CEF Commentary April, 2021: CEF Discounts Tighten To Levels Not Seen Since 2013

Summary

Large-cap stocks hit new highs on strong data with record highs set several times during the week and finished very strong rising 300 points on Friday.

Discounts on taxable bond CEFs are now very close to NAV. My calculation (which adjusts for the massive premiums on the CLO funds) shows the space at -0.82%.

There's only one fund left with a negative one-year z-score, the Western Asset Income (PAI). The discount of -5.4% is compelling if you want IG bond fund paying 3.8%.

Other "cheaper" funds include TCW Strategic Income, BlackRock Taxable Muni and Guggenheim Tax Muni & Inv Grade Bond.

As Howard Marks likes to state, when investors have zero consideration for risk, the future returns of these investments will be lower.

Try Yield Hunting Premium FREE for 7 days! Subscribers receive daily Notes and Weekly CEF Commentaries, as well as Model Portfolios to follow!

Macro Picture

Large-cap stocks hit new highs on strong data with record highs set several times during the week and finished very strong rising 300 points on Friday. Growth outperformed value during the week as tech seems to be regaining its market leadership. We saw solid gains by Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) which combined account for 405% of the sector's market capitalization in the S&P 500.

The big news on the week was the PPI (producer price index) which is a gauge of input prices for manufacturing and could be a precursor to consumer price increases (inflation). The PPI figure rose by 1% in March, approximately twice the consensus estimates. That equates to a 4.2% yoy increase in prices on the PPI, the largest in almost a decade.

The number reflects supply chain pressures in combination with a reopening/increase in consumer spending theme. In other words, the increase in spending by consumers on goods and services is being strained by the global supply chains which have not been repaired since COVID began.

We're also seeing base effects come into play here. The definition of base effects is the distortion in monthly data that results from abnormally high or low levels of data points in the year prior's month. This is what we are going to see now as the year ago month (March) was the start of a significant drop in data points, especially for inflation.

Here's a good Northern Trust article on it for those interested: Supply Chain Disruptions and Aging Populations.

Commentary

Discounts on taxable bond CEFs are now very close to NAV. My calculation (which adjusts for the massive premiums on the CLO funds) shows the space at -0.82%. RiverNorth puts the number closer at -0.21%. In either case, there is almost no value left in taxable CEFs.

In fact, there's only one fund left with a negative one-year z-score, the Western Asset Income (PAI). The discount of -5.4% is compelling if you want an investment grade corporate bond fund that pays just 3.8%. The shares are attractive for a lower-risk (no leverage), higher portfolio quality fund.

But that's it. No other fund has a negative one (-1) or lower z-score. Not sure if I can recall that ever being the case in the two decades I've been following the space.

Other "cheaper" funds include TCW Strategic Income (TSI), BlackRock Taxable Muni (BBN), and Guggenheim Tax Muni & Inv Grade Bond (GBAB). The reason these funds are relatively cheaper (with -0.8 z-scores, a measure of the number of standard deviations below the mean the current discount resides) is because their yields are low. Investors are hunting for yield in the juicier areas of the market signaling to me that risk is simply NOT a consideration any longer.

Here are the funds with negative one-year z-scores. You can see the yields are definitely on the lower side of the spectrum for CEFs.

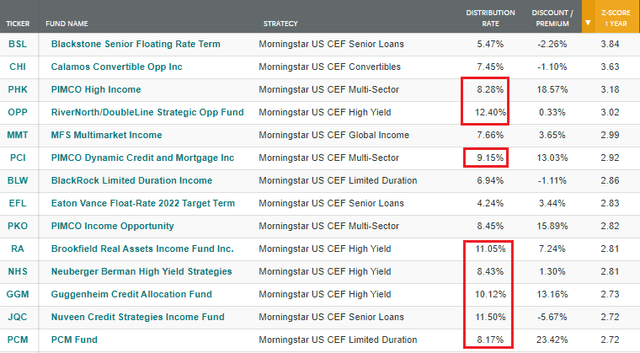

If we re-sort and go by highest one-year z-score, you can see the higher yielding funds populating the top of the list:

As Howard Marks likes to state, when investors have zero consideration for risk the future returns of these investments will be lower. Just looking at this list, there are only a few that are even trading at discounts any more. Most of these funds are in sell territory.

I discussed PIMCO High Income (PHK) the other morning saying I was holding on to my position for now having reduced my PIMCO Strategic Income (RCS) position. But at an 18.6% premium and nearly parabolic move, it's tempting to take the gains (its in my IRA) and tactically re-position.

As I noted, I wouldn't mind moving at least some of my PHK to more defensive positions like BBN, GBAB, and TSI or Angel Oak Dynamic Financial Income (DYFN), which trades at a -8.2% discount. The fund is up to 71% coverage yield which helps improve the warranted discount to about -6.8%. So there's not a whole lot of upside but at least it's upside and not all downside.

Lastly, we would continue to focus on term funds taking advantage of any sell off that occurs. I added a new "Target Buy Price" (column F) so you can gauge where the flag flips on the Rating column.

Moving to munis, which I like far better here than taxables, the Blackrock mergers were completed. On Friday, all shares of BSD, MFT, BSE, and BFY ceased trading on the exchanges. The results were fantastic.

The below fund was by far, my largest investment in these mergers.

The return from when we mentioned in February was nearly 5%, total return in about 45 days.

From the Feb. 21 Weekly Commentary, we wrote:

In the BLE group we see the most amount of potential alpha. This is because BLE trades at a +3.5% premium. Here, BBF is the clear fund to hold. I would caveat that as the risk in this arbitrage is that investors in BBF, MFT, and BSD who get merged into BLE don't want to hold a fund trading at a premium, and sell. There aren't many muni CEFs trading at a premium without the name PIMCO on them. That is a lot of risk there.

There was an article on PIMCO CEFs on Seeking Alpha recently that stated the following:

At the same time, it is our view that commentators make too much of muni redemptions and their potential impact on fund income. This is because tax-exempt bond coupons, unlike their corporate counterparts, are typically not set according to the prevailing yield levels which mitigates the impact of funds having to find new bonds for their cash.

This is false. While the replacement coupon may be the same, what the fund has to pay for that coupon goes up. In other words, they're paying a higher price for those muni bonds meaning they are buying fewer bonds.

For example, say the fund bought $10M worth of bonds at par with a 5% coupon almost 10 years ago. It has been producing $500K in annual income but the call protection period is now over. The bond is called and the fund now has to reinvest that $10M. Yes, by convention, most new-issue long munis are still sporting a 5% coupon, as the author promotes. However, the price they have to pay for the 5% coupon is now much higher.

If the fund reinvests the $10M in a 5% coupon bond now priced at 110, they obviously can’t buy as many bonds as before when 5% coupons sold at 100. Having to pay a higher price for a replacement hurts two ways. Fewer bonds purchased means less money at maturity and lower annual income. In this example, the new purchase only generates $454,545 in annual income, as they can only buy $9.09M (i.e., $10M/1.10) in terms of maturity value. So while the fund still has $10M in net asset value now, they won’t by the time this new bond is called. In the example, they will only get $9.09M back at redemption.

The numbers are much worse than this today as one can’t even get a 3% yield to the call on investment grade. We are all being forced to “buy" less income at a higher price. Obviously funds own hundreds of bonds, all going through this erosion process, albeit each at a different stage in time.

What about from the investor’s standpoint? First, when you get that fat tax-free payment from your muni CEF recognize that you are in essence getting a ROC even though it isn’t classified that way. If a fund buys a bond at 120 and it matures at 100, then every monthly payment you receive includes a little sliver of “principal”.

Second, let’s talk NAV cannibalization. We know that muni rates have come crashing down from where they were 10 and 20 years ago. And we know that when rates move down, prices move up. So if that’s the case, why aren’t muni fund NAVs sky high? In fact, just the opposite is true. Most funds were launched with an inception NAV between $14 and $15/share. And yet many of those funds, even the best TR performers, have NAVs today with handles of 11, 12, and 13. Same story with many of the muni funds that launched with inception NAVs of $10/share — they now have NAVs that start with a 7 or 8. What you are seeing is the compound effect of this NAV cannibalization over several decades.

In summary, we found this other author’s statement very odd. When muni funds reduce their distribution, more often that not, the press release includes a footnote attributing income reduction to redemptions, like this:

MAV’s June per share distribution of $0.0375 represents a 11.8% decrease from the $0.0425 per share distribution paid in May. The Fund’s maturing and callable securities were often replaced with new securities with lower yields, reducing the Fund’s income. This change better aligns the Fund’s distribution rate with its current and projected level of earnings and reserves.