Summary

Many investors like the concept of an annuity but hate the word "annuity" liking it to a four-letter word.

The portfolio provides a monthly income stream that is better than what traditional annuities pay and yields about 8%.

The investor can apply as little or as much maintenance to their "annuity" as they would like.

The Core Income Portfolio is our version of this strategy providing a more diverse list with only minor work on the investors' part.

(This is a conceptual report primarily for newer members to understand just how the CEF can be used for an annuity replacement)

I am always amazed how many retirees become quasi-professional investors upon retirement. Is that enjoyable? Is it worry-free? In my prior years in the advising industry so many do-it-yourself investors were glued to CNBC for most of the day during their golden years. They were worried about their nest eggs lasting the duration.

Some say the peak of civilization was in the 1960s and 1970s when the largest percentage of the population was covered by defined benefit pensions. These provide a lifetime income stream that is not tied to the stock market. The investment risk is placed on the employer or pension plan owner. The typical pensioner could live "risk-free" not having to worry if their IBM stock rose each year. Of course, most were taking a large amount of credit risk but that's another story.

Most investors want some sort of income stream that covers their retirement spending. They don't want to rely on capital gains each year given the additional volatility they have experienced in recent years.

There is no doubt that do-it-yourself investor requires more work today than just a decade ago- let alone compared to the '80s and '90s. Those were the days where one could set a 60/40 asset allocation and literally not have to do a thing to manage it other than perhaps an annual rebalancing. Most investors that come to our marketplace service ask about how "hands off" the management of the portfolio is.

Hands off is a tricky thing. What one considers hands off another may consider too much work/trading. In my mind given the current market environment, one trade a month should still be considered "hands off."

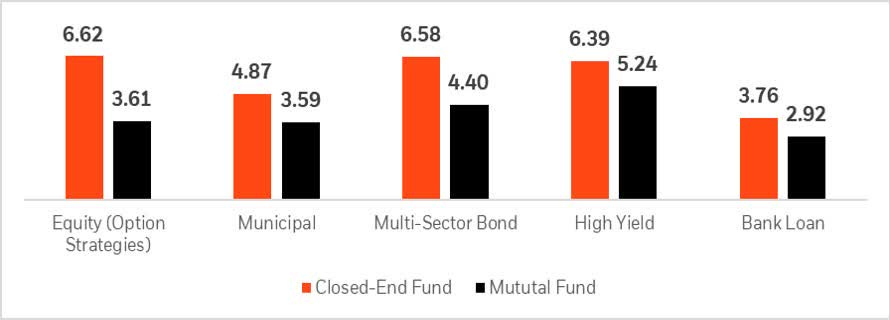

So the service set out to create a portfolio that could produce greater than 4% in income without having to trade much (1-3 trades per month). The closed-end fund ("CEF") is the obvious choice for that tool to create that pseudo-annuity. It pays monthly income (at least the fund we purchase) and has yields that are above 5%. And long-term performance does much better than mutual funds:

*5-year return averages

(Source: Blackrock)

Creating An Annuity

Many investors today have trouble paying bills out of savings. This is a natural by-product of working for 30-40+ years and using paychecks to pay your mortgage, credit cards, and other bills. When they retire the paychecks stop but the bills do not. This is why pensions appeal to so many people.

Many investors use dividend stocks and REITs to accomplish this but most of these securities pay quarterly and have a lot of risk in them. And most pay less than 3% in yield. Again, the CEF structure is ideal for this given the high yield and zero reliance on capital gains.

What would this annuity look like:

I would start with three multisector funds with great track records and top notch management.

Three Multisector Funds

(1) PIMCO Dynamic Income (PDI): The fund remains a top performer, yields 9.76%, and you get a premier portfolio manager in Dan Ivacyn and PIMCO. Remember, this fund is not LOW RISK by any means. The NAV incepted at $23.50 and has been as high as $34 and as low as $19. Today, it is back to $24.70. But if you can ignore the NAV and even greater price volatility this fund pays a distribution that has barely changed in 8 years. In terms of distribution reliability, this thing is near the top.

I have rarely ever sold a share of PDI over the last 6 years. This is one you buy opportunistically, DRIP (if you're not reliant on the income), and hold in perpetuity. While doing fund swaps in this space can result in significant positive outcomes, it isn't necessary.

(2) DoubleLine Opportunistic Credit (DBL): Jeffrey Gundlach is one of the more famous investors today and he has a significant amount of his net worth in this fund. That alone would be good enough for many investors. But this fund has done extraordinarily well given the amount of NAV risk in it. It is much less leveraged than a typical CEF at just 18.8% which helps dampen volatility. The fund is mostly mortgages, a combination of agency (very high quality securities) and non-agency (higher yielding). The fund also has a bunch of CLOs but higher quality tranches compared to pure-play CLOs like Eagle Capital (ECC) and Oxford Lane (OXLC).

The recent annual report showed the fund is out-earning the distribution nicely which means the payment is safe. The fund won't hit home runs but will generate at least mid-single digit returns with lower risk than being in a pure high yield fund. The 6.72% yield is more like 7.3% when considering what they actually earn. This is another fund I DRIP and also buy more of when the discount widens beyond -4%.

(3) Blackrock Credit Allocation (BTZ): One of the most unsung funds in the CEF space. This fund has built a great long-term track record that bests PIMCO Income (PONAX) with similar risk levels. If the fund was an open-end, this thing would have $100B+ in assets. You can get it as a $2B fund. In the last ten years the fund has produced total returns of nearly 9% per year- understanding that historical performance is unrelated to future returns.

Overall leverage is near average but on the lower end of the range at 27% and the fund has ample volume at 375K share traded per day. The portfolio is mostly corporate bonds centered on the triple Bs. It has about 40% in high yield, mostly double-B. This is a fund I do tend to trade a bit but investors do not need to. Buying at a -10% discount and selling around -4% has been profitable. But simply buying at a double-digit discount is enough to generate nice gains.

Add In Three High Yield / Floating Rate Funds

Complimenting the above with some higher risk, higher return funds can augment the portfolio yield (if you need it) while providing a correlation benefit.

(1) Ares Dynamic Credit Allocation (ARDC): This is a unique fund that splits the portfolio between high yield bonds and floating rate loans and shifts that based on market conditions. The fund is a bit higher risk than the multisector funds but offers up a juicy 8.50% yield at a -14% discount, currently. Buying shares at a mid-teens discount and holding has been a profitable endeavor. But you need to be able to accept the volatility on price which can be high- almost to stock like volatility.

(2) Blackrock Multi-Sector Income (BIT): This is a mirror of BTZ mentioned above. The fund is 60% non-investment grade and 40% investment grade. Assets are large at over $1B with a lot of liquidity as 200K shares are traded daily. Leverage is on the higher end at 34%.

I consider BIT a core non-investment grade holding. It is not in the Core Portfolio because of the issues they faced early last year in regard to their largest holding, Aviron. But it appears those issues are no squarely behind them and management is attempting to regain fund reputation. That is likely here as the 8.7% yield is very competitive and the discount has tightened up strongly. In the last year, the fund's NAV is number one in the category out of 22 funds.

(3) Apollo Tactical Income (AIF): A floating rate fund, AIF has struggled in the last year on price but continues to perform mid-single digits on NAV. Longer term it has put up a great track record. It is the number one space in the loan category for the last three years and number two over the last five years.

Some investors may be turned off by the yield but management attempts to right-size the distribution with the earnings of the fund. They recently increased the distribution by 11% perhaps foretelling a cessation in distribution cuts.

Add In Three Term Funds For Volatility Dampening

Term funds are CEFs that are slated to liquidate at a certain point in the future and in some cases (target terms), attempt to do so at a certain price. These funds can be tethered to their NAV preventing large discount widening in the cases of funds that will liquidate in the next couple of years.

(1) AllianzGI Convert & Income 2024 Target (CBH): This is a convertible fund but the added safety of a near-term liquidation (just under 4 years) and a term structure to keep the discount in check. The fund will liquidate at NAV and attempt for that NAV to be $9.83. The current NAV is well above that at $10.36 but this is a more volatile category tied largely to tech stocks.

What is typical with terms is that they cut the distribution as it approaches liquidation to solidify hitting the target. Also, positions mature and they typically place that capital into t-bills to hold. With a $10.36 NAV we have a lot of cushion plus the fund is trading at a -4.6% discount providing a tailwind yield of 1.2%.

(2) Invesco High Income 2023 (IHIT): As the name implies, the fund will liquidate in just under three years. The fund currently trades at a -4.1% and invests primarily in commercial mortgage backed securities. The fund still has a high chance of meeting its NAV target of $9.83. However, the NAV is rising nicely. The yield is 7.2%.

With 3 years to go you can divide the current discount by 3 to get the rough tailwind yield which is 1.3%. That is a nice bump to your yield and hopefully some capital gain if the recovery continues.

(3) Nuveen Emerging Market Debt 2022 (JEMD): This is an emerging market debt fund that will liquidate in late 2022. The current discount is -4.1% which means you get a tailwind yield of 2.1% per year in addition to the yield of 5.3%. EM debt is a very attractive asset class as the US dollar continues to decline rapidly. It has been overvalued for some time and is likely to fall making EM debt (and equity) very attractive.

What That Annuity Looks Like

Equal weighting those names produces a portfolio with a yield just under 8%. Not too shabby. The portfolio over the last three years would have gained about 3.5% in market value (capital gains ONLY) but produced over 8% annually in income. For those following the 4% rule, that is an excess 4% in income to pay taxes and/or reinvest and compound.

Steven Bavaria far more eloquently than I discusses this in his writings of comparing dividend growth investing to income investing. If an investor generates 8% in income or 4% in income and 4% in capital gains, they should be largely indifferent.

Investors in this strategy should have little maintenance over time. You can live off the income or some of the income, reinvest the rest to combat NAV decay from the occasional over-distributing and you have your asset base (principal) upon death- which is not the case with the traditional annuity.

For low maintenance, you could simply set the payment amount at a certain percentage of the yield of the portfolio- for example, at 5% of the market value of your quasi-annuity. Then every six months to a year, check the cash balance in your account and reinvest the excess or pooled cash back into the above positions.

What Are The Risks?

A traditional annuity places the investment risk and longevity risk on to the issuer. But to pay for that, the investor loses the liquidity of the assets and in fact loses the assets permanently. Using this approach, the investor needs to accept the investment risk, that is the market value fluctuations.

We have often posted this chart to illustrate the point. It highlights the ULTIMATE ANNUITY:

Those chart shows the fluctuations in PIMCO Corp & Inc (PTY) since the fund incepted in 2003. You can see the extreme declines and increases in the fund price starting at $15, rising to $18, down to $5, up to $22, down to $11, up to $20, and back down to $16.

However, the market value is almost immaterial. The income levels (displayed on an annual basis in blue on the bottom) are what the investor should care about. The benefit of the traditional annuity is that the investor doesn't see the day-to-day fluctuations and they don't care about it. It's on the insurance company. But with this approach, you need to be able to "train yourself" to ignore day-to-day and even month-to-month price volatility. If you can, check balances very infrequently like every 3-6 months at most.

Summing It Up

So that's my take on creating your own annuity where you do not cannabalize your own assets for a very small internal rate of return. But for that loss of assets, all risks (aside from the insurer going bankrupt) are eliminated. There is no guarantee that these 9 CEFs above will continue to produce that ~8% income stream. But thankfully we have a lot of cushion in that income production for those using a 4-5% withdrawal rate rule. In the end, we will still have some residual value left unlike the traditional annuity.

By selecting a diverse set of well-run CEFs, an investor can re-produce their own annuity creating monthly income with little to no maintenance if that's their desire. Is this the best selection of funds to do so? Absolutely not. I am well aware of that. However, the goal is to demonstrate the ability to construct just such an income stream- something I like to call Paycheck Replacement.

Our Core Income Portfolio is similar to this. We attempt to maintain a diverse selection of funds that represent the best opportunities available to us with the least amount of work, and risk, necessary.

-----------------

Yield Hunting Premium Subscription

Our strategy, simply put, is to create a portfolio of fixed income closed-end funds and alternative asset classes (such as REITs, Preferred Stock, and Baby Bonds) to create a risk managed approach to retirement income.

This approach can either be a standalone strategy (i.e- for most or all of your portfolio) or as a replacement for the failed 'fixed income' portion of your equity/ bond mix.

Either way, the goal is to create a safe income stream that meets as much of your monthly retirement expense needs as possible- thereby leaving the principle (as well as any equity positions) alone to grow unmolested. If selling is not necessary, we have effectively removed any or all sequence of returns risk from the portfolio.

We urge you to not miss this opportunity to take advantage of this really great offer. You really have nothing to lose with the one week free trial which locks you in at the lower rate.

This is a unique opportunity to create a fixed income closed end fund portfolio utilizing extremely rare discounts and high yielding securities. Yield Hunting can be utilized in various ways- to be the 'bond side' of your 60/40 diversified portfolio, your paycheck replacement strategy for retirement, or as a way to de-risk away from lofty equities and risky dividend stocks.

Our service utilizes Closed-End Funds, ETFs, Muni's, REITs, and Preferred Stocks to decrease risk, while still achieving a 9+% yielding portfolio.

Get a One Week Free Trial Here:

Your market investments are Monty Carlo returns, like mentioned. My annunity pays out min 7% for life. Your principle is locked in the market to make the dividends also. What I do not withdraw, my heirs get! I know exactly the payout any year from day one. Adds certainty to planning. A little bit of each is the way to go.