CEF Analysis: Senior Loans Look Best Positioned

Summary

The loan space continues to see inflows which should be supportive of NAVs. As NAVs increase, they can increase leverage supporting distributions.

Loan funds remain one of the cheapest asset classes in the CEF spectrum with five-year z-scores that are barely positive.

We like KIO and ARDC which are hybrid funds (half loans, half fixed coupon bonds "HY") but they can be a little junkier.

Another option is that the market is giving us another opportunity to own PHD. It moved to a -3% discount but has recently retraced a bit back to -6.4%.

I do much more than just articles at Yield Hunting: Alt Inc Opps: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

(This update was issued to members of Yield Hunting on Feb. 8. Please be aware that some of the data is old and our recommendations may have changed.)

We have been pushing leveraged loans as the place to be for several months now. In our latest update on the sector in mid-January titled "Floating Rate Sector Update - Rates Are Rising Which Should Shine A Light On The Sector" we noted that floating rate securities (of which constitute the majority of the senior loan space) were out of favor. However, the spread between loans and high yield bonds was widely favoring the former.

We said the funds we liked best were:

(1) Pioneer Floating Rate (PHD)

(2) Blackstone Senior Floating Rate (NYSE:BSL)

(3) Blackrock Floating Rate (NYSE:BGT)

(4) Vertical Capital Income (NYSE:VCIF)

Today we would shift that a bit. We still like these funds but some of them have changed quite a bit since we last covered the sector. Today we would look at some of the hybrid funds which allocate to both high yield and senior loans.

(1) Ares Dynamic Credit Allocation (ARDC)

(2) KKR Income Opps (NYSE:KIO)

(3) Pioneer Floating Rate

We also would think about watching or swapping or outright trimming some of the more expensive funds like:

First Trust Sr Floating Rate Income II (FCT)

Sector Update

The average price at which U.S. leveraged loans entered the secondary trading market jumped for the second consecutive month in January amid extremely strong conditions in the segment.

The average break price hit 100.34% of par in January, from 99.91 in December, according to LCD, with a wave of loan repricing transactions gripping the market as investor demand in the floating-rate asset class soared and the share of loans in the secondary priced at par or better reached its highest point since the start of the market turmoil, just before the onset of the COVID-19 pandemic in early March.

(Source: S&P)

CEF Analysis

The loan sector remains one of the cheaper CEF sectors out there looking at five-year z-scores. The last time loans were this cheap was in 2016 when they traded at double-digit discounts. Then short-term rates began heading higher in earnest peaking in late 2018 and CEF investors got scared and ran for "rate hedges" like floating rate loans.

Today, the five-year z-score for the sector is 0.30, which is about in the 30th percentile for valuation (0% is cheapest and 99th% is more expensive). While the z-score is not negative, it's near the lower end of the range and one of the cheapest among any CEF sector. The only sectors that are cheaper are MLPs, real estate, and small areas of the muni market.

We think the fund flows are starting to pile in to the space which should drive the underlying NAVs of the funds. While average prices in the sector are near fully valued, we could see prices rise well above par as investors seek the interest rate 'safety' of a floating rate structure.

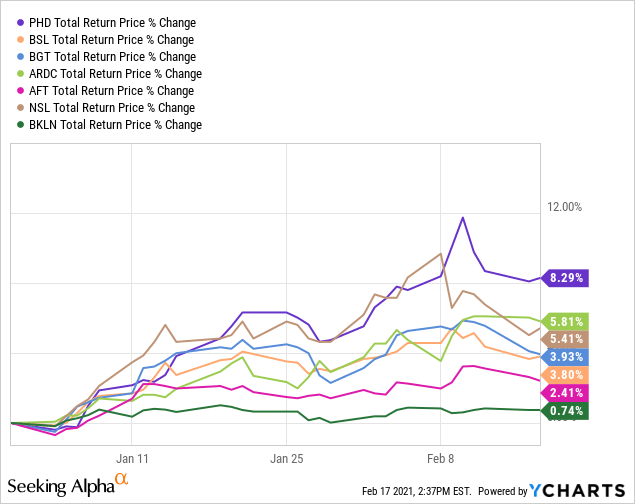

We have highlighted floating rate as a key area of our analysis for the last several months. Pioneer Floating Rate has been one of those that we have been very bullish on and one of our top picks in that early January analysis. As the chart indicates below, the price has done very well rising 8.3% in three months besting the space.

Clear Sells

Eaton Vance Floating Rate Income Plus (EFF)

Eaton Vance Sr Floating Rate (EFR)

Invesco Sr Income (VVR)

Eaton Vance Floating Rate Income (EFT)

Nuveen Floating Rate Income Opp (JRO)

Marginal Sells

Blackrock Floating Rate Income Strategies (NYSE:FRA)

Blackrock Debt Strategies

Invesco Dynamic Credit Opp

First Eagle Senior Loan (FSLF)

On Watch

Blackrock Floating Rate

First Trust Senior FR Income II

Potential Swap Candidates

Ares Dynamic Credit Allocation: This is a hybrid fund that shifts the allocation to high yield bonds, leveraged loans, and CLOs based on underlying valuations. Right now it sees value in the CLO space with 21.2% in CLO debt and another 11% in CLO equity. This is a safer way to access that space than venturing into ECC, XFLT, or OXLC. The yield is 7.83% and well covered at 108.3%. UNII is strong too. However, those numbers are stale through 6/30 so we should be getting new data shortly. The portfolio is a bit junkier though than a lot of the loan space with a chunk in CCC rated debt at about 17% of the total.

KKR Income Opportunities: This fund gets left out a lot because it is a mix of loans and high yield bonds. Right now, it's more loans (~54%) than bonds (45%). The discount has tightened a bit to -7.2% but it still remains one of the better value. The 8.3% yield that's well covered at 117%. UNII is slightly positive. So a very safe distribution. The NAV has been a very strong performer. One of the more junkier funds out there with 47% of the portfolio in CCC rated positions.

Pioneer Floating Rate: This was our favorite two months ago and remains a favorite today. Of course, had I done this analysis a week before I wouldn't have included it on my list. At that point the discount was only -3% (today it is -6.3%). The NAV has done well in the pure floating rate segment rising over 7% in the last three months. This portfolio is a bit higher quality (but not much) than the prior two options with *just* 12% in CCC rated debt.

Blackstone Long-Short Income (BGX): The three Blackstone (formerly "GSO") funds could all be number four. They are all similar portfolios and perform similarly. BSL has the best total return of the three funds but BGX has the higher yield. The yield on these funds are in the sixes but it, like PHD above, has about 12% in CCC rated debt.

We recommended Blackrock Floating Rate and sister fund Blackrock Floating Rate Income in early January. Since then the discounts have tightened a few points to less than -8%. We would consider taking the profits from this one and rotating to Ares Dynamic Credit Allocation or Blackstone L-S Credit Income/Blackstone Senior Floating Rate Term.

PHD is giving some investors another opportunity to own it after the last batch of selling sent the discount back to -6.4%. It has one of the best NAV trends of any fund in the space.

For those that own First Trust Sr Floating Rate Income II, the higher distribution yield is definitely driving the discount tighter. But remember that higher distribution is due to them paying out an accrual set aside for the potential adverse lawsuit outcome. When the suit was dropped in 2019, they started paying out the funds that were set aside. The higher payout has been going on since mid 2019 but they really increased it in June of 2020. With coverage at 42% the true earnings power of the fund is about $0.045 per share per month. If the accrual was $8M and there are roughly 26M shares outstanding, the accrual would have been exhausted in less than six months [$8M accrual / $1.5M per month = 5.2 months]. Not sure if/when they will cut the distribution back but it appears we are running on borrowed time.

The next distribution announcement is Feb. 20 or thereabouts. Not saying they will cut for sure but it's a possibility. But like we saw with DMO, just because they are likely to cut doesn't mean they will. FCT has the largest yield of the non-CLO loan funds so it could continue to draw the attractive of yield-focused investors which closes the discount further. Saba, the hedge fund, sold many thousands of shares of FCT at prices much lower than the current one.

It may make sense to rotate into KIO or ARDC here if you're willing to go a little junkier.