Retirement: Sequence Of Return Risks In Retirement

Summary

Sequence of Return Risk is a major obstacle to a retiree realizing a fully funded retirement.

Should a retiree go all cash and short-term bonds losing out on long-term growth as the length of retirement increases? Or stay invested in equities and risk a large downturn?

We attempt to mitigate risk, while maintaining both high yield and long-term growth using higher-quality high-yield CEFs plus a wide range of peripheral investments for growth.

We think sequence of returns risk is one of the greatest threats to investors today. Greater than interest rate risk, inflation risks, and credit risk. With markets at arguably lofty valuations, and bond markets offering very little yield, the risk for retirees outliving their assets is substantial. It is the largest risk we attempt to mitigate for investors.

Having enough money for retirement is one of the greatest fears Americans have as they age. One major issue, especially for those who have recently retired or are about to retire, is sequence risk. In terms of retirement preparation, it is the risk of experiencing large drawdowns in your portfolio just as you retire and start making withdrawals.

The order (or sequence) of calendar year returns makes a huge difference in how long a retiree can fund their retirement. Take the below example where 30 year returns are given. Simply reversing the order of the returns, creates two vastly different outcomes. The portfolio with 'early losses' is depleted by year 17 while the portfolio with 'reversed returns' last for 30 years and increases in value. Same returns, different order.

(Source: Prudential Investments)

A 23 year old employee, just starting out, has decades to recoup any losses and can (and will) weather multiple downturns during his career and can therefore accept a large amount of risk.

However, as you can see above, older investors are more vulnerable to the returns experienced especially as their financial plans show a declining total net worth. A big portfolio drop at the beginning of retirement could possibly wipe out all of the portfolio gains from the first 25 years of one’s career. Therefore, the timing of returns is highly important and can create instances where two different retirees with the same balance in their portfolio and same investments realize two different types of retirements.

Professor Wade Pfau, Ph.D., CFA, a retirement expert, notes in an article from 2013 that you cannot control when you're born. His findings show that the accumulated wealth between two exact savers can be between 3.0x and 27.7x. His conclusion:

These are very different outcomes for people who otherwise behaved exactly the same. What’s more, we see cases like how 10 years after the person retired with 27.7x, the subsequent retiree only had 8.7x. This is despite the fact that 20 years of their respective careers overlapped. What’s more, the person retiring only one year later than the fellow with 27.7x only had 17x their salary. This despite the fact that 29 years of their 30-year careers overlapped with one another. With William Bernstein’s idea of waterfalls, some of those folks with the lower wealth accumulations might have just missed their chance to reach their wealth target after 30 years, and might find that they don’t get to where they had hoped to be with even 50 or 60 years of work.

This is sequence of returns risk!

What Can Be Done?

If a retiree starts out after a large drop in the market, he will be withdrawing by selling his shares at lower values than an individual who starts out retirement selling his shares at all-time highs (where we are today). Therefore the former retiree will have the burden of reducing the amount of shares available to experience the rebound and get back some of those losses experienced. All other variables equal, retiree 2 will have a longer portfolio duration than retiree 1.

So how can you end up like retiree 2 and not retiree 1? Most would say it's just pure luck, right? Well there are ways to mitigate sequence risk...

There are a few obvious strategies. For instance, scale back on withdrawals. It may not have a noticeable impact on your day-to-day comfort level but, compounded, they can help keep your portfolio robust. If you can avoid a major sale of higher-risk investments in a down market—especially early in retirement—all the better!

Work longer. By working an additional one to three years, the effect on the portfolio can be profound. Each additional year of work not only adds more capital to your nest egg via savings, but also delays the start of withdrawal from the portfolio. This solution has the most positive effect on the portfolio.

Make the Right Moves

First off, many advisers will tell investors to reach for yield you must expose yourself to risk via volatile dividend equities. This is an inefficient and risky retirement income strategy. However, you can reduce the sequence-of-returns risk by reducing the overall risk of the portfolio by decreasing the exposure to equities. However, our strategy decreases that risk while maintaining a high single digit yield return (more on our approach later).

The main issue is if you invest too timidly initially, the funds may not grow enough to meet your needs down the line. Conversely, invest too aggressively and you could wipe out 30%, 40%, even 50% of the overall balance of the portfolio in one year if/when we see the next draw-down.

We recommend a multi-pronged course of action that should help mitigate risk and prolong investments to weather any fluctuations:

1) Spend Conservatively- Reduce withdrawals in down years to make up for the decrease in share price. It may not have a noticeable impact on your day-to-day comfort level but, compounded, they can help keep your portfolio robust.

2) Hold for the long term- don't sell at a loss unless absolutely necessary. If you can avoid a major sale of higher-risk investments in a down market—especially early in retirement—you'll be in a better position for the long haul.

3) Invest for both growth and income- yield is more predictable and sustainable while growth helps to mitigate inflation.

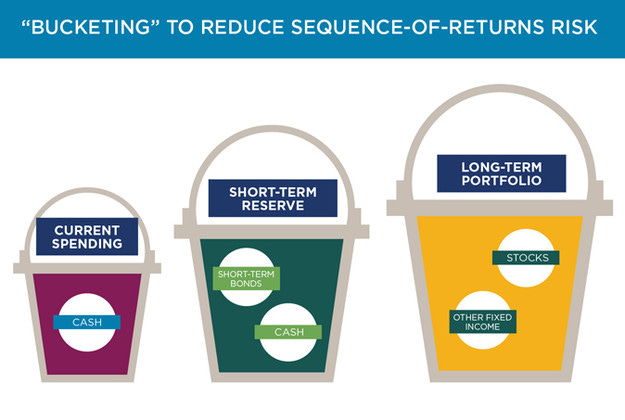

Every retiree has a different situation so the first two are not always viable. A popular three-tiered investment strategy (seen below) is a prudent (albeit basic) course of action. It's called "bucketing" where you have three different types of investment strategies: Cash for current needs; Short-term Reserves will weather downturns and fund near term withdrawals, and Long Term Portfolio which will remain invested to participate in market growth for future (5+ years) needs.

(Source: SCHWAB)

Our Strategy

Yield Hunting uses a unique investment approach to mitigate sequence of returns risk. Our Core- Peripheral Portfolio Approach is designed to produce a steady stream of income with high-yielding CEFs, mitigating a large amount of risk that dividend producing equities would be exposed to- and at the same time leaving some exposure to long term high growth areas via individual securities.

Utilizing this approach with the bucket system stated earlier, a retirees total investment (after the first bucket "cash" is set which is typically around 8%) would be roughly 60% in the Core Portfolio and 40% in the Peripheral Portfolio. The true allocation would be based on the risk tolerance of the individual and risk capacity of the portfolio. The Peripheral consists of a combination of exchange traded debt (baby bonds), business development companies (BDC's), preferred stocks, and individual dividend equity payers.

This allows us to realize yield in excess of 7%, while exposing investors to much less volatility and risk than the S&P 500. This is essential for retirees and other investors looking to mitigate sequence risk. Other guidelines our investment strategy uses to minimize risk are:

2% max allocation to individual securities- ensures no one security can effect the overall portfolio too much.

Sub-sector diversification- in-depth analysis of fund holdings and strategies to avoid overlapping exposure.

Contrarian Research- we use numerous information sources to investigate multiple strategies in order to avoid herd mentality.

Conclusion

Sequence of return risk can be crippling for investors at the start of retirement. No portfolio is risk-free, but through careful planning, risk and volatility can be minimized while maintaining long term growth for a healthy retirement.

Try Yield Hunting Premium for 7 Days On Us!

What Makes Yield Hunting so unique?

Our Core Portfolio has a standard deviation of just 4.94%. That is about 40% of the S&P's volatility over the last three years. And remember, the S&P had historically low volatility during that period of time. The Sharpe ratio is over 2X that of the S&P 500. That ratio tells us how much return per unit of risk we are taking.

That is an astounding figure given that the risk measure of the Core Portfolio is based on the PRICE volatility, not the NAV volatility. If we could assess the NAV volatility, it would likely be at least one point lower if not more.

In other words, you are taking two-thirds LESS RISK by NAV than the S&P and only giving up a quarter of the gains!