Morning Note | Nov 22, 2022 | Muni CEFs Continue To Rebound

Good Morning!

Markets are modestly higher today amid low volumes on the short Thanksgiving week. China saw its first deaths in the mainland from Covid since May prompting fears among investors that the country would shut down again. Several Federal Reserve officials are set to speak, including Kansas City Fed President Esther George and St. Louis Fed President James Bullard. Economic reports due out include the Philadelphia Fed’s nonmanufacturing business outlook survey and the Richmond Fed’s manufacturing index.

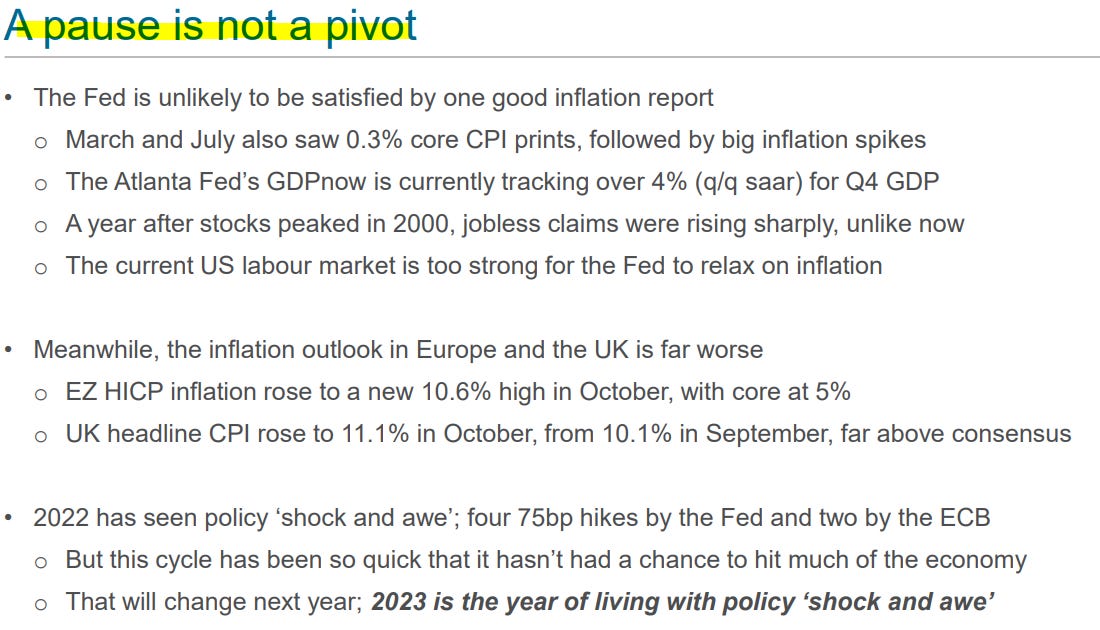

Yields are in focus with the 10-yr still sitting at the 3.8% level. Commentary from Fed officials over the last week indicates that the policy rates could be in the 5% to 7% but the market doesn't believe them with Fed Funds futures sitting at 4.86%.

Barclays bank reiterated their preferred asset allocation of cash and long duration over equities.