Summary

Closed-end fund investors have suffered in the last two years as interest rates rose and the bond market declined.

Bond CEFs, which employ leverage, have been hit hard due to the inverted yield curve and thin liquidity.

Municipal bond CEFs are currently at their cheapest levels ever, presenting potential opportunities for investors.

In taxables, look at a combination of quality and credit with taxable munis, preferreds and IG credit combined with loans.

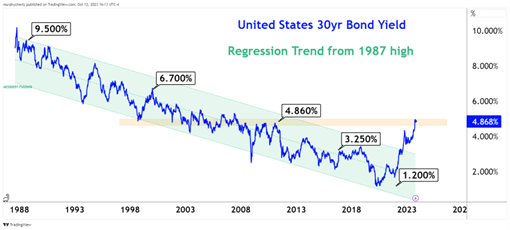

Closed-end Fund Investors ("CEFs") have suffered a bunch of pain in the last two years as interest rates moved up from levels never seen before, in aggressive fashion. The nearly 40-year bond bull market ended shortly after Covid started.

The move in rates has been nothing short of face-ripping and the bond index is now going to be down for three straight years for the first time ever.

CEFs, most of which employ leverage, feel the pain more harshly since leverage not only amplifies gains but also the losses. In an interest rate environment characterized by an inverted yield curve, bond CEFs are borrowing short and investing long, not earning a lot of incremental income above the cost of leverage to justify the risks.

Still, most funds simply keep the leverage on in order to not have to sell cheap positions and/or draw new lines of credit in potentially unfavorable financial conditions.

In addition to that, add in discount risk and thin liquidity, and you would wonder why anyone would ever invest in bond CEFs.

Well, the answer is that they tend to outperform over time. The pain to the downside can be rough but the upside is typically just as fast. In years when bond CEFs suffer bad losses, the subsequent years tend to be good ones.

When discounts are extraordinarily wide, you can think of the price as being 'springloaded', especially as tax loss selling has exacerbated the declines and widen the discounts in the last month.

Muni discounts, already wide entering the fourth quarter, are another 1.1% wider over the trailing 30 days. This is as cheap as they've ever been.

We would stress that the upside here is far greater than the downside, even if the worst case scenarios of interest rates (10-year going to 5.5%) being discussed in the financial news media comes to fruition.

The largest driver of that would be the re-steepening of the yield curve if that were to occur. Most of the move in the long-end of the curve has come with the short end not moving all that much.

That means the cost of the leverage relative to what you can earn on those borrowed funds is improving. While a rising long-end of the curve is bad for NAV performance, an increasing spread between long and short is positive for distributions.

Over long periods of time, even the recent atrocious performance, CEFs outperform mutual funds thanks to leverage. We would argue that future performance looks even better and will increase that spread over the next few years.

In other words, this is as bad as it gets for CEFs vs. mutual funds.

Municipal Bond CEFs Remains At Their Cheapest Levels Ever

Out of the nearly 7,000 individual trading days going back to 1996, current discounts have only been wider 39 of those times, or 0.056% of all observations for the last 27 years.

You can probably guess when those 39 days occurred. Most of them happened during Covid and the Financial Crisis.

Our Top Picks and Review Write-ups:

Keep reading with a 7-day free trial

Subscribe to Yield Hunting to keep reading this post and get 7 days of free access to the full post archives.