Investment Grade Bond Exposure For The Risk Averse Yield Seeker | Yield Up To 7%

Investment grade exposure remains a great way to gain yield without a lot of risk

SUMMARY

Interest rates have risen to the point where investment grade fixed income actually is paying income again.

BDC Notes are probably the best risk-adjusted return out there at the moment with yield to maturities of 6% or more.

There are other options as well in the preferred stock, baby bond, and closed-end fund space.

Bookmark this report as there are a ton of high-quality yield ideas in it that one could use to build a durable portfolio that actually yields something.

Our narrative for the last several months continues to be to take some risk offer the table and focus on the economic regime we expect to be in six months from now.

Has the bottom been placed? Who knows and by the time we do, the investment implications have passed.

The rest of this year is going to be a very tough call. Will we go into a deflationary bust with a moderate recession that drives up the unemployment rate and pushes down interest rates significantly?

Or will inflation remain stubbornly high, a recession avoided, with ever higher interest rates as the Fed continues to play catch up?

Recently, Mohamed El-Erian penned an article in the FT (Financial Times) in which he stated that the market is underpricing the terminal rate and risks of sticky core inflation are significant:

While headline inflation is expected to fall in the next three months (the July reading is due out on Wednesday), core measures are likely to stay uncomfortably high and prove unpleasantly sticky. As the Fed scrambles to regain control of inflation and restore its damaged credibility, aggressive rate hikes and the contraction of a bloated $9tn balance sheet risk pulling the rug from under the economy and markets. These have been conditioned for way too long to function with floored rates and massive liquidity injections. The alternative of an early pause in the hiking cycle is not a good one as it risks leaving the US with both inflation and growth problems well into 2023.

Yields today have moved up dramatically since the start of the year. Fixed income once again produces.... income.

Many are pointing to the recent CPI numbers as an indication of peak inflation. It is possible. As we noted in the Weekly Commentary, most CPI moves month-to-month are due to changes in oil prices and oil prices continue to come down.

The Fed is now expected to raise rates just 0.5% in September, down from 0.75% before the CPI report.

(h/t BDC Buzz)

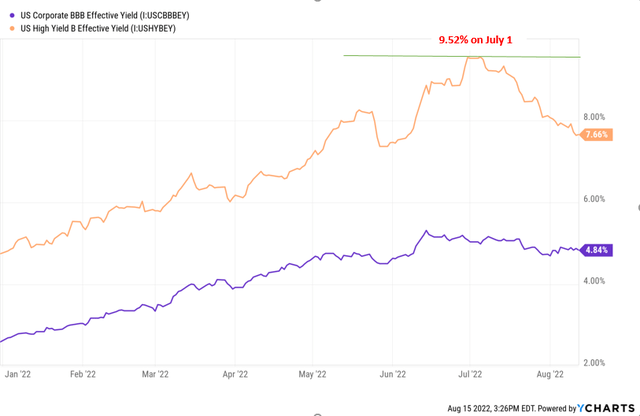

Yields on investment grade and non-investment grade debt continues to look good but they are well off their highs thanks to tighter spreads and long-term rates coming back down by half a point or more.

I often look at the ratio between investment grade (BBB) and non-investment grade (single-B). The orange line, B effective yield, peaked at 9.52% on July 1st. Over the last six weeks, that yield has fallen by 20% to 7.64%.

At the same time, investment grade yields have come in but by a much smaller amount. The current 4.84% is only down 8.5% from the peak in mid-June.

And the spread between the two areas of the bond market has come way in. The chart below shows the ratio of the BBB effective yield to B effective yield. You can see the dip around May-July 2022 and the subsequent recovery.

The reason we show this is simply because we do not see a ton of value in high yield fixed coupon bonds today versus investment grade bonds. Why take a lot of additional risk to capture an extra 2.8% when you can take the nearly 5% and sleep well at night?

I also input this table from Bancroft Capital to show that you also don't get paid much additional to go out deep into the curve. In other words, keeping things shorter maturity makes a bunch of sense here as well since the addition yield pickup by going from 1 year to 5 years is almost meaningless while adding a bunch of interest rate risk.

Individual Bond Investment Grade Options

BDC Notes can be a great way to gain exposure to higher-coupon individual bonds with less risk and volatility than a bond CEF or the common of a business development company ("BDC").

BDC Buzz, a wizard in the BDC space, has been highlighting the investment grade notes as a great opportunity as well.

Many BDCs have investment grade ("IG") bonds/notes for lower-risk investors that do not mind lower yields/returns. Thanks to the recent declines in fixed income, the traditional bond market is now offering some excellent values, especially in the BDC sector, and I will discuss over the coming weeks. However, many of these bonds are now rebounding and I have started making purchases of mid duration maturities, which for me is between 3 and 6 years.

Traditional bonds do not trade on stock exchanges but are available through your brokerage using CUSIP numbers with a face/maturity value of $1,000. These bonds pay interest semi-annually with a pro-rated interest payment on the purchase date. Brokerages express the trading prices as a percentage of the face value.

As discussed later, ARCC's 2031 bond is currently priced at $79.71, which implies a current value of $797.10 for each bond. For more information on examples of how to trade bonds using CUSIPs and limit orders, please see the following link.

Most BDC bonds have credit ratings from Moody's and/or S&P and so far, no BDC has ever defaulted.

In general, we want to go highest quality with the shortest duration. The Sherman Ratio is a good starter screen to use in these types of investments.

Here are Landlord Investor's and my selections from the group.

(1) Ares Capital- (ARCC) 2.15% 2026 (04010LBA0) YTM: 6.0%

(2) PennantPark- (PNNT) 4.00% 2026 (708062AD6) YTM: 7.0%

(3) Golub- (GBDC) 2.50% 2026 (38173MAC6) YTM: 5.8%

(4) Owl Rock- (ORCC) 2.625% 2026 (69121KAF1) YTM: 6.4%

(5) Hercules Cap- (HTGC) 3.375% 2026 (427096AH5) YTM: 6.4%

(6) Ares Capital (ARCC) 3.875% 2025 (04010LAZ6) YTM: 6.0%

You could purchase 1-1.5% positions in each of these (and/or others) to build a 6-10% portfolio allocation that yields over 6.4%. With duration less than 3 years, and an investment grade rating, it is extremely difficult to find a better yield per unit of risk in the markets today.

A good example of not being paid to go long maturity is in the ARCC bonds themselves. The 2026 bonds carry and yield-to-maturity ("YTM") of 5.9%. Compare that to the 2031 bonds have a YTM of 6.3%. So you only pickup 0.4% for going out from a 3.9 year term to a 9.3 year term. Not worth it in my book.

We will continue to find more individual corporate bonds, preferably investment grade rated, for inclusion into income portfolios.

Preferreds of CEFs

This is a category I've discussed a lot in the past few years as a means to produce a mid-single digit yield (at a minimum) with little credit risk. The largest risks these preferred stocks face is typically liquidity risk, i.e. just a few hundred or thousand shares traded can send the price down sharply.

Most are callable or mature (most are perpetual maturity) at $25 (retail preferreds). So paying under par can provide potential capital appreciation once the preferred gets called.

These are the instruments that a closed-end fund uses to secure their borrowing to gear up the fund. In other words, some CEFs issue a preferred stock to lever up their funds.

The preferreds have a lot of protection to the holders including a 200% asset ratio test. They tend to be some of the safest preferred stocks out there and yet they can pay yield-to-calls (most don't have a maturity) of more than 6.0%.

We like the select few that do have a maturity first and foremost but would not hesitate to purchase some that do not at the right price.

Our picks:

(1) Eagle Point Income (EIC-A), YTM 7.13, YTW 6.58%, price $23.96. Unrated (but term we think offsets that risk)

(2) Bancroft Fund (BCV-A), YTW 5.47%, A1 rated

(3) RiverNorth Opportunities (RIV-A), YTW 6.04%, A1 rated

(4) RiverNorth Doubleline Strategies (OPP-B), YTW 5.53%, A1 rated

(5) XAI Octagon FR & Alt Inc (XFLT-A), YTW 3.50%, YTM 5.93%. Unrated but term again offsets. Call not likely.

(6) Aberdeen Income Cr Strat (ACP-A), YTW 5.46%, A2 rated

(7) Eagle Point Credit (ECCC), YTW 7.13%, YTC 8.93%, unrated but term structure

IG Baby Bonds / Other Preferreds

Baby bonds are exchange traded debt issues. They are very similar in structure to an ordinary individual corporate bonds but are traded on an exchange instead of "OTC" (over-the-counter).

Innovative Investor describes Baby Bonds in this way:

They may be labeled Notes, Senior Notes, Debentures, Junior Debentures or any of a number of different names, but for the most part they are the same. They are junior to secured debt, and senior to common and preferred stock in the capital stack. Income received on Baby Bonds is interest and thus if held in a taxable account the income will be taxed at ordinary tax rates.

Maturity dates on baby bonds typically range from as little as 2 years all the way up to 100 years. Business Development Companies (BDC’s) normally issue the shortest maturity baby bonds, while utilities issue those with the longest maturities.

We also looked at other perpetual preferreds.

There are two times to buy preferred stocks. I had an old boss who used to say they have the upside of bonds and the downside of stocks. While true, it depends on how/when you buy them where that becomes the case. Buying at or above par does skew your risk to the downside. Additionally, buying when coupons are very low means that small moves in rates can cause large moves in price.

We want to buy when rates/yields are up and prices below to well-below par. That gives us a much higher income stream than doing the opposite while at the same time reducing risk through the purchasing below par.

Landlord's Investor's Picks:

(1) El Paso Energy Capital Trust I 4.75% Convertible Preferreds (EP-C), YTM 6.5%, par $50

(2) Atheen Holding Ltd. (ATH-D), yield 5.84%

(3) Wells Fargo L-series $1,000 par 7.5% Pref (WFC-L), yield 5.73%

(4) Spire Inc (SR-A), yield 5.83% (5) Brookfield BRP Holdings (CanadaCanada) (BEPH), yield 6.22%

(6) Renaissance Holdings Ltd (RNR-F), yield 5.79%

(7) Axis Capital Holdings Ltd (AXS-E), yield 5.82%

Closed-End Funds

There are a few CEFs that operate in the investment grade space offering less NAV risk than high yield and loan funds. We've discussed these a few times. However, for the risk averse investor, many of these funds still have leverage which means that their NAV movements will be amplified a bit.

Western Asset Premier Bond (WEA), yield 6.83%, disocunt -5.1%

Blackrock Income (BKT), yield 7.47%, discount -3.5%

Invesco Core Bond (VBF), yield 4.38%, discount -5.4%

TCW Strategic Income (TSI), yield 4.33%, discount -3.8%

Funds That Should Be On Your Watchlist For When They Are Cheaper:

DoubleLine Opportunistic Credit (DBL), -5% or wider

Blackrock Taxable Muni (BBN), -3% or wider

Blackrock Core Bond (BHK), -4% or wider

Concluding Thoughts

We've given you lots of options to build a 5%+ yielding portfolio without having to venture into junk. This is only possible in the couple of months as interest rates have moved higher and spreads have widened off the tights (but moving back in that direction).

Now is the time to upgrade your portfolio by replacing lower quality holdings (junk rated debt) with investment grade. While you sacrifice some yield, your downside risk is lowered greatly.