Guest Article: Militia Long/Short Equity ETF (ORR): A Hedge Fund-Style Investment with No Incentive Fee

This is George Spritzer’s article from October 13th on Seeking Alpha. The fund is up 13%+ since the publishing date.

Summary

The Militia Long/Short Equity ETF (ORR) offers retail investors access to a hedge fund-style, global long/short equity strategy managed by David Orr.

ORR has delivered strong performance (+24% since inception), with low correlation to the S&P 500.

The fund employs aggressive leverage (150% long, 100% short), focuses on non-US developed market longs and US ETF shorts, and is non-diversified with high turnover.

ORR is best suited as a speculative or satellite allocation (1-3%), not a core holding, especially for those confident in David Orr’s continued outperformance.

designer491/iStock via Getty Images

Summary

The Militia Long/Short Equity ETF (ORR) is an actively managed fund seeking capital appreciation using a global long/short equity strategy. The launch date was January 14, 2025.

The ETF targets a 50% net long exposure. It generally holds 150% longs combined with 100% shorts.

Managed by David Orr of Militia Investments, the fund is a hedge fund-style vehicle which aims for low correlation to the broader stock market. Since inception, its performance has been quite strong.

David also runs the small Militia Capital hedge fund which is now closed to new investors. The hedge has an excellent track record with a Sharpe ratio around 2. The hedge fund recently closed to new money because of scaling issues in some of its strategies. The ETF is an attempt to offer some of the larger scale strategies to a wider audience.

ETF Overview

Ticker: ORR

Strategy: Actively Managed Global Long/Short Equity

Inception Date: January 14, 2025

AUM: About $129 million (as of Oct. 11, 2025)

Investment Manager: Militia Investments, LLC (Sub-Adviser: David Orr)

Management Fee: 1.30%

Total Expense Ratio (Net): 14.19% (includes underlying short expenses)

Performance Since Inception:: ~ 24% (as of 9/30/2025)

Distribution: Does not pay a regular dividend.

Investment Strategy: Global Longs and U.S. Shorts

ORR operates an actively managed global long/short equity strategy with a focus on capital appreciation. The strategy employs a non-diversified portfolio and may have high portfolio turnover at times. The fund uses leverage with an average of about 250% gross exposure (150% long and 100% short) and 50% net long exposure. The fund will typically have a lower correlation and beta to the market than most public investments.

The Elephant in the Room: The Quoted Expense Ratio

The most challenging aspect of ORR for retail investors is its stated Total Expense Ratio (NET) of 14.19%.

Management Fee: The stated Management Fee is 1.30%.

Other Expenses: 12.89% Dividend Expense, Borrowing Costs, and Brokerage Expenses on Short Sales.

No, you are not really paying 14.19% expenses when you buy this ETF. The Other Expenses of 12.89% comes from quirks in how the SEC defines expenses. The main cause for the over-inflated expenses occurs because of the way the SEC accounting handles short selling.

There are several reasons for this:

When you short a dividend paying stock or ETF, you are responsible for paying that dividend to the person you borrowed the shares from for your short. From a pure economic standpoint, there is really no net cost here. The share price will drop by the dividend amount (on average) on the ex-dividend date on the same day you have to pay out the dividend. But the SEC requires that the fund treats the full dividend as a cost in the expense ratio.The gain on the short from the drop in the share price is treated as a profit or gain to the NAV, but does not reduce the expense ratio. This is probably why it is rare to see many short-selling ETFs.

Part of the short selling strategy used by David Orr is to sell short stocks or ETFs with high dividends that are “overpaying” these dividends in an unsustainable way so they may be forced to cut the dividend in the future. Because of this, ORR generally pays out a lot of dividends on the short side of its portfolio leading to the high short expenses.

When you short a stock, you may have to pay a borrow fee which is included in the expense ratio. But often when you short a stock, you get paid a short credit balance based on the cash received from the proceeds of the short sale. In many cases, this short credit balance earns interest close to the cost of the short borrow. For example, you might pay 4% to short an easy to borrow ETF you don’t like, and earn 3.5% on your cash from the sale. So the “cost of carry” seems to be around 0.5%. But the 3.5% cash credit is not counted by the SEC, but the 4% borrow fee goes into the expense ratio. The SEC accounts for gross expenses, not net expense, which vastly overstates the true costs.

David Orr has commented on his X/Twitter feed about why the short selling fees are so high:

“Frankly, the way the expense ratio gets calculated in the ETF prospectus is nonsensical. Regulators should update this number to better reflect reality. But since they don’t, and since most people do not understand this, ETF managers are reluctant to do anything in their portfolio that causes this official number to go up. Well, I say to hell with that. I’m just going to do whatever I think has the maximum expected value even if this hurts marketing to many potential investors.”

ORR- The Long Side of the Portfolio

The long side currently focuses on companies, typically in non-US Developed Markets outside the US. David Orr is based in Japan, and has many investments in small-cap Japanese stocks. Having “feet on the ground” likely gives David somewhat of an edge with these issues.

The selection process is based primarily on the net present value of anticipated future cash flows, and the manager is willing to invest in growth or value stocks. Long exposure normally exceeds 100% of net assets, and is capped at around 150%.

ORR- The Short Side of the Portfolio

The short side primarily targets US-listed companies whose net present value of anticipated future cash flows is expected to decline or be negative, leading to a future stock price decline. They also look for companies with high unsustainable dividends that may be due for a distribution cut.

The fund also takes short positions in ETFs, which may include leveraged, inverse, or inverse leveraged ETFs. For instance, recent holdings have included short positions in (QYLD) , (SDIV) and (TNA). The fund may also use short positions in foreign currencies, such as the Japanese yen, to mitigate currency risk associated with its foreign long holdings.

Portfolio Construction and Key Holdings

Top Holdings

The ETF holds a relatively concentrated portfolio, with the top 10 holdings accounting for a significant portion of the total portfolio exposure. Some of the top holdings are not single stocks but other ETFs, which the manager utilizes for shorting or to hedge against factors.

Recent top long and short positions have included:

Short Positions: (QYLD) Global X NASDAQ 100 Covered Call ETF (-30.87%), (SDIV) Global X SuperDividend ETF (-9.52%) and (TNA) Direxion Daily Small-Cap Bull 3X Shares (-5.63%).

Long Positions: (9435.JP) Hikari Tsushin Inc. (+8.54%), (TSM) Taiwan Semiconductor Manufacturing Co (+8.32%) and (ET) Energy Transfer LP (+7.11%).

Sector Allocations

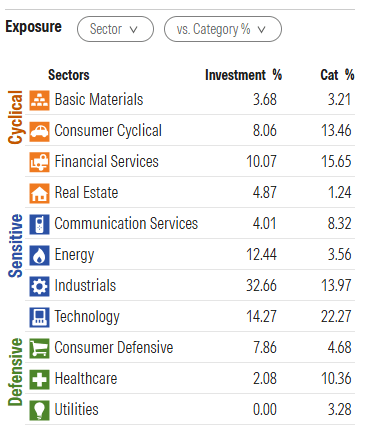

Morningstar gives the following sector allocation as of October 9, 2025:

Note the high allocation to Industrials and below average allocations to Technology and Health care.

Risk: Non-Diversification and Aggressive Stance

The fund is classified as non-diversified. This allows it to invest a larger portion of its assets in a small number of issuers, magnifying the potential impact of a single holding’s performance on the overall fund. The aggressive strategy, including shorting, leveraging, and fairly high turnover may increase the risk and complexity beyond the usual equity ETF. But David Orr was a professional poker player and knows how to manage risk and has been careful to hedge many of the risks in the portfolio.

Performance and S&P 500 Comparison

Long/short equity funds are often evaluated on how well they can deliver absolute returns with lower volatility and low correlation to the broad markets, especially during downturns.

Recent Performance

As of late 2025, ORR has demonstrated strong recent performance, with an Inception-to-Date return of approximately 24%.

Comparison to the S&P 500 (SPY)

ORR’s strategy aims for fairly low correlation with the S&P 500. Since inception, It has normally carried a positive beta of about 0.5 with the S&P 500. Perhaps a better benchmark for ORR would be a 60-40 ETF like (AOR) or something like Vanguard’s Wellington Fund which has lower volatility than the S&P 500.

Management

The Militia Long/Short Equity ETF is managed by David Orr, who is also the General Partner of Militia Capital, a private hedge fund. The ETF structure allows retail investors access to a more scalable version of his hedge fund strategy, which, according to Orr, runs at a lower gross leverage (around 250% in the ETF vs. over 300% in the hedge fund) and cannot short the same volatile microcap stocks as the private hedge fund.

David Orr’s background as a professional poker player is relevant to his role as a hedge fund manager because many of the risk management skills used for poker are useful in managing a large long/short portfolio.

Differences Between ORR ETF and David Orr’s Militia Capital Hedge Fund

While the ORR ETF’s strategy is similar to David Orr’s hedge fund, with both being long/short and having some common long positions, there are also some key differences:

Feature

ORR ETF

David Orr’s Hedge Fund

Gross Leverage

Runs 250% or lower.

Runs over 300%

Short Positions

Often shorts ETFS. Cannot short the same stocks as the hedge fund to avoid volatility, illiquidity, and crowding.

Shorts volatile and illiquid microcap stocks

Beta

Has positive beta around 0.50

Has zero beta

Position Inclusion

Doesn’t include positions from other Portfolio Managers (PMs)

Includes positions from other PMs

Trading Style

Cannot make short-term trades like the hedge fund. Requires coordination with market makers.

Can make short-term trades

These differences mean the ORR ETF will not closely track the returns of the hedge fund. I have a friend who knows David Orr personally and owns both the hedge fund and the ORR ETF. The ORR ETF has done quite well, but the hedge fund has done even better. As of September 30, the hedge fund was up 47% year to date on a net basis (+57% on a gross basis before fees).

Since inception, the hedge fund has blown away the S&P 500 with a 536% net return versus 89% for the S&P 500.

Here is a link to the 2025 3Q shareholder letter:

David Orr has done several interesting podcast interviews where he talks about his strategies in more detail. I would recommend listening to some of them if you decide to invest some funds in ORR:

A Fresh Perspective on Long/Short Investing June 24, 2025

Navigating 300 Positions and the New Market Reality - David Orr | Senzal Insights June 27, 2025

Sept. 16, 2025

Here is link to the ORR ETF web site where the Holdings tab is updated every day:

Summary

ORR is an interesting unique ETF offering that offers a hedge fund style strategy to retail investors. You get exposure to a sophisticated long/short approach with a focus on value/growth foreign longs and US ETF shorts.

Pros: Run by David Orr who was a professional poker player. Access to a concentrated, actively managed hedge fund strategy; Potential for lower volatility/correlation compared to broad equities in a downturn; Strong +24% absolute returns since inception in early 2025.

Cons: Very high stated 14.19% expense ratio which may discourage potential new investors. The management fee is lower at 1.30%. Fairly high turnover; Non-diversified status; Relatively short track record as an ETF. Bid-asked spread can be fairly wide at times. Total return vehicle- No dividends paid so far.

Recommendation: ORR will not be a core portfolio holding for most investors. It is more of a speculative allocation for investors who believe that David Orr will continue to outperform the equity markets going forward on a longer term basis and are happy with the global long/short US strategy. Some investors may want to take on a small allocation to ORR (say 1%) strictly for the entertainment value. For those who have more conviction, I think a 3% allocation to ORR is not unreasonable.

The ORR ETF has mainly traded at a small premium over NAV since inception. You can view a historical chart of the discount/premium at the ORR web site. But on October 10, 2025, ORR closed at a rare -1.29% discount to NAV.

I think this may be a good opportunity to take an initial position in ORR or add to an existing position. I started investing in ORR around six months ago and have gradually added to my position on the way up. I plan to keep ORR as more of a long term holding as long as the good relative performance continues.