Create Your Own Annuity - Revisited

Summary

Annuities are one of the best tools for a retirement income plan but have one large drawback - the loss of principal.

You give up your assets for a lifetime income stream that lasts as long as you and your spouse live. The insurance company assumes all of the risks.

A CEF portfolio can be built that provides similar distribution yields as an income annuity (for someone in their 60s) but the assets are not lost forever.

We review the portfolio annuity we built back in December and create a new one based on today's values.

(This report was issued to members of Yield Hunting on May 14th. All data herein is from that date.)

Part I was originally released at the end of 2020 titled "How To Construct A Simple Annuity for Retirement." In it, I discussed how the buy-and-hold mentality (or even the buy-and-rent crowd) can construct a simple portfolio that acts very similar to an income annuity that one would purchase from an insurance company.

In this report we go over the results of that portfolio and some updates to it on how to think about this sort of strategy. We also build a new annuity which can be used for those who missed the boat in December or those who may want to rotate into slightly better values today.

Reviewing Our Annuity

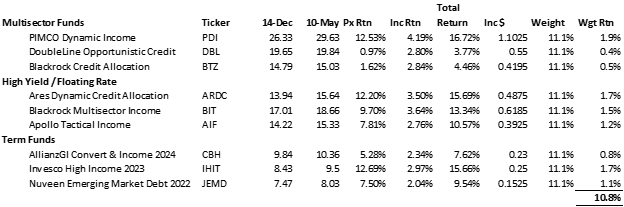

If we had equal weighted the portfolio among the 9 positions we chose back in December, the total return since that date would have been 10.8%. It was a good period of time for taxable CEFs. The key is going forward from here. Let's not extrapolate the past into the future - especially such a short period of time.

Here are the details:

(Source: Alpha Gen Capital)

All nine funds were up in value with the weakest being DBL (because of its interest rate sensitivity) +3.77% and PDI being the best at +16.7%.

The distribution on all of these is probably safe outside of IHIT and PDI. For IHIT, coverage is down a bit but still relatively strong. We are approaching the two years left mark and from there, distributions are likely to be cut for target terms. It becomes more of a total return play at that point.

PDI, we've discussed ad nauseum, I think will eventually cut the distribution but it could be months away - at which point many variables can change during that time period.

Another Look At The Risks

The largest difference between an income annuity and a synthetic one is who assumes the risk. Obviously, with a traditional annuity, the insurance company is assuming the risk. That risk comes in the form of longevity risk (primarily), which is you living much longer than they model out. The second risk is of course, the investment risk, or the risk that their general account portfolio takes a sustained hit.

One thing every annuitant should know is that at some point, poorly run insurance companies assign their risk to the annuitant. In other words, if an insurance company is so poorly run that the company has to fold (low probability event) then the annuitant has assumed the risk, the credit risk from the company.

But again, as I noted in the first report, the largest and most acute risk is YOU. The inability to hold during severe market volatility. I get this question often - what is the largest risk to this strategy? THIS IS IT! Think of the fear, anxiety, and downright disgust you had when the market was cratering in March 2020. Now that is worst case scenario.

I want you to really think back. Many people tend to forget about the risks and downside and only focus on the upside. They tend to put the pain they felt those first three weeks of March out of their memory. They recall it being bad but just how they felt and how bad it was can be a blur. That's human design right there and investing biases.

Just think if you sold in March 2020 what your results would look like. That is the largest risk.

If I Were Starting Today...

Portfolio evaluation and construction is always a function of the starting date/point of when the portfolio is coming together. Would I add BlackRock Multi-Sector Income (BIT) for instance, today? Probably not.

Here is how I would construct a similar portfolio today:

High Yield / Floating Rate:

(1) Barings Global Short Duration (BGH): This is a high yield, junky, CCC-rated corporate bond fund. The yield is strong at 7.7% but even higher when looking at actual earned yield. The discount is tight compared to its historical average but wide compared to the taxable bond CEF space as a whole. We think this one is still relatively cheap (though not cheap in the absolute sense) and can be bought here.

(2) Cohen & Steers Tax-Advantage Preferred Securities (PTA): A preferred fund that is great for the taxable account. Most of the dividends are tax qualified meaning they pay a lower tax rate so the after-tax yield on this fund can be higher than higher yielding taxable CEFs. The discount is small at -1.6% but most of the preferred space sits at a premium to NAV so this one, relatively speaking, is kind of cheap.

(3) PGIM Short Duration High Yield (SDHY): Another short-duration high yield fund that pays over 6% and has a nice NAV trend. The discount is also kind of cheap at -6% after being as tight as -1.5% not long ago. The manager is one of the best in the game and has a good track record. We like the fund for its minimal interest rate sensitivity and higher quality (non investment grade) portfolio.

Multisector:

(1) Angel Oak Dynamic Financial (DYFN): This is a bank loan fund that owns bank debt. The distribution is managed at 7.52% with a -7.2% discount that is relatively attractive. The NAV is very steady - mostly because of illiquidity- but still it is a safer fund to own. I really like the sponsor and think they are a top notch firm that can produce alpha. The NAV is starting to trend higher and has done well since inception.

(2) Brandywine Global Income Opportunities (BWG): This is a global multisector fund with a mix of government debt, corporate debt, and securitized debt. The yield is compelling at 7.8% with a rare double-digit discount to NAV. With a -11.3% discount this fund is going to appear on many investors' radar as so many newbie CEFs are coming into the space and looking for two things, yield and wide discounts.

(3) PIMCO Dynamic IncomeOpportunities(PDO): This is a new PIMCO CEF and is being discounted because the fund is a) new and b) lower yielding. But if the sister funds were launched today, they would have a similar yield because that is what the current environment can earn today. PDI and PCI are only earning 8%+ yields because the funds were launched long ago in different yield environments. The fund is trading at a small premium and yields 6.8%. But the distribution is very safe (and could be raised).

Terms:

(1) Western Asset Global Corp DefinedOpportunity(GDO): This is a term fund that is not a target term. So it liquidates at a certain date but not a certain price (or tries anyway). The fund is trading at a -3.4% discount to NAV which means you have a nice positive tailwind yield as it pulls toward the NAV over the next 3.5 years when it will liquidate. That provides you with an extra 0.9% return per year. The distribution is 6.72% with a NAV that is fairly flat over the last 9 months. The discount should be relatively stable.

(2) First Trust High YieldOpportunities2027 (FTHY): This is a longer-dated term fund that has 6 years until liquidation. We typically don't see a term fund trade like a term fund (i.e. closer to NAV) until it gets to or close to about four years until liquidation. The -6.1% discount is nice as it adds about 1.0% per year to returns. The yield is 7.2%, unearned, but very strong which should also help keep the discount fairly tight.

(3) Nuveen Emerging Market Debt 2022 (JEMD): This is an emerging market debt fund that will liquidate in late 2022. The current discount is -4.1% which means you get a tailwind yield of 2.1% per year in addition to the yield of 5.3%. EM debt is a very attractive asset class as the US dollar continues to decline rapidly. It has been overvalued for some time and is likely to fall making EM debt (and equity) very attractive.

How That Annuity Would Look

If we equally weighted the above portfolio, the yield would be about 6.80%. For many individuals that are using the 4% withdrawal rule, that gives the investor a bit of leeway for taxes (if the 4% is net of taxes owed) and for reinvestment to maintain principal. By having that cushion in place, you prevent a lot of the problems from the fluctuations in capital.

One thing I would consider doing is keeping the excess cash into a "reserve" and using that reserve for distributions. When the reserve rises in value because of the excess, you can opportunistically add a new fund or to existing holdings, augmenting income. The reinvestment adds to your principal but also adds to your income to help offset any potential distribution cuts that come down the road.

I put the portfolio into yCharts and did some risk assessments. While the risk-return is not as strong as the Core Income Portfolio - mostly because of liquidity and diversification (there are more holdings in the Core), it is fairly good.

The annual standard deviation (how much the value of the portfolio moves around) is about 9.85% on price. The time frame for this portfolio is about 5 years based on the fund with the least amount of data. That means that 68% of the time, the portfolio will move just under 10% above or below the mean in a given year. And 95% of the time, it is under 20%.

Can you handle a 20% decline? Then there's the Black Swan event. We just had one last year. The portfolio during the Covid Crash fell about 31.5%, about 3 points less than the equity market. That hurts. Would you have sold? Would you have held on? Would you have focused on the income?

If you can weather that, I think you weather anything. The Covid Crash was far worse than the Financial Crisis of 2008 in that it happened so fast and with such strength.

Concluding Thoughts

Most investors love the concept of an annuity (and I plan on doing an update on actual income annuities soon) but hate that seven-letter word. The largest overhang to an income annuity is the 'loss of principal'. I'll have some thoughts about that road block for investors in my annuity report. But the above CEF portfolio is an attempt to mitigate that concern. However, in order to keep your principal, you have to handle the volatility.

One way to frame it is to compare to a defined benefit pension plan or an income annuity. The two are likely to pay similar levels of income if you are in your 60s. If you are considering an income annuity and take the CEF route instead, you have to cogitate that with the annuity, the market value is lost anyway.

What do I mean?

If your CEF annuity pays roughly the same amount of annual income as an income annuity, then any market value is gravy. That is because with the CEF annuity, you have some assets left. For that privilege you have to assume all the risk as we noted above. So even if your market value is down the investor should think about how 100% would be gone with the income annuity.

A good option for investors looking for a diversification of income plan would be to combine the income annuity with the CEF portfolio. Most of the models I've seen combining the two create a portfolio the yields about 50% more than a mutual fund portfolio (using Fidelity Total Bond and PGIM Total Return) with roughly the same or slightly lower risk.

Time to go Yield Hunting!

Our member community is fairly uniquely focused primarily on constructing portfolios geared towards income. The Core Income Portfolio currently yields over 8% comprised of closed-end funds. If you are interested in learning about closed-end funds and want guidance on generating income, check out our service today. We also have expert guidance on individual preferred stocks, BDCs, ETFs, and mutual funds.

For those of you looking to revamp your fixed income allocation, create an income stream for paycheck replacement, or just diversify into some alternative securities, please give us a look!

In addition to the portfolios mentioned above, our subscription service provides:

Monthly Newsletters- Details the current investing environment, global news that can affect your portfolio, portfolio construction techniques and advice, and a review of the performance of our model portfolios.

Weekly Updates- Goes through the events of the week and things to watch for in the upcoming week. This also includes performance for our holdings, changes in the portfolio, new opportunities for investing, and the effects the current market situation will have on them.

Fund Analysis- Spotlight focus on investments we find particularly interesting with analysis from industry experts on opportunities we see in the CEF, REIT, Muni, and High Dividend Equity space.

24/7 Access- You always have someone to answer your questions! We respond within 24 hours to any email from our members at admin@yieldhunting.com

Retirement- Our ongoing series dedicated to helping retirees and those approaching retirement navigate the many issues they face.

... and much more!

We believe if you give our strategy a try, you will not be disappointed.

Try us for 7 days FREE!