Weekly CEF Commentary | March 19, 2023

SPECIAL 20% OFF… PLUS FREE ONE WEEK NO RISK TRIAL!

Macro Picture

Stocks were mixed on the week despite withstanding several bouts of volatility with the S&P up 1.4% but the Dow down slightly. The Nasdaq was moderately higher at +4.4%. YTD, the S&P sits at +2.5% but the Nasdaq is up +11.4%. The VIX continues to move higher reaching 24.6 from 23.5 last Friday.

The big news on the week was the risk of contagion from the banking sector. A group of 11 of the largest US banks- after some prodding from the US government and their guarantees- organized a rescue plan for First Republic Bank. Under the plan, the group will deposit $30 billion with First Republic for an initial period of 120 days.

After Thursday’s close, First Republic’s board of directors announced it had suspended the dividend on its common stock. It didn't stabilize the stock, however, as it fell another ~18% on the week.

The other larger headline was European banking giant Credit Suisse (CS) was also experiencing problems. CS is a much larger bank relative to Silicon Valley or First Republic. The Swiss National Bank stepped in with an infusion of capital of $54B.

The Labor Department reported that headline consumer inflation had moderated in February in line with expectations to 6.0% on a year-over-year basis, its slowest pace since September 2021. Thursday brought surprise news that producer prices had declined 0.1%, due in part to a sharp decrease in transport and warehousing costs.

Interest rates continue to tell lots of stories. A flight to safety has been occurring which has- once again- included buying treasuries. Remember, for most of 2022 a flight to safety was not towards treasuries but the dollar (and to a much lesser extent, gold).

The 10- yr hit as low as 3.37% on Thursday, the lowest since late January. The 2-yr continues to show a fed pivot with the yield on the note falling- at one point- nearly 100 bps. It ended the week at 4.14% after cresting at 5.07% last month.

I loved this quote from JP Morgan:

“Everything everywhere…”, “When the tide goes out,” etc., etc. Everyone seems to have their favorite idiom to describe what’s been happening in markets this past week. In reintroducing the Crisis Watch title, our preference was to reference a set of children’s books. All this aside, there seems to be a degree of unanimity that central banks are somehow culpable and that we’re at a point where the past year’s tightening is now “breaking” things. Maybe, but maybe not. We think poor decisions are at least as strong a correlating factor between Silicon Valley Bank’s demise and the ongoing travails at Credit Suisse than is the interest rate cycle. What we will acknowledge, however, is that liquidity can only paper over some cracks for a while, but not forever, and there’s no doubt that tighter financial conditions amplify downside risk when bad decision-making becomes clear for all to see.

Current market expectations are changing rapidly. Obviously, nothing is set in stone and can change back quick but we now have rates priced in for June of this year. Terminal rate expectations are down to 4.88%, which is where we will be if the Fed hikes by 25bp next week. By year's end, Fed funds is predicted to be back below 4% (-100bps) and below 3% by the end of 2024 (-200bps).

I would not expect that Fed pivot to happen- unless we have a more widespread and sustained banking crisis. Right now, it appears that this is being driven by customer behavior. This is markedly different from 2008 when it was driven by poor credit decisions.

The sucking sound of deposits from small banks to large will likely not stop, especially at banks with a large percentage of uninsured deposits. Depositors are waking up to the fact that FDIC insurance only covers the first $250K in the account and moving their money accordingly.

They are also realizing that their Schwab, Fidelity, TD, E-Trade, IB, etc. accounts are covered by SIPC (except in the case of pure cash in some instances). Thus, they are moving checking and savings accounts to a brokerage account and investing in money market funds.

One only has to look at the Services measures of CPI to know that the Fed is unlikely to pivot anytime soon.

Shelter inflation lingers as a powerful updraft to the monthly numbers, and in February, rent of primary residence rose 0.8% m/m. High frequency data point to a deceleration, but it has yet to materialize. Still, the Fed has specifically focused on core services less shelter (about 25% of consumer spending), an area theoretically sensitive to higher wages. In February, this sub-series also moved in the wrong direction, posting a 0.4% m/m gain (0.6% m/m when medical insurance was excluded).

Some Links To Read:

CEF Market Review

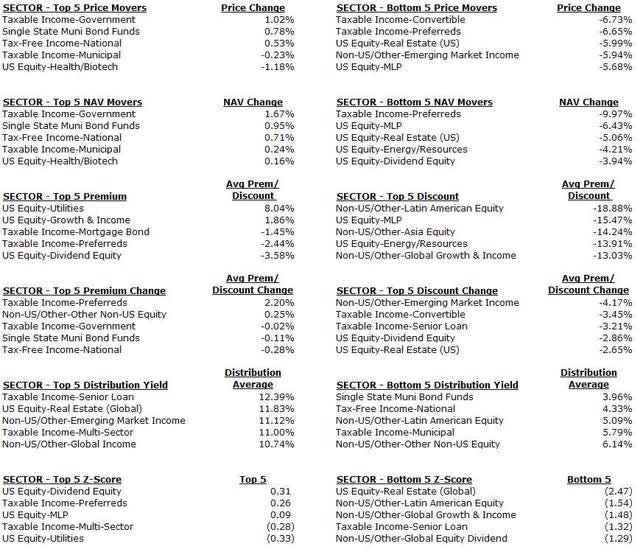

Discounts blew out last week as retail investors shunned risk and increased cash positions amid a flight to safety. Taxable bond discounts are wider by 1.8% (a two standard deviation move). Muni discounts hit double-digits, an area they haven't been in since late 2018 (and even then they were there barely a month). Equity discounts are also getting cheaper... finally!

We have been railing against taxable CEF discounts for some time and we are finally seeing some traction in that regard. But now we are seeing credit spreads start to widen as well. That's a sign that we could be approaching a better time to invest in taxable CEFs.

NAVs were all over the place with preferreds falling almost -10%. Real estate, MLPs, and dividend equity NAVs were down significantly.

Conversely, government and muni strategies were up on the week as rates fell back on recession/ banking sector fears.

Coincidentally, preferreds becomes more expensive on the week with the average preferred CEF seeing the discount close by over 2.2%. EM Income, convertibles, senior loans and real estate saw discounts widen fairly significantly, ranging from -2.7% to -4.2% for the week.

US equity CEFs are now the richest CEF sector at +0.31 (which isn't that rich at all). Preferreds and MLPs are also in the positive side of z-scores but again, just barely so not expensive at all.

Real estate, loans, and equity sectors are the cheapest at the moment.

We saw the Core work the way it is supposed to work last week as defensive/ durable and indestructible assets offset breakable asset weakness.

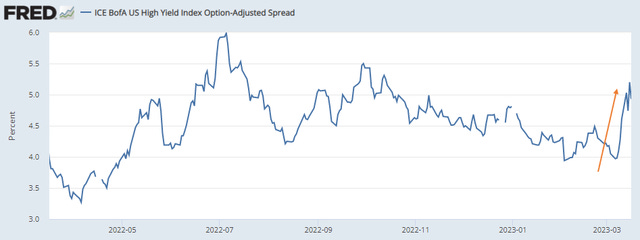

High yield and senior loans got clobbered on the week as investors moved towards safety. High yield spreads nearly hit 5% despite being sub-4% on March 7th.

Loans are also getting hit as the terminal rate breaks lower- though it has been bouncing around the last several days between 4.6% and 5.0%. Leverage loan prices took a high last week falling nearly -1.5%. The LSTA US Leveraged Loan Price Index fell to $92.83, from almost $95 two weeks ago.

A flight to quality could continue.

Commentary

I still believe a recession is coming and it makes sense to have decent cash levels available along with very durable assets. Right now I have about 25% in cash and cash equivalents and another 6-7% in treasuries of intermediate or long-term maturities.

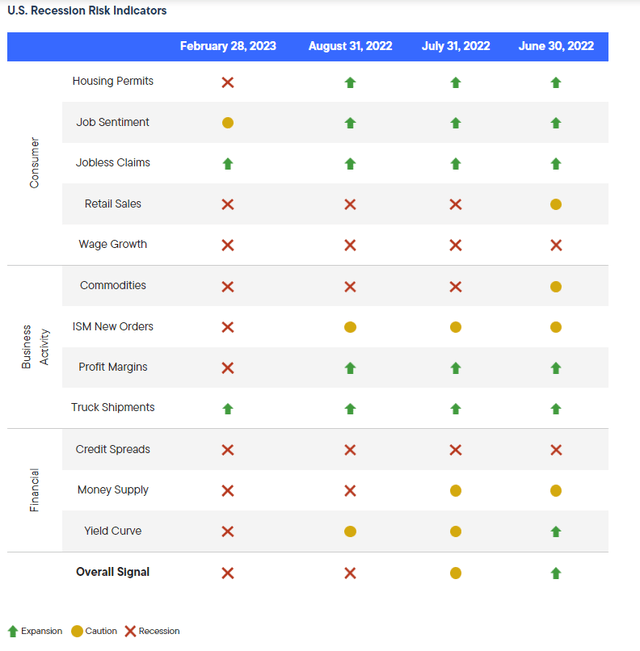

The Clearbridge recession dashboard is nearly all red- and it would be unprecedented for it to show these data points and a recession not come. Just the job market and truck shipments remain the only factors that haven't turned yet.

That said, remember we don't make large, binary calls. In other words, we are not ALL IN or ALL OUT of markets. We do make adjustments based on a risk-return model framework allocating to bond sectors where we see the most amount of upside for the least amount of risk.

Right now, high yield is the worst of those models. We would want to own high yield later this year when spread (we think) widen out materially from here. Once the high yield master index (FRED DATABASE) widens out to at least 600 bps, and preferably 700 or 800 bps, we would want to buy in materially.

So, keep defensive but don't go to all cash or anything massive like that. If the banking system cools down and thinks normalize, at least for a time, riskier assets could zoon.

PIMCO released their monthly UNII update.

Coverage levels improved like we thought that they would given the rebound in the dollar.

Valuations have improved on the PIMCO funds which was our largest concern last month when investors were freaking out about the low coverage ratios.

[Subscribers received a detailed, fund by fund analysis of each PIMCO fund]

Statistics

Sector:

[Subscribers received a detailed, fund by fund analysis of each PIMCO fund]

Try Yield Hunting Premium for 7 Days On Us! Also, the above button is good for 10% off our already reduced annual rate!

What Makes Yield Hunting so unique?

Our Core Portfolio has a standard deviation of just 4.94%. That is about 40% of the S&P's volatility over the last three years. And remember, the S&P had historically low volatility during that period of time. The Sharpe ratio is over 2X that of the S&P 500. That ratio tells us how much return per unit of risk we are taking.

That is an astounding figure given that the risk measure of the Core Portfolio is based on the PRICE volatility, not the NAV volatility. If we could assess the NAV volatility, it would likely be at least one point lower if not more.

In other words, you are taking two-thirds LESS RISK by NAV than the S&P and only giving up a quarter of the gains!

Time to go Yield Hunting!

Our member community is fairly uniquely focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today.

We also have expert guidance on:

Fixed Income closed-end Funds, Muni's, Preferred stocks, Baby bonds, ETFs, and Mutual funds.... among others.

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one-week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Invest alongside a real portfolio manager and financial advisor with over 25 years experience managing assets- along with his dynamic team. Yield Hunting’s easy-to-follow low-maintenance models are aimed to generate a high single-digit yield for retirement income planning or fixed income allocations.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 9% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor. Current yield is over 9% .

Active Income Portfolio - The active income portfolio is your total asset allocation solution. It is built with an income focus in mind but has total exposure across all asset classes. We base our sector/asset allocation based on our Macro Ratings tab and put our money where our mouth is!

Model of Models - This is our conservative model, appropriate for the largest percentage of members of our service. It is an allocation blueprint for members to align based on their risk tolerances.

Database Lists - We also have lists of individual Munis, Preferreds, Corporate Bonds, Term Funds, and Mutual Funds to compliment your portfolio.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. We do offer past issues for free. Simply message us that you would like to receive a past newsletter and provide an email address to send it to.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via chat, private message, and email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.