Weekly CEF Market Report - April 4, 2021

Macro Picture

The S&P 500 crossed the 4,000 mark for the first time ever on the holiday-shortened week. The S&P 400 Midcap Index also hit a new high on Thursday. Early in the week we saw volatility rise because of the Archegos blowup but contagion worries from a few stocks being liquidated were put to rest by Wednesday. The news flow quickly shifted to Biden's infrastructure plans and markets calmed.

The infrastructure plan is $2.25T, which was actually at the lower end of expectations. Although later in the week Biden said a second package would be revealed later in April that focused on health care, education, and child-care spending. Biden’s plan did not include tax increases on upper income individuals, as some had speculated, but it did include raising the top corporate tax rate back to 28% to cover the cost of the bill.

Economic data came in strong this week with consumer confidence recording the largest gain in 18 years for March. Consumer expectations also showed a large jump. Payrolls came out on the holiday showing over 900K jobs were created and the unemployment rate fell to 6%. A lot of the job gains came from leisure and hospitality as well as government.

Bond yields ended the week at 1.72%, which were near the upper end of the range and about 5 bps from the post-Covid highs. The VIX is down to 17.3 which we discuss below.

Commentary

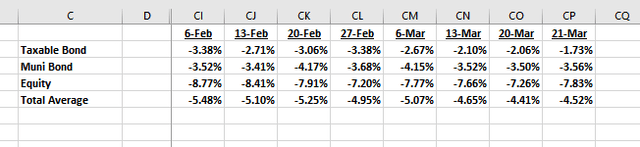

Like a broken record, discounts tightened further in the last week reaching -1.73% for taxable bonds from 2.06% the week before. In the last four weeks, taxable bond CEF discounts have tightened by nearly 1 point. We are now just 40 bps from the lows set just before Covid hit (again, this was a one off, one week event).

Muni bond discounts have been fairly stagnant the last three weeks as investors are hesitant (read: fearful) of rising rates. As opposed to taxable bond CEFs, there remains more value in the space with the potential for greater discount tightening. For one, the average long-term discount for muni CEFs is tighter than taxables by nearly 2.5 points. Said another way, over long periods of time muni CEFs tend to trade tighter than taxable bond CEFs. So mean reversion theory would state that either muni CEFs should get tighter discounts or taxables should start trading wider.

The VIX is now around 17, the lowest levels since the pandemic started over a year ago. The fact that the VIX is finally falling down is supportive of CEF discounts.

In this Weekly Commentary article we discuss potential blowouts for discounts in the future. The problem is that most of the time the catalyst that blows out discounts is an unknown unknown. Meaning it could not be foreseen ahead of time. This was the case slightly more than a year ago. How many in January 2020 could accurately say they saw a virus causing a massive sell off in the markets?

The largest threat to CEF discounts that is known would be rising rates and inflation. The current environment is actually fairly rare in that we have ("fast") rising inflation expectations and rising long-term interest rates with CEF discounts tightening.

It can be argued that CEF discounts are more of a function of the leverage they employ and thus, the spread or steepness of the yield curve, is what matters most. I.e. the ability to borrow at zero and put that capital to work at ever higher rates as long-term interest rates rise.

However, that belies the fact that the overall effective yield of the High Yield Master Index is near record lows. So even though the yield curve is steepening, yields are nearing records lows because the other factor is spreads. Remember there are two factors that drive the yields of bond assets: interest rates and spreads. Spreads being the additional yield over and above the risk free treasury bond.

Spreads are tight and there is no juice left there. So upside from a rising NAV from price appreciation is likely over. A portfolio manager can still select a discounted bond that they believe is mispriced and produce "alpha" but as a broad assessment, cap gains will be harder to come by.

From a CEF perspective, discounts are also tight. The high yield CEF sector, one of the more popular and better performers long-term, is trading at one of the tightest levels of the last five years. Even going back ten years there are only 11% of observations that were tighter. What could drive those wider?

As noted, spreads are tight. Tighter spread mean capital gains will slow or even reverse. That could cause some investors to sell and widen out discounts.

Leverage costs seem to be the largest driver of CEF discounts in the last decade. As leverage costs have dropped, CEF discounts have tightened. When leverage costs have risen (like 2015 and 2018), discounts have widened materially. The Fed is on hold until at least the end of next year if not longer so leverage costs should not be a 'fear variable' for discounts.

Then there's the macro of course. Something that causes high yield spreads to blow out. In 2014-2016, it was the collapse of oil prices. In 2018, it was market volatility in relation to higher rates. In 2008 it was the Financial Crisis. In general, high yield spreads do not blow out often. In fact, it is a fairly rare occurrence and typically only occurs when the S&P 500 is in or nearing a bear market.

The chart below shows those occurrences since 2007. They are not often. And we can go years without much movement (2012-2015).

Given the last event happened just a year ago, the scarring and fear that that caused is still fresh in our minds. This could cause some investors to "sell out" too quickly and forgo many months or even years of higher coupon payments when rotating out of CEFs and into mutual funds/ETFs or other lower yielding securities.

So the question, what is the solution?

Unfortunately, there is no hard and fast rule. Each investor needs to assess how much of their portfolio will be devoted to CEFs. Risk budgets need to be analyzed and investors should remember how they felt a year ago when discounts widened so fast. That obviously could happen again at any time for reasons completely unknown to us.

In my mind, risk averse buy-and-rent investors should be taking down there CEF exposure in favor of mutual funds, ETFs, and senior securities like baby bonds and preferred stocks. They can also use some term CEFs as a discount mitigant but those will not be perfect since they are also currently trading rich.

Income-only focused investors can simply do what they do best: focus on the distribution stability of their holdings and ignore valuations. Nothing wrong with that. Distributions should be ok for the next several quarters. Eventually, if the HY Master Effective Yield remains this low or lower, distributions will become more precarious. Additionally, if leverage costs go up, it will definitely mean distributions will come down.

Buy-and-hold investors I think can stay put for now. As I noted above, spreads can remain tight for a long period of time. Add in the fact that leverage costs remain low and shouldn't rise for at least a year and a half, I think the known variables are not a risk. It is the unknown unknown that is the only risk on the table today. That is likely why CEF discounts could remain tight for some time.

------------------------------------------------------------------------

Yield Hunting Premium Members received a full list of funds in each sector- which funds we like here, and which to avoid...

Yield Hunting Premium Subscription

START YOUR FREE TWO WEEK TRIAL NOW

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the 2-week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 9+% yielding portfolio.

Click here:

Here are some reviews:

Invest alongside a real portfolio manager and financial advisor with over 25 years experience managing assets- along with his dynamic team. Yield Hunting’s easy-to-follow low-maintenance models are aimed to generate a high single-digit yield for retirement income planning or fixed income allocations.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 9% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor.Current yield 8.53%. 2019 return 19.56%

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.46% (some tax-free muni income). 2019 return of 23.14%.

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability.Current yield of 4.96% (mostly tax-free). Since inception (November 1, 2019) return of 2.96%.

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securties where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. We do offer past issues for free. Simply message us that you would like to receive a past newsletter and provide an email address to send it to.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via chat, private message, and email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.