PIMCO Update | November 2023 | PDI's Distribution Reliant On Its ATM

Summary

PIMCO Dynamic Income Strategy replaces NRGX energy fund, offering more flexibility in investment strategy.

PDI distribution remains high compared to other funds, supported by at-the-market offerings and a dividend reinvestment plan.

Leverage has been reduced in October, coverage ratios have improved, and NRGX has converted to PDX with a new investment strategy.

The ATM offerings and DRIPs of the funds help to offset some of the shortfall in the difference between earnings ("NII") and total distributions.

If the fund doesn't trade at a premium, that ATM gets shut off and the fund will not earn nearly enough to pay the distribution. That is a big risk. 19a notices are a concern.

PIMCO released their monthly update and we also had the conversion of their energy fund, NRGX, to a new multisector strategy and name, PIMCO Dynamic Income Strategy (PDX). I think PDX is one of the better options in a special situation, but I hope that PIMCO is actively reducing the energy component, primarily the MLPs as they look overvalued since oil has fallen so significantly.

In this report, we go through the PIMCO Dynamic Income Fund (NYSE:PDI) distribution and how they make up the shortfall between what they earn (net investment income) and what they pay out in distributions. This is an important report.

Valuations are not all that compelling here and I recently reduced my large PIMCO Access Income Fund (PAXS) position on the rebound in the price. This was merely a portfolio positioning reduction.

Otherwise, I don't see a whole lot of compelling buys here but would consider a purchase of the Income Strategy funds, PIMCO Income Strategy Fund (PFL) and PIMCO Income Strategy Fund II (PFN).

Leverage and Coverage Update

Leverage was reduced by a fairly significant margin in October, likely as a result of PIMCO reducing exposure as NAVs fell during the month. Remember, interest rates up, bond prices down - that inverse relationship. PIMCO has been extending duration across their company albeit slowly. The added duration or interest rate sensitivity and jump in rates helped reduce NAVs.

As NAVs come down, leverage, without even adding a single dollar of borrowing, will go up. In order to keep leverage static, they would need to pay back some of the borrowing by reducing their holdings.

In the first chart of this section, as rates rose this year, you can clearly see just how much leverage has been taken down. In the case of PIMCO Corporate and Income Opportunity Fund (PTY), PIMCO Dynamic Income Opportunities Fund (PDO), and PFN, it amounts to -36.7%, -30.0%, and -33.7% of total borrowing. That is substantial.

This is essentially, a slow deleveraging of the fund over time over the course of this year. An orderly deleveraging isn't necessarily a bad thing, though, more frequently than not, they are selling those assets down which isn't optimal.

The only fund that didn't have to deleverage this year is PDI, which has kept leverage fairly level. More on that later...

In terms of coverage, we saw the dollar rise against the euro and the pound helping to increase coverage ratios as those currency forwards are marked-to-market. The dollar has since declined in November so I would expect to see coverage ratios fall in the next report.

We also had the July month roll-off, which overall was a poor net investment income month and helped coverage ratios look a lot better.

On a three-month basis, we now have 3 funds that have coverage ratios above 100%. The rest are close save for PCM Fund (PCM) which sits at 55%. This is because PCM is purely a domestic fund without those currency forwards we just mentioned.

None of the funds have any UNII to speak of so I would place the odds of a special distribution among the funds at a very low probability.

Overall, the coverage ratios look a heck of a lot better but I wouldn't rule a cut out in January as they right-size them for the current environment.

NRGX Becomes PDX

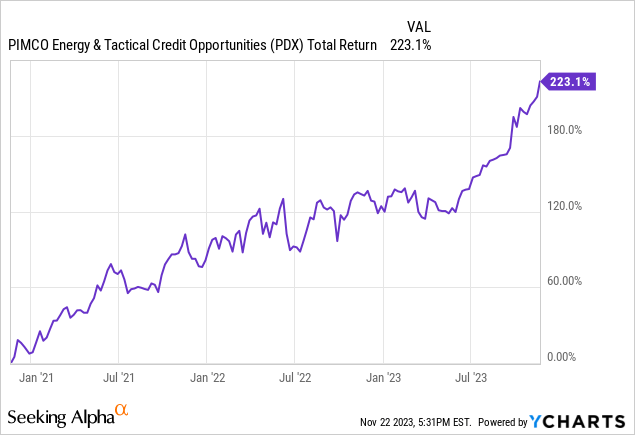

NRGX made the switch at the perfect time. While PIMCO was likely pressured into the change because Saba has been building a large position, the change from a MLP/energy equity fund to a bond fund couldn't have been timed better.

The fund rode the uptrend in energy-related names including MLPs for the last three years since Covid. That was highly profitable for the fund as oil prices went from almost zero to $95 a barrel.

In the last several weeks, oil has pulled back significantly to the mid-$70s per barrel range, down about 20% since the peak a few months ago. It is only a matter of time before energy names in the equity space see a pullback as well.

It remains to be seen what the distribution rate will be set at and how much MLP/energy exposure they will keep. The new strategy is a bit different than the other multisector CEFs like PDI, PDO, and PAXS.

PDX will have a bit more flexibility across the capital structure with more ability to move into equities and distressed/private debt markets. There are also no restrictions on the amount of junk debt or emerging market debt/equity that they can hold.

While the investment strategy will let them carry more risk, it remains to be seen whether they will actually do so. We know that their secular outlook is fairly bearish and that they believe many areas of the bond market actually have equity-like return potential with less risk. Thus, I would expect fairly lower equity exposure.

Here is the new investment strategy from the website:

PIMCO will manage the fund with a focus on seeking income generating investment ideas across fixed income sectors, including opportunities in developed and multiple emerging global credit markets. PIMCO may choose to focus on particular countries/regions, asset classes, industries and sectors to the exclusion of others at any time and from time to time based on market conditions and other factors. The relative value assessment within fixed income sectors will draw on PIMCO's regional and sector specialist insights. As a matter of fundamental policy, the fund normally invests at least 25% of its total assets (i.e., concentrates) in the energy industry.

The fund seeks to achieve its investment objectives by utilizing a dynamic asset allocation strategy among multiple sectors in the global public and private credit markets, including corporate debt, mortgage-related and other asset-backed instruments, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers and real estate-related investments. The fund may invest without limitation in investment grade debt securities and below investment grade debt securities (commonly referred to as "high yield" securities or "junk bonds"), including securities of stressed, distressed or defaulted issuers. The fund may also invest without limit in common stocks and other common equity securities issued by public or private issuers.

As stated, it remains to be seen what the ultimate portfolio will look like, if it will be a mirror to PDI/PDO, or if will be an entirely separate animal.

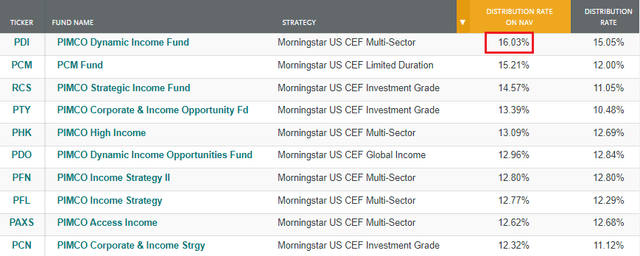

PDIs Distribution Remains The Outlier

When looking at the distribution rate on NAV you can clearly see that PDI pays a distribution well above the other funds.

The at-the-market offering that PDI employs helps to generate accretive earnings for the fund allowing it to support a higher distribution.

An at-the-market offering is the slow trickling out of new shares to the market amounting to a slow, continuous IPO. However, it can only be done when the share price is at a premium to NAV.

In theory, they should only be doing this in order to raise capital when there is a good opportunity in the markets to deploy fresh funds into securities at cheap valuations. The fact is, however, that the stream of new capital flows regardless of the opportunities in the market.

Additionally, PIMCO offers you the ability to DRIP your dividends. This is a Dividend Reinvestment Plan. When set up with your broker you can reinvest your distributions at the greater of the NAV or 95% of the market price or NAV. Thus, if PDI's price is above a 5% premium, you will get a 5% discount off that price and if it's at 5% or less of a premium, you will be able to buy it at NAV.

Note: (amounts below are in thousands ,000)

The aggregate of the ATM offering and DRIP program netted the fund $750,593 according to the most recent annual report from July 30th. That helped offset some of the deficit in the variance between total distributions paid to shareholders and the net investment income earned in the portfolio.

Looking at the annual report, gross investment income after fund expenses increased by over $240K from the start of the fiscal year. This was mostly due to higher coupons earned on their investments. However, net investment income increased only $105K (to $545K), thanks to SUBSTANTIALLY higher interest expenses (+600%!) on their leverage/borrowing through reverse repos.

In the last year, distributions to shareholders totaled $803K. Clearly, that is more than they earned on net investment income ($545K) by some $258K.

The relevant information is below in the highlighted red boxes. You can see that the net investment income plus the net proceeds from the at-the-market offering plus the distribution reinvestments ("DRIP") surpasses the distributions paid to shareholders. So long as this is the case, the distribution should be fine.

While this seems good and sustainable, it may be until it isn't. The 38,572 new shares issued in the last year all need to be paid at the same distribution rate as the shares that were already outstanding. Thus, total distributions to shareholders will continue to grow even with the same distribution rate.

So long as the fund can issue new shares it will be able to fund most of the deficit resulting from the fund not earning all the net investment income it needs to pay shareholders.

That is reliant on the fund staying at a premium to NAV. We already saw the fund go below NAV for a period of time in October. While it was a relatively short stay at a discount, it shows that it can happen. The spigot for new shares and fresh capital to pay distributions was shut off for about two weeks.

If it is shut off more consistently, you will likely see PIMCO be almost forced to cut the distribution.

The way to look at this is simply:

Going back to the table above, if you cut the ATM proceeds in half because the fund had a lengthier stay at a discount over the course of the year, you would have net investment income of $544k minus total distributions of $803.7K plus net proceeds from ATM offerings of $330K plus DRIP of $91K. That would be a surplus of $161K. Getting close.

However, in the next year, if repo rates fall and the fund can reduce its interest expense (this is their firmwide secular view), then the increase in interest expense from fiscal 2022 to fiscal 2023 of ~$120K likely would go away helping offset some of the shortfall of $259K between net investment income and total distributions.

In October, PDI issued a 19a notice showing about 38% of the distribution was ROC. That could be because of the ATM being cut off for a bit- though they've been issuing 19a notices since July. Hard to know the actual driver and if that won't be reconstituted later on.

That's the rub with this fund. There are a few others with ATM offerings like PTY, PDO, PCN, PAXS, PHK, PFL, and PFN. However, most other funds have much smaller gaps between the gross investment income earned by the fund and the aggregate paid to the shareholders. This is due to the larger distribution on NAV of PDI but also because of the strength of that "fund brand" allowing it to supplement the distributions with new shares.

If you look at PAXS, it has traded at a discount for most of the last fiscal year. Their net proceeds from the ATM were zero and just a minimal amount in div reinvestments from the DRIP.

Total distributions were $98,875 and net investment income was $79,679 so they could not make up the difference. The good thing for PAXS is that it launched recently so the distribution on NAV is more in line with what they think they can earn.

PTY and PCN have much better earning profiles and are not as reliant on the ATM or DRIPs to the same extent. PDI and PDO are the most reliant.

So what does all this mean?

Like the Guggenheim Strategic Opportunities Fund (GOF), PDI is a bit dependent on the share price trading above the NAV and the distribution staying at these levels is contingent on the amount of new capital that comes in from the ATM and DRIP programs.

The 19a notices that PDI has been issuing of late are a bit worrisome - especially since in each subsequent month, the amount of RoC has been increasing.

In my last update, I noted that PAXS was one of my largest holdings. I did lighten up on that position in order to raise cash as the valuation increased since then. However, I still like this fund as one of the best for long-term holdings among the PIMCOs, given the safety of the distribution. I just would hold off buying any here and would wait for a pullback.

The two other best options are PIMCO Income Strategy I and II (PFL)(PFN). They are also less reliant on the ATM program for making up the net investment income to distribution shortfall and the valuations are actually somewhat decent here.

Concluding Thoughts

We have discussed in more depth the sustainability of the distribution of the PIMCO funds, focusing our attention on PDI, specifically. As we have demonstrated, a lot of the chance of a cut comes down to the valuation of the fund, and the ability to keep the share price above NAV.

Should the shares trade below NAV for a prolonged period of time, it is more likely a cut will come. The rise of interest expense in the last year has been negative but it pales in comparison to the amount of cash flows from the ATM and DRIPs. Those are highly important to a fund like PDI.

What conclusion can we draw?

Each person will likely have their own conclusion. PDI has been successful at producing the cash flow they need to sustain that high yield. However, the NAV is still on the wane having now fallen from $25 to the current $16.55. That limits the amount of leverage that the fund can put on and makes the yield higher. And subsequently makes the fund even more reliant on the ATM and DRIPs.

I continue to watch the NAVs of these funds as a good indicator of their health. Right now, I have only modest exposure to PDI preferring PAXS and PFN along with the new NRGX/PDX fund.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

---------------

Try Yield Hunting Premium for 7 Days On Us! Also, the above button is good for 10% off our already reduced annual rate!

What Makes Yield Hunting so unique?

Our Core Portfolio has a standard deviation of just 4.94%. That is about 40% of the S&P's volatility over the last three years. And remember, the S&P had historically low volatility during that period of time. The Sharpe ratio is over 2X that of the S&P 500. That ratio tells us how much return per unit of risk we are taking.

That is an astounding figure given that the risk measure of the Core Portfolio is based on the PRICE volatility, not the NAV volatility. If we could assess the NAV volatility, it would likely be at least one point lower if not more.

In other words, you are taking two-thirds LESS RISK by NAV than the S&P and only giving up a quarter of the gains!

Time to go Yield Hunting!

Our member community is fairly uniquely focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today.

We also have expert guidance on:

Fixed Income closed-end Funds, Muni's, Preferred stocks, Baby bonds, ETFs, and Mutual funds.... among others.

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one-week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Invest alongside a real portfolio manager and financial advisor with over 25 years experience managing assets- along with his dynamic team. Yield Hunting’s easy-to-follow low-maintenance models are aimed to generate a high single-digit yield for retirement income planning or fixed income allocations.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 9% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor. Current yield is over 10% .

Active Income Portfolio - The active income portfolio is your total asset allocation solution. It is built with an income focus in mind but has total exposure across all asset classes. We base our sector/asset allocation based on our Macro Ratings tab and put our money where our mouth is!

Model of Models - This is our conservative model, appropriate for the largest percentage of members of our service. It is an allocation blueprint for members to align based on their risk tolerances.

Database Lists - We also have lists of individual Munis, Preferreds, Corporate Bonds, Term Funds, and Mutual Funds to compliment your portfolio.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. We do offer past issues for free. Simply message us that you would like to receive a past newsletter and provide an email address to send it to.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Daily Note- A brief synopsis of the day, including what to look for and specific actionable advice.

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via email at admin@yieldhunting.com for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.