PIMCO Update April 2021 | Nothing New To Shift My View

Summary

PDI and PCI continue to have weak fundamentals.

PDO continues to be the best buy in the space.

PMX falls back to the buy-range.

Since this article, PDO's valuation has skyrocketed above what we deem fair value. Subsequently, coverage ratios for PCI and PDI have fallen dramatically.

We still believe a distribution cut may be imminent for the resulting fund, PDI, once the merger is complete in a couple of months.

(This report was issued to members of Yield Hunting on May 28th. All data herein is from that date. Since then a new UNII report has been issued showing further weakening of the coverage ratio. It just reinforces our views about PIMCO CEFs.)

Executive Summary

The PIMCO suite of taxable funds still look relatively weak fundamentally with large negative UNII balances and coverage that is sub-100%. The fiscal year end is approaching and the funds look to end it again with a sub-100% coverage.

PIMCO Dynamic Credit and Mortgage Income (PCI), which is undergoing a merger with PIMCO Dynamic Income (PDI) and PIMCO Income Opp (PKO), continues to show coverage around 68% and PKO at 71%.

The non-agency MBS market remains strong but less and less additive to returns as those securities are now trading tighter than most BB and B rated corporate debt.

We continue to like PIMCO Dynamic Income Opps (PDO) due to its relative level of distribution safety and lower valuation. PDO remains a great swap fund to go to as the term structure prevents it from getting to a massive premium. That will allow you to go from a PTY to PDO and not give up a lot of yield while substantially reducing your premium risk. Subsequent to this report, the price of PDO rocketed higher. That doesn't change our viewpoint for the fund but we would prefer to wait until the price is closer to par.

The most overvalued funds remain PIMCO Corp & Inc Opp (NYSE:PTY), PIMCO Income Strategy (PFL) and PIMCO Income Strategy II (PFN), with PCM Fund (PCM) not far behind.

Investors should be looking at NII yields to make their judgments on the funds (and we analyze using 6-month coverage ratios below). If those were the stated distribution rates that investors saw on CEFConnect, we believe the valuation (premiums) that the funds traded at would be very different.

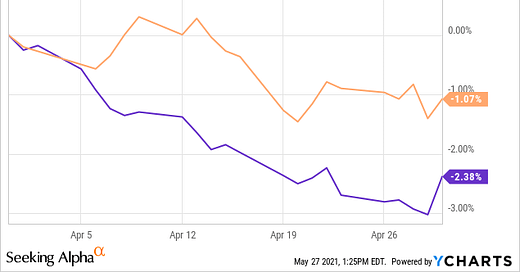

Taxable Coverage Update

Eight of the 12 taxable funds from PIMCO saw coverage erosion in the month of April. PDI and PKO were basically flat, and PHK and PGP saw nice increases. The declines in the coverage coincide with lower moves in the dollar against the pound and euro, the currencies where most of their foreign holdings are denominated. The dollar fell sharply against the euro by more than 2.3% and over 1% against the pound. This is pulling down the coverage ratios in the taxable funds, all else equal.

But not everything is equal. PKO saw a small increase in coverage and PDI and PCI small decreases. The currency drag was likely offset by a boost to the other areas of exposure they hold. What are those other areas?

Most of the other exposures are from high yield credit, investment grade credits, and non-USD bonds mostly from the developed countries. We can use proxies for those exposures. We charted those below using the High Yield Bond ETF (HYG) [high yield bonds], non-agency mortgages (ANGLX) [mortgages], iShares JP EM LC Bond ETF (LEMB) [non-USD bonds], and Invesco International Corp Bond ETF (PICB) [International developed world bonds].

l did well in the month of April. So my concluding thoughts would be that the coverage ratios would likely be much lower had they not been able to achieve good results in their underlying portfolio (outside of the currency hedges).

PCM fund continues to be all domestic which is why the coverage remains at 100% whereas the other funds are ~20% below. This is a cause for optimism regarding PCI and PDI. We know that PIMCO will not cut the distribution based on currency movements as over long periods of time, those movements offset each other.

So would PDI and PCI be at 100% if not for the foreign holdings? It's possible but really difficult to know. If that's the case, the distribution for PCI and PDI may be safer than they appear.

However, from a fundamental standpoint, we know that portfolio yields even with 45% leverage will have a hard time sustaining distributions that are over 8.5%. There just isn't much left in the market that yields those kind of coupons. And eventually leverage costs will head back up which would mean that portfolio yields would have to be even higher to offset that drag.

Eventually, the distributions will likely have to come down. The question is when?

Tax-Free Coverage Update

The PIMCO munis do not get the same kind of coverage that the taxables receive despite having fantastic long-term performance. YTD, PIMCO Municipal Income III (PMX) is up 5.2% YTD on price and 2.5% on NAV. That NAV performance puts it in the middle of the pack.

Fundamentally, we saw a nice tick up in coverage ratios for the national PIMCO munis. PMX coverage hit 109% while PMF is at 113%. The two over-distributing funds, PML and PCQ, remain sub 100% at 97% and 95%, respectively.

(Source: Alpha Gen Capital)

We are almost to a pivotal moment when those two funds reach zero in their UNII buckets. They had been under-distributing for so long that they built up large reserves for their distributions. However, a few years ago, their coverage ratios fell below 100% and starting drawing down those reserves. At one point, PML had a UNII reserve of nearly 50 cents! Today they are down to just 5 cents. The level has more or less stabilized but will likely fall again next month to 4 cents if nothing changes. PCQ did lose a penny of UNII and is down to 3 cents.

The rest of the PIMCO muni CEF suite looks healthy when it comes to distributions but not necessarily cheap.

(Source: Alpha Gen Capital)

Our three choices among the funds are:

These three funds have the best combination of yield, distribution safety (fundamentals), and valuation.

PMX is currently trading at a 6.5% premium and sports a 4.5% tax-free national yield. If you can add shares at $12.25 or less we think this is one to grab and hold for a long period of time (buy-and-hold).

PNI looks good here having corrected a bit with the premium evaporated and is at a small discount. The yield is lower at 4.15% but if you live in New York, who just raised their state income tax, that is a very compelling tax-equivalent yield. We think you can add shares at any place that is a discount to NAV.

PCK remains close to or just below fair value at a 1% premium. The yield is similar to PNI at 4.16% but if you are in the top rates in CA, then this yield is equivalent to nearly 8% taxable. I like these shares below $9.20.

NAV Performance Is Looking Up

The NAV performances are improving which should help the distributions around the edges. NAVs, net of the distributions, were up between 0.5% and 1.7% in the month of April. YTD, NAVs are still flat after paying out the distributions showing that most of the funds on a total basis are paying all of their total returns.

That simply means that the funds' portfolios are generating yield but that is not enough to cover the distributions. Instead, they are having to pay out their NAV gains as well. For example, PDI's NAV return since January 1 is +0.3%. But the NAV total return is nearly 4%, YTD. The yield is eating up all of the income production and most of the NAV gains. That isn't sustainable.

(Source: Alpha Gen Capital)

The NAV performance coincides with the increase in leverage in their taxable funds in the last month. A lot of new investment opportunities could have been found- in speaking with PIMCO they noted a lot of opportunities in structured and private credit from post-Covid "re-opening" companies. That entails buying the debt or convertible notes of a company like Royal Caribbean or some other re-opening theme and riding those names back to health. A lot of the debt of those companies remains depressed unlike their equity counterparts.

The NAV of PDI has done better which may be due to the secondary they conducted in November. That raised a bunch of new capital at a pretty good time as markets exploded higher over the next several months. A lot of the re-opening themes were added into PDI at the time along with private credits.

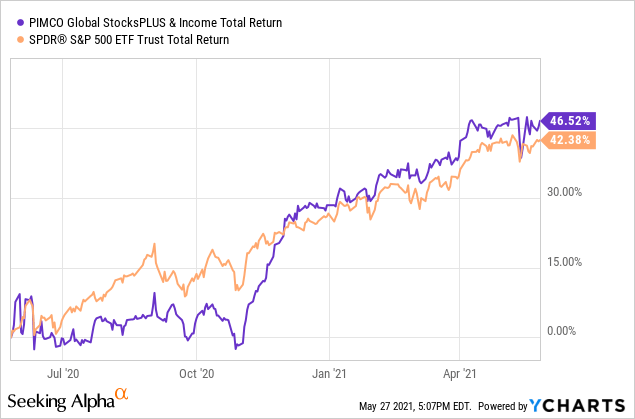

PIMCO Global StocksPLUS & Income (PGP) continues to power ahead and do well thanks to its allocation to the S&P 500/MSCI EAFE and the options writing taking advantage of the higher volatility to gain more premium. The leverage and the derivatives help to produce added gains when the market drives higher but can be a big anchor when it moves lower. At a high premium like this I'm not all that interested in the fund (just to get equity like risk and gains). I'd be more interested in the fund near par.

s remain on track. However, just how they will continue to produce NAV gains will be a bit of a mystery. The underlying portfolio's all have holdings that are at or above par. Credit spreads are at very tight levels. Effective yields are near all-time lows. This is the basis for our conclusion that the distributions will eventually need to be cut.

Valuation Update

Valuations for the funds remain near fair value. We had adjusted our buy and sell thresholds slightly. For the most part, the taxable funds are near their midpoints of their average ranges.

At a 14.5% premium, PDI has now recovered about 1.5% of the premium lost in the drop a few weeks ago. At that point, the fund was trading near an 18% premium and fell back to about 13%. With the NAV up 21 cents in the trailing 30 days net of the distribution, I am comfortable holding here. I haven't added or sold anything in quite some time (I do DRIP the distributions).

The same goes for PCI which is now just under a 10% premium after reaching a 14% premium a few weeks ago. That NAV has not done as well with the trailing 30-day gain at just 11 cents net of the distribution.

Opportunistic Swaps

Our model shows that the PIMCO Income Strategy funds (PFL)(PFN) are a bit overvalued here and that investors in them could do well swapping to PDO or even PKO.

Those in esoteric funds of PHK and RCS, we think would do best to hold here and wait for a more expensive exit point. For RCS, that would be closer to a 20% premium and for PHK about 18%-19%. Remember, though, funds with the larger premiums tend to have the higher beta.

PTY Is now trading at an astronomical premium of 38%- the highest it has been EVER! It is no surprise that the fund saw the largest drop a few weeks back when these funds 'corrected'. The premium fell from 36% to 27% in one-day. An 8% decline.

For those in PTY, the model suggests swapping to PCN for strong NAV correlation. However, one could swap from PTY to PDO and only give up 1% in yield but go from a massive overvaluation to an average valuation near par. To me, that is a no -brainer.

For those asking about PDI and PCI, again we continue to hold but did swap some of our position to PDO a few months ago. Since that time, PDO's total return NAV has actually outperformed the NAVs of PCI and PDI. Price has lagged though.

ng style, the new PDO is a godsend. That is because the fund is actually a term fund with a 12-year term to liquidation. That means the fund will likely never trade at a large premium to NAV as the headwind yield (the amortization of the premium towards par as it approaches liquidation) will be too great.

A few months ago when premiums were even higher, I recommended those looking at PIMCO check out their interval fund, PFLEX. The fund is operated very similarly to PDI and PDI but has new cash coming in- which can be a positive or a negative- and always trades at par- which can also be a positive or a negative.

Right now, we think rotating from the higher premium funds to PDO or the interval fund PFLEX (only sold to institutional investors through an advisor) makes a lot of sense. When the high premium funds correct we can then rotate back from PDO to PCI/PDI/PKO or RCS/PHK.

Unfortunately, we are losing two funds in the upcoming merger of PCI and PKO into PDI. However, with RCS and PHK investable again (after many years of carrying massive premiums) we now have those as options. In fact, I have just as much in PHK and RCS as I do in PCI and PDI today.

PDO remains our top option and a larger weight in our Core Income Portfolio given that lower valuation and earned yield. We believe staying in here and collecting a nearly 7% distribution (NII yield is actually 7.68%, more on that in a moment).

Key Points And Things To Consider

The valuation of the PIMCO funds tend to be driven by stated distribution yields and notoriety, rather than true earnings yield and valuations. PDI and PCI trade at higher valuations simply because the stated yields are north of 9%. These are also larger funds with more liquidity. That combination of high yield and liquidity means the funds garner more interest from institutional shareholders and advisors pushing up the valuation.

The higher yield is probably the most important factor. It is one of our central tenets of investing in closed-end funds as retail investors tend to select the funds with the highest yields and buy them, regardless if those yields are earned.

PIMCO is no different. The stated yields of PDI and PCI still being in the 9s despite the high premiums means the underlying portfolio yields are even higher. The NAV yield for PDI, for example, is over 10.5%. Think about that for a moment: a 10.5% yield in a 1.6% rate world. Even if the portfolio were 100% CCC junk bonds, the underlying portfolio yield would be about 7.1% before leverage. Add in leverage of 42% and you get to a gross portfolio yield of 10.1%. Take out the fees and you are down around 8.1%. And that is in the junkiest of the junky.

So the PDI portfolio is clearly not earned. And yet people still buy it simply because of those higher stated yields.

Below we created a NII yield comparison table using the UNII report sheet. All we did is take the current distribution rate and adjusted for the 6-month coverage ratio to get a 6-month NII yield. All that means is we adjusted the yield of the fund to what it is actually earning.

(Source: PIMCO)

The key thing to consider here is that PDI and PCI, adjusted for their coverage ratios, are actually paying a yield of 7.3% and 6.9%, respectively. If we compare that to PDO, which has a much lower distribution yield of 6.92%, the NII yield is actually 7.71%. That is because the fund is earning 111% of that 6.92% rate. So in actuality, before we even consider gains, PDO is earning more than PDI or PCI and most of the taxable funds. The only fund that beats it is PHK, another fund we like.

Concluding Thoughts

There is a lot to think about in this report. You can tell we favor PDO over the other taxable funds but still hold PCI, PDI, and PHK/RCS. Holding five different PIMCO taxable funds may seem like a lot given their NAV correlations but the valuations are not overly compelling to make full swaps at this point. Should PDI or PCIs premiums rise another 4-6%, we would likely be swapping out of them more fully and into other options in the PIMCO suite.

As I noted, some have access to institutional products so if ALL PIMCO funds get expensive, they can swap to the interval fund, PFLEX. Unfortunately, that is not a retail product and I'm not sure it will ever be. However, we do have PDO which is a term fund which should prevent it from ever getting to a premium of more than 7-9%. Thus it can always be a swap candidate for us to rotate into.

Distributions on the primary taxables remain precarious and are likely to be adjusted, perhaps once the merger has been completed. For now, we are holding our smaller position in PCI and PDI and prefer to be heavier into PHK and PDO (along with some RCS).

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 8+% yielding portfolio.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 8% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor. Current yield 8.53%.

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.46% (some tax-free muni income).

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability. Current yield of 4.96% (mostly tax-free).

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securities where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital (Yield Hunting) - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.