PIMCO Enters The Merger Game: What Are The Implications?

Summary

PIMCO surprised investors by announcing a merger of two of their most popular funds into a third.

Most of the arbitrage already is gone but we highlight some of our thoughts surrounding what's next and the distribution.

I wrote to members this AM that I expected PDI to be down 1% to 2% and PCI to be up 1% to 2%.

Ultimately, I do think the distribution will need to be cut but perhaps this merger gives PIMCO some time to assess the environment a few months from now.

I do much more than just articles at Yield Hunting: Alt Inc Opps: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

(Portions of this note was written to members of Yield Hunting prior to the market open.)

PIMCO surprised closed-end fund ("CEF") investors with a press release late Thursday announcing the intention to merge three of their most popular products into one massive fund.

PIMCO Dynamic Credit and Mortgage (PCI), already one of the largest CEFs and the largest taxable bond CEF in existence, is slated to be merged into PIMCO Dynamic Income (PDI). They also noted that smaller PIMCO Income Opp (PKO) would be merged into PDI as well. Both need shareholder approval plus PDI's shareholder's approval.

The announcement came after market close on April 29. I think this is important because come Monday, we get the May distribution notice as well. The release states that the board of directors approved a reorganization of PCI and PKO into PDI.

However, they're subject to shareholder approvals of PDI and PKO as well as other contingent factors. Those factors include:

PDI shareholders must approve the merger with PCI and PKO (to issue additional common shares).

PKO will only be merged into PDI if the shareholders of PCI approve the merger. In other words, PKO will not be merged if PCI doesn't merge into PDI.

No action is needed from shareholders of PCI.

In addition, the board has incentivized shareholders by reducing the management fee for the resulting mega-fund, PDI, by 5 bps to 1.10% from 1.15% of average daily total managed assets. It is effective when PCI merges into PDI (not necessary for PKO to merge for this to occur). Just PDI shareholders to approve the deal.

They also announced a 75% fee waiver for PKO for the two months following once PKO and PDI shareholders approve the deal.

After the mergers are complete, the resulting fund (PDI) will be managed just as it is today - same investment objective and mandate.

The expectation is that the mergers will be completed two to three months following the shareholder meeting. So I would expect this to be done sometime in late September or October.

Comments

So what happens? You have a $3.4B fund and a $600M fund merging into a $2B fund. So you average weight the premiums to get where they will end up. In other words, the resulting fund will be about $6B in net assets ($10B in total assets) so PCIs weight will be 56%, PKO 10%, and PDI 34%. Multiply those percentages by the current premiums to get where we end up which is just over 13%. So PDI is overvalued by 3.2%, PCI under valued by 2.1% and PKO overvalued by 1.7% using April 29 ending premiums.

In other words, the resulting fund should have a 13.1% premium based on where they were on the 29th.

This is certainly not going to be a similar move like we saw in the Guggenheim funds (GOF)(GPM)(GGM) where these funds were diametrically different in terms of investment mandate and valuations. GOF was at a 26% premium and GPM at an -11% discount! That's a massive chasm that needed to be closed.

We have four months minimum before any of this closes so it will close maybe 50%-75% of that variance today (Friday the 30th) and then the rest over time. I would expect PDI to open lower by 1-2% and PCI to be up 1%-1.5%. I would also fully expect shareholders to pass this deal.

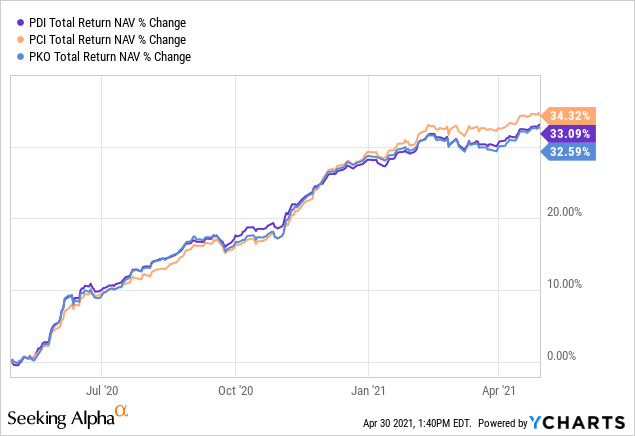

Not too much changes in terms of underlying exposure. The three funds were really triplets (especially PCI and PDI). The below chart shows the total NAV returns over the last year. The variance between the three funds is negligible (less than 200 bps).

Using Acamus' CEF Analyzer Correlations Tool, we can see that the NAV of PDI is very correlated to both PKO and PCI. However, there is more "comovement" (not a statistical term but one created by Acamus to denote the "beta" of the NAV relative to the dependent variable, in this case PDI's NAV). What this means is that PCIs NAV tends to move with 92% correlation to that of PDIs and PKO is actually slightly tighter at 96%. However, PKO tends to move at a slightly greater amount while PCI's less.

For example, if PDI's NAV is up 10% over the course of the next quarter, then using this data we can expect PKOs to be up 11.7% and PCIs to be up 9.2%- all else being equal.

The higher beta for PKO is likely a result of the portfolio containing less in the way of non-agency mortgages and more high yield credits.

The leverage is achieved with roughly similar borrowing costs and methodologies. So the borrowing cost for the resulting fund should be the same.

Concluding Thoughts And Most Importantly.....

These funds have similar means of leverage, similar investment mandates (more or less), and similar portfolios (more or less). So why did PIMCO after all these years join the merger mania that has been happening in CEF land?

My thought ("hunch") is that these three funds were the most susceptible to a distribution cut. This could be a last ditch effort in mitigating that. By merging the fund you reduce expenses and improve net investment income margins. If you look at the most recent financials (semi annual report from Feb) PDI had gross investment income of $104.5M but net investment income of $81.7M. That is a gross margin of 78.1%.

Looking back at a few of the recent mergers, like in the muni space (not apples to apples I realize), funds were able to boost that margin by 100-200 bps. For PDI, that would mean and extra $800K to $1.6M in net investment income slightly boosting distribution coverage. It's too bad the Guggenheim merger has not gone through because I'm still waiting to see if they cut the distribution when that closes on the resulting GOF. Are they using it as a means to reduce the distribution?

Same with PIMCO, it could be cover for a cut to income. For now, I don't think you do anything. Sure, PCI is relatively cheaper now that it will likely merge into PDI at NAV. But it is likely to be up 1-2% at the open as I noted above and most of the juice gone immediately. We get the distribution announcement on Monday. I still think there's a small chance they cut but at this point I think they wait for the merger to be completed before doing so. To see where the resulting fund ends up in income production with their internal people modeling out just what is a likely level of NET investment income going forward and then assess the distribution change, if necessary.

We lowered our exposure to PCI and PDI in our Core Income Portfolio (yield is 8% tax-equivalent). With the proceeds we bought PIMCO Dynamic Income Opps (PDO). Sure, we give up 200 bps of yield but this yield is EARNED. We sidestep the risk of a distribution cut and the resulting premium risk (i.e. the share price plummeting). I also think the distribution is under-earned for PDO which is why the NAV is outperforming the others'.

------------------------------------------------------------------------

Yield Hunting Premium Members receive a full list of funds in each sector, which funds we are buying and selling, model portfolios to guide them…

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the 2-week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 9+% yielding portfolio.

Here are some reviews:

Invest alongside a real portfolio manager and financial advisor with over 25 years experience managing assets- along with his dynamic team. Yield Hunting’s easy-to-follow low-maintenance models are aimed to generate a high single-digit yield for retirement income planning or fixed income allocations.

With a subscription to Yield Hunting, you get access to:

Our Three Portfolios that help create a safer and consistent 9% income stream:

Core Income Portfolio This is our main model. It has about a dozen securities (almost all CEFs) with almost no equity exposure. The risk profile by NAV is less than half that of the S&P 500. It is a bit more passive than most portfolios, with only a handful of trades a month- making it very easy to follow even for the novice investor. Current yield 8.53%. 2019 return 19.56%

Flexible Income Portfolio: This is our active trading portfolio. It is designed for more aggressive investors looking to maximize capital gains along with yield- looking for funds that have a high probability of mean reversion (extremely large discounts that have a good chance of closing in the short term). Current yield of 7.46% (some tax-free muni income). 2019 return of 23.14%.

Taxable Income Portfolio: This portfolio takes a more tax-advantaged approach, attempting to maximize after tax gains by utilizing funds that keep an eye on tax liability. Current yield of 4.96% (mostly tax-free). Since inception (November 1, 2019) return of 2.96%.

Peripheral Portfolio Database: This is aimed at diversifying the Core Portfolio by investing in equity CEFs and REITs, preferred stocks, exchange-traded baby bonds, ETFs, Mutual Funds, and other securities. It is less a full portfolio than a list of researched funds that we recommend for those that want to expand beyond the conviction list of securities but don't have the time or inclination to do the research themselves. This includes a "Safe Bucket" section detailing the highest yielding cash-plus securities where excess cash can earn upwards of 4%. The model portfolios are designed with real time pricing detailing specific "buy, hold, sell" ratings.

Low Maintenance Models: This is for the pure, hands-off novice. In these models, you will assess your risk tolerance and can simply follow the model as you see fit within your risk profile.

Our premium service is organized in the following manner:

Monthly Newsletter - Details the current investing environment, portfolio construction techniques and advice, and a review of our model portfolios. We do offer past issues for free. Simply message us that you would like to receive a past newsletter and provide an email address to send it to.

Weekly Commentary - Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings and the effects the current market situation will have on them.

Yield Hunting Review - this will take a more macro approach to the market for more long-term

Spotlight - Several write-ups each month, with specific analysis on securities we want to bring to our members attention where we see specific opportunities.

Alerts - Buy/ sell alerts on securities within the portfolio as conditions warrant

And finally....

Access - You are not on your own! We are available weekdays during market hours via chat, private message, and email for any and all questions or concerns. We also offer a complimentary cursory review of your portfolio, so you know you are not going it alone and always have a professional's ear whenever you need it.

Why Yield Hunting?

While our service is aimed primarily at late stage career and retired investors, the strategy can also be used to lower risk by augmenting traditional equity investing via open-end mutual funds or ETFs. This includes those who have spent many hours researching and selecting the equity side of their portfolio, but don't have the knowledge or time to do the same for the fixed income side. We use high quality institutional research to avoid distribution cuts, opportunity risk, and other pitfalls which can derail your strategy.

Our Team

Three For The Price Of One! Being one of the larger services means we have a larger budget. We believe we've assembled some of the best talent on Seeking Alpha analyzing closed-end funds.

Our stacked team includes:

1) Alpha Gen Capital - I am a career financial advisor (non-practicing) and investor. Not someone from another career doing this on the side. The AGC team and I use detailed analysis to provide safe and actionable insight without the fluff or risky ideas of most other letters. Our goal is to provide a relatively safer income stream with CEFs and mutual funds. Maybe more importantly, we also help investors learn about investing and how to properly construct a portfolio.

2) George Spritzer - Another career financial guru who runs a registered investment advisor with a specialization in closed-end funds for individuals. George uses the following investment strategies: 1) Opportunistic Closed-end fund investing: Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. 2) Exploit special situations: tender offers, fund terminations, fund activism, rights offerings etc.

3) Landlord Investor- Spent his career as a management consultant for public sector clients at a multinational consulting firm in the DC area. He has transitioned to a new career as a full time landlord. His investment portfolio is comprised of two parts -- broad-based index funds and income plays such as preferred stock, CEFs, and REITs. He also owns individual/baby bonds which he buys on margin to boost total return. Landlord is our 'individual preferred stock' expert analyst.