Closed-End Fund Analysis | Weekly Commentary February 21, 2021

Macro Picture

Equity indices ended the week lower and have not really moved since the start of February sitting just below record highs. Interest rates are weighing on investors' minds and put downward pressure on tech names. At the same time they have boosted bank shares and other value stocks.

Investors are anticipating at least a temporary bout of inflation in the next few months as states re-open thanks to the vaccine rollout. That coupled with what is apparently going to be a $1.9T stimulus bill are placing upward pressure on treasury yields.

The yield on the 10-yr note rose 13 bps on the week to 1.32%, the highest level in more than a year. But yields are moving up mostly for "good" reasons.

Investors are optimistic over the prospects of the economic reopening thanks to the vaccine distribution to the population

Fiscal stimulus to the tune of 9% of GDP is massive in scale and is large enough to boost GDP growth substantially

But with the large stimulus, inflation expectations are rising significantly causing investors to sell bonds

And the Federal Reserve's pledge to allow inflation to run a bit above target to offset earlier inflation shortfalls and reduce "labor market scarring" adds fuel.

With stronger economic data coming in recently including a big retail sales number for January at +5.3% and industrial production up nearly 1%- that is also driving bond yields higher.

Other good news is that a vaccine study out Friday of 9,000 Israelis who received just the first dose of the Pfizer vaccine had efficacy of 85%. That suggests you can space out the second to allow faster distribution of the first dose to a larger number of people.

In general, keep an eye on interest rates. Loans, convertibles, and high yield did well in the last week with NAVs up between 0.3% and 1.0%. Resilience to higher rates is something to look for right now.

I'm not selling any muni CEFs despite them being the least resilient to higher rates as I don't think the higher rates phenomenon will last beyond 2021.

Below are the taxable bond CEF space ranked by 5-day NAV returns:

Commentary

Discounts widened across the board but were focused much more heavily on the municipal and preferreds sectors. Overall, taxable CEFs saw discounts widen by nearly 30 bps. Doesn't sound like much but it's a lot in a week when you look across some 170 funds. Munis, however, widened by 76 bps which is a tremendous amount for five trading days. Clearly investors are worried about higher interest rates.

Tax-free national munis were down 1.85% on price for the week but NAVs were down less than 1.1%. Despite the drop, tax-free munis are up 1.1% in the last month with the NAV up 0.8%. The sector discount of -4.1% is right around the 50th percentile of observations for the last 7 years.

Rates are rising quickly so investors are panicking. It is my thought that rates will not be allowed to rise much more than 1.6% or 1.7%. As we noted above, rates are rising for "good reasons" but despite the reasoning be good doesn't change the typical relationship between cash flows and the discount rate used to value them.

The most common question I got this week is if I should sell my muni and preferred (longer duration or more interest rate sensitive assets)? This is a typical reaction. But being a contrarian investor and counter-cyclical allocator requires you to do the opposite of what the market's knee-jerk reactionaries are doing.

Therefore, I would want to ADD duration at some point should rates rise another 30-40 bps from here. Remember, all else being equal, a steepening yield curve where longer-maturity rates are rising and short-term rates are held steady (or even fall as we saw this week) is bullish for muni CEF distributions but bearish for NAV values. In other words, the distribution becomes healthier while your principal falls. This is because the spread you earn between the cost of the leverage (short-term rates) and the coupon earned on the underlying investments increases, boosting the earnings power of the fund. For those that are primarily concerned with the distributions, then this isn't a large concern.

Of course, this means you have to watch very closely the maturity and call schedules in funds as anything that is callable or matures will be replaced with much lower yielding coupons. Rates on the long-end are still well below where they were even 18 months ago.

So the question remains, what to do? I will be looking at adding to muni CEFs eventually. Not here, yet. I would want to see more bloodshed like we saw in the last week replicated for several more weeks. If discounts widen out to -6% or greater, I'll start adding again.

In the meantime, I continue to stay over-weighted to the high yield portion of the muni market. Nuveen Municipal Credit Opps (NMCO) at nearly -6% discount looks appealing here. Rotating from some of the overpriced higher quality (high IG) muni CEFs to lower quality, cheaper HY muni CEFs is a potential mitigant. Nuveen Dynamic Muni Opps (NDMO) is another option.

Another way to play it would be through special situations. There is a lot of dislocation in the muni market at the moment. We have had several mergers and pending mergers that have caused some mispricings. One would be Nuveen AMT-Free Quality Muni (NEA) which absorbed NUM recently. This caused the fund to issue two distributions this month. In addition, CEFConnect has the distribution at $0.0345 instead of the correct $0.0585 which likely caused some to sell. As this gets fixed we could see some alpha produced as the discount closes to its fair value. Just a few weeks ago, the discount was in the 6's whereas today it is near -9%. At the same time discounts for most muni CEFs have tightened, last week notwithstanding.

Blackrock munis are another source of some alpha as the mergers have been approved and some funds offer up a small gain upon completion. Commish posted this table on the chat showing the potential gain through the merger process of certain funds.

A big caveat: This is not risk free! There are several ways this can turn out with the acquirer discount moving towards the targets.

There are three primary risks:

*the acquiring fund's premium evaporates, all else equal, pre-merger

*prices and NAVs of all funds keep sliding (BSE example)

*the acquiring fund's share price sells off post-merger (NEA example)

At the same time, prices and NAVs of all muni CEFs slide further. For example, say on 2/9 you wanted to jump on BSE’s big potential 8.9% gain. BNY was at $15.78 and BSE was at $14.40. So you locked in BSE at $14.40. Now look at the share prices only 10 days later. BNY has dropped over $1/share. It isn’t quite below $14.40 yet — if it goes there, that smart BSE purchase 10 days ago will be under water.

The NEA example is the post-merger discount widening materially partially on the confusion of the distribution- thinking it was cut- and partially because NUM shareholders no longer have a state specific fund and want out.

The other thing to consider is that any swap made is likely a taxable event. The taxes owed will likely be more than even the potential gain IF it materializes in the first place.

But if you look at these as relative trades- where you would have exposure to the muni CEFs regardless of the potential for the gains from the arbitrage- then you can potentially boost your return without changing your risk profile.

Right now the MHD fund group doesn't have much alpha. You pick up a small gain by owning MUH over MHD. More importantly, swapping from BBK or BAF to MUH makes sense.

In the MQY group, it continues to make sense to hold MYF or MEN (I hold mostly MEN). If anyone happens to own MHE or MZA (AZ specific) swapping to MEN or MYF makes sense to produce some alpha. This also has the NEA problem where people in the AZ fund or Mass funds are getting a national fund and may want to sell.

In the BLE group we see the most amount of potential alpha. This is because BLE trades at a +3.5% premium. Here, BBF is the clear fund to hold. I would caveat that as the risk in this arbitrage is that investors in BBF, MFT, and BSD who get merged into BLE don't want to hold a fund trading at a premium, and sell. There aren't many muni CEFs trading at a premium without the name PIMCO on them. That is a lot of risk there.

In the NY muni group, both target funds, BFY and BSE, are clear winners. However, these are lower liquidity funds and you have to assume New York state risk of course.

Outside of munis, preferreds are taking it on the chin as well. Individual preferreds are mostly perpetual maturity and the fixed-to-floating rate feature on some is useless unless short rates rise.

Rivernorth Opportunity (OPP-A) is a good option now that the shares have fallen back. The price is now below $24 which on an annual distribution of $1.09375 equates to a fairly safe 4.8%. With the open-end conversion vote in a few months now, there is the possibility for a nice capital gain on top of that though I place a less than 50% probability on that occurrence.

Another CEF preferred that is relatively safe is the new Nexpoint Strategic Advisors (NHF-A). While slightly more risky than OPP-A, it is still relatively lower risk with a marginal investment grade rating. The annual income is $1.375 which on the current price of $21.70 equates to a 6.28%. Hard to beat that in the current market. But you need to be able to sustain price fluctuations given the lower liquidity and rate fears.

Outside of those two, stick with the mREIT preferreds. Here you can purchase a few shares in a few different securities to create diversification.

Capstead Mortgage Corp (CMO-E), yield 7.51%

New Residential Inv (NRZ-C), yield 7.4%

Two Harbors Inv (TWO- B), yield 7.8%

Chimera Inv Corp (CIM-A), yield 8.1%

Outside of munis and individual preferreds, the best option I see out there is KKR Income Opps (KIO) at a -7.4% discount and nicely rising NAV.

I am not in the camp that we will see inflation spike and be sustained above trend for a long period of time. We are likely to see a burst of inflation as the economy fully reopens and people who have been isolated and cooped up spend more freely. However, we still have a large amount of people unemployed, which is likely to be a net drag on inflation pressures medium-term.

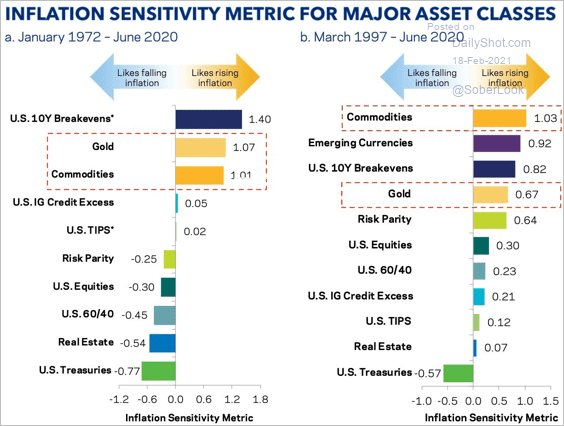

Here are the areas of the market that "like" inflation and those that do not.

CEF News

Distribution Increase

Tekla Life Science Inv (HQL): Distribution increased by 7.5% to $0.43 from $0.40

Tekla Health Inv (HQH): Distribution increased by 6.25% to $0.51 from $0.48

Brandywine Global Income Opp (BWG): Distribution increased by 6.7% to $0.08 from $0.075

Western Asset Inflation Linked Income (WIA): Distribution increased by 6.8% to $0.0315 from $0.0295

Western Asset Inflation Linked Opp & Inc (WIW): Distribution increased by 6.5% to $0.033 from $0.031

Distribution Decrease

Western High Income Opp (HIO): Distribution decreased by 7.7% to $0.03 from $0.0325

Western Asset Managed Muni (MMU): Distribution decreased by 5.6% to $0.0425 from $0.045.

Special Distributions

Blackrock Muni Income Inv Quality (BAF): $0.098392

Blackrock Muni Bond (BBK): $0.1626

Blackrock MuniHoldings II (MUH): $0.112172

Blackrock MuniHolding Quality (MUS): $0.103875

Blackrock MuniHoldings: $0.605

Merger

Apollo Tactical Income (AIF) and Apollo Sr Floating Rate (AFT): The funds announced that they have approved a reorganization merging AFT into AIF. Anticipated completion date is second quarter of 2021.

Tender Offer

First Trust Aberdeen Global Opp Inc (FAM): The fund announced final results of the tender offer for up to 20% of its outstanding shares at 98% of NAV. Since the tender was oversubscribed the fund will purchase 46.5% of shares at $10.76 per share.

Rights Offering

Tekla World Healthcare (THW): The fund announced terms for a non-transferable rights offering to shareholders of record on March 8, 2021.

The Fund will issue to shareholders one non-transferable right for each Share of the Fund owned, rounded down to the nearest number of rights evenly divisible by three. Pursuant to the Offer, shareholders will be entitled to acquire one Share of the Fund for every three rights held. Fractional shares will not be issued upon the exercise of rights. The rights will not be admitted for trading on the New York Stock Exchange. Shareholders who fully exercise their rights will have, subject to certain limitations and subject to allotment, an over-subscription privilege to subscribe for additional shares. The Fund may issue, at its discretion, up to an additional 25% of the shares available pursuant to the Offer to honor over-subscriptions.

The final subscription price per share (the “Subscription Price”) will be determined based upon a formula equal to 95% of the volume weighted average price of a Share on the New York Stock Exchange (“NYSE”) on the date on which the Offer expires, as such date may be extended from time to time, and each of the four (4) preceding trading days (the “Formula Price”). If, however, the Formula Price is less than 90% of the NAV per Share at the close of trading on the NYSE on the Expiration Date (as defined below), then the Subscription Price will be 90% of the Trust's NAV per Share at the close of trading on the NYSE on the Expiration Date.

Statistics

Sectors:

Core:

All CEFs:

---------------