markets....

-----------------------------------------------------------------------

Yield Hunting Premium Members received a full list of funds in each sector- which funds we like here, and which to avoid...

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 8+% yielding portfolio.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 8% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a couple of trades per month- making it very easy to follow even for the novice investor. Current yield 8.3%.

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.4% (some tax-free muni income).

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability. Current yield of 4.9% (mostly tax-free).

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securities where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. It is the perfect place to start for new subscribers!

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance of our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Substack and Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.