BPRE: Bluerock Pvt RE Opens Up Down Nearly 40%. Opportunity?

Legacy investors immediately took a 40% haircut but was it a failure of private assets or the "wrapper" of those illiquid securities.

Private investments have become mainstream. Ten years ago, most investors only heard about private real estate and private credit in the context of endowments, pensions, and ultra-wealthy family office investments. Today, many advisory portfolios include them—often through newer vehicles designed to make “institutional-style” strategies more accessible.

But easier access does not eliminate a core challenge: pricing. Unlike public stocks and bonds that trade every day, private assets don’t have a constantly updated market price. Instead, managers estimate values periodically. Those estimates can be reasonable—until they are forced to meet a real-time test: public trading.

That is why private credit, in particular, is now getting more scrutiny. The space has grown dramatically—rising from roughly $46 billion in 2000 to more than $1 trillion by 2023—driven in part by a structural shift as banks pulled back from certain types of lending. For years, most “bubble” talk has centered on hot A.I. stocks. A better place to watch may be private credit, where rapid growth and less transparent pricing can collide.

Recently, the conversation has shifted toward valuation practices—how quickly managers adjust “marks” when conditions change. Bloomberg captured the issue bluntly: sharp differences in how firms value similar private assets are drawing attention not only from investors and academics, but also from regulators and law enforcement.

Several high-profile stress events have added fuel to that fire. Bankruptcies, challenged transactions, and headline losses have raised a simple question: when something goes wrong in private credit, how fast do valuations catch up to reality—and by how much?

That brings us to Bluerock Private Real Estate (BPRE). In its move from a private-style structure to an exchange listing, the fund quickly began trading at roughly a 40% discount—a jarring gap that has become a case study in what can happen when private assets meet public markets. Some see it as proof that private marks were too generous. Others see a potential opportunity—if the discount proves excessive relative to fundamentals.

BPRE is not a brand-new strategy. It began life in 2012 as the Bluerock Total Income + Real Estate Fund under the ticker TIPWX, one of the earlier real estate interval funds. What changed is not the existence of the portfolio—but the way investors can now price it, in real time, every day.

There has been a lot of articles on private credit valuations (“marks”) and some of them have focused on BPRE as another example. However, this is NOT an instance of a bug of private credit valuations, but a glitch in the move towards private assets being stuffed into even semi-liquid fund wrappers.

In this case, investors who had wanted out of the interval fund for years, finally got a chance to do so once the fund listed, but got a cold, hard, education on liquidity when everyone rushed for the exits at the same time. This is less a negative about private assets and more so about a good ol’ run on the fund.

What is an Interval Fund?

An interval fund is a hybrid fund between an open-end mutual fund and a closed-end fund. They were designed to solve a structure problem in the mutual fund world. The liquidity mismatch was caused issues in the Financial Crisis of 2008. Prior to interval funds launching, you either had to invest in a limited partnership (“LP”) or a public REIT.

An open-end mutual fund is restricted by the Investment Company Act of 1940 from holdings more than 15% of its assets in illiquid securities. This was done so that they could always meet investor redemption requests, called the ‘liquidity mismatch.’ If they hold illiquid buildings or property, it could take months for them to sell them to pay out fundholders. But a mutual fund technically offers its investors daily liquidity.

Interval funds are in the grey area between daily liquid mutual funds and illiquid ‘locked up’ partnerships. An interval fund only has to meet investor redemptions on a quarterly basis. And they have a 5% cap on the total amount of redemptions that they are required to pay out each quarter.

The ‘sticky capital’ allows the portfolio manager to remain fully invested in long-term, higher yielding, illiquid private assets, which would be impossible in a daily-liquid mutual fund.

As they said in the WSJ:

The idea—in some ways a laudable one—is to encourage investors to stay put for long periods, rather than fleeing at the worst possible time. In principle, the managers of interval funds can buy illiquid assets without being forced to sell into a downturn when investors want their money back.

Many interval funds have been launched- as of December 2025 there were approximately 154 interval funds with roughly $133B in total assets. 2024 was a record year with 43 new launches and we had 33 launches completed through the first three-quarters of the year so far. Most interval funds can only be purchased through an advisory channel and cannot be accessed by a retail investor brokerage platform.

More than 50% of all new launches in 2025 were focused on private credit or asset-based lending. This is driven by high interest rates making “sticky yield” products highly attractive to income-seeking retail investors. Despite the high number of funds, the market is “top-heavy.” The top 20 funds still control roughly 59% of all assets, though this concentration is slowly diluting as more specialty managers enter the space.

Bluerock Fund History

Bluerock Private Real Estate Fund was created in late 2012 as a means for individual investors to access institutional-quality private real estate managers. This was an asset class dominated by large endowments, insurance companies, and pension funds. In the aftermath of the Financial Crisis, they sought to create a fund to capture the recovery in the real estate market, generating high current income, and long-term capital appreciation, with low-to-moderate volatility.

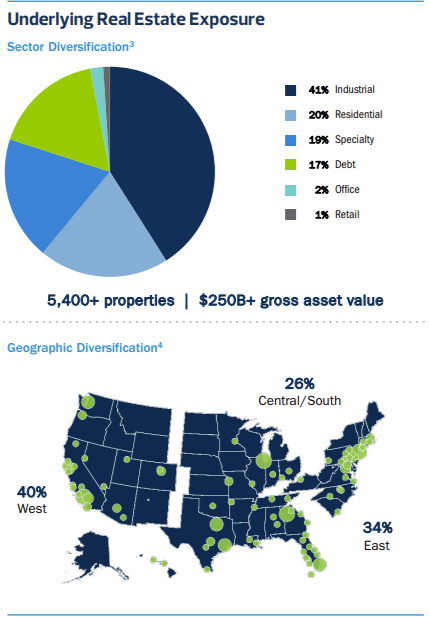

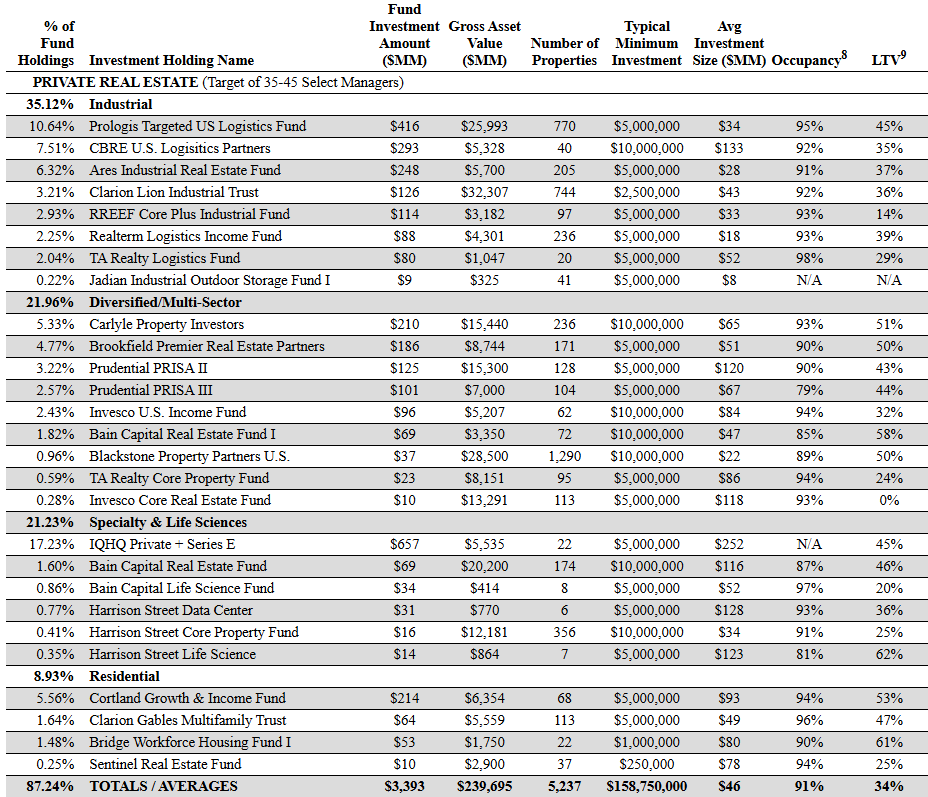

The strategy is a ‘multi-manager’ approach where Bluerock takes the capital raised and places it with private equity real estate funds with long track records of success and typically higher barriers to access. In other words, they don’t directly own the real estate.

Those managers are household names in the space including Prologis, Carlyle Group, CBRE, Ares, Brookfield, and Clarion. Bluerock, the fund’s sponsor, has been around a long time and manages a whopping $120B in real estate transactions. Today, Bluerock has more than $19.5B in properties and managed assets.

BPRE grew quickly thanks to strong performance aided by the recovery in the real estate sector and low interest rates. By 2021, the fund had raised more than $3B in assets under management. Management would market the fund by highlighting the fund’s decade of existence and how it outperformed the NAREIT index with lower volatility than public REITs.

In 2023, they surpassed $1B in total distributions paid to shareholders since the inception of the fund.

An Interval Fund Succumbs to the Same Problems

As was the problem with stuffing illiquid investments into open-end mutual funds, the same issue started to occur with interval funds. After all, an interval fund is still semi-liquid.

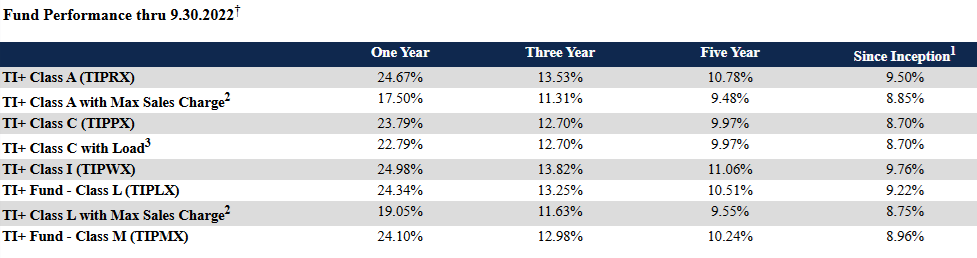

Once interest rates started to rise shortly after the Covid pandemic, their strong performance turned - and turned quickly. But here’s where they stood at the end of 2022, just as interest rates were shooting to the moon.

They wrote:

From inception (10.22.2012) through 9.30.2022, TI+ (A Shares) generated a cumulative total return of 146.44%, or 9.50% annualized (load waived). The Fund was able to accomplish this primarily through private real estate investments, generating both income and capital appreciation. Private investments are supplemented with select public real estate securities.

But then in 2023, the fund saw its performance drop by nearly 13%.

Then the redemptions started. Remember what I said earlier about shareholders only being able to sell once per quarter and that the total redemptions couldn’t total more than 5% of assets?

That 5% limit is both a benefit and a curse. Since there is that 5% limit, shareholders who want out are inclined to then redeem all or more than they otherwise would in case the fund hits the limit. This ensures that they can get the capital that they want out. If they end up selling too much, then well, it’s easy to simply rebuy the next day since you can put in money on any day the market is open.

Yes, you can only redeem once per quarter, but you can put in money anytime.

Selling in mutual funds with illiquid assets tends to beget more selling, and sooner or later, you get a ‘run on the fund.’ Here, it is imperative to have the first mover advantage: at the first sign of a problem, be the first one out the door.

In French, there’s a word for what happens next. Degringolade. It essentially means a downward spiral. That’s because when investors sell, the fund is forced to sell some of their positions in the underlying funds, which then have to sell assets. Selling assets that are marked by the fund’s themselves in many cases, creates what is called ‘price discovery’, or the real value of the assets, what someone is willing to pay for it.

In most cases, that can be much below the value that the fund’s have marked those assets on the books. This is similar to Blackrock, who recently had marked the private debt of Renovo Home Partners, a home improvement company, to be worth 100 cents on the dollar at the end of October of this year only to mark it down to zero a month later.

As those funds sell assets and reduce the marks on the value of the underlying assets, it weakens overall performance stoking further selling pressure, and more asset selling. Rinse. Repeat.

The ‘Strategic Shift’ to a Closed-End Fund

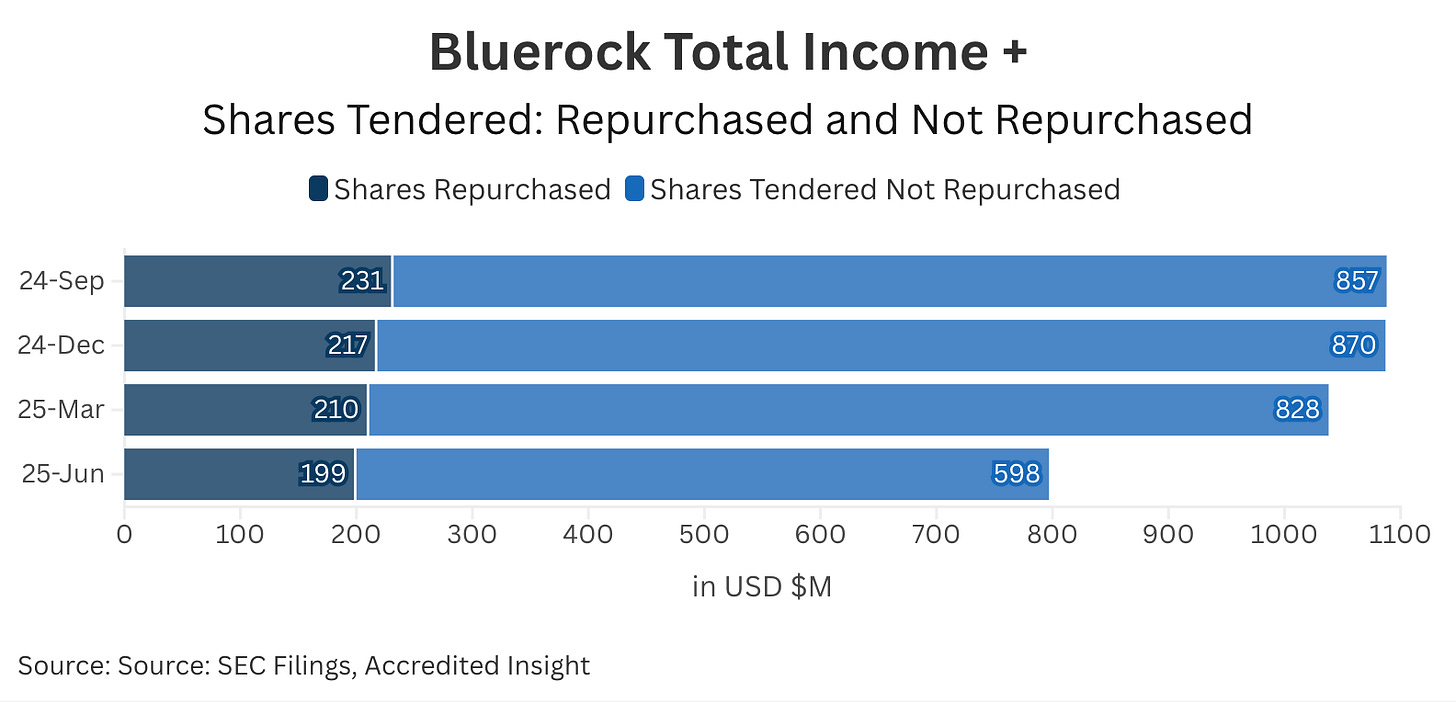

TIPWX technically had a run on the fund since, for nine straight quarters, more than 2.25 years, they hit the 5% cap in redemptions. Some investors, even after nine straight quarters of “selling all” had more than a third of their position still in the fund. Since 2024, the shareholders of TIPWX had received about a quarter of their redemption requests. But it is not a quarter of their prior total account value but a quarter of their current value. And nearly a quarter of the total assets in the fund were queued for redemption.

Here is the amount of shares sold versus the amount tendered for sale over the last four quarters before they announced their intention to list and close the fund (credit: Leyla Kunimoto):

It would take nearly two years, assuming no additional redemptions were entered over that period (a very low probability) for it to work through them all.

In response, the fund decided to seek shareholder approval to list the fund on the New York Stock Exchange in order to satiate investor demand for liquidity. Why? Because investors wanted liquidity to get out all at once and a listing would offer that. It would also prevent Bluerock from having to sell assets in the portfolio are fire sale prices.

This is exactly what the interval fund was designed to do - prevent portfolio managers from being forced sellers. However, last summer, here we sat as Bluerock was a forced seller.

With the sponsor shedding assets, a listing would do two things:

Provide the shareholders the liquidity they were clamoring for

Keep the assets in the fund and create a permanent vehicle that generates fees

The problem for shareholders was that they would likely have to take a haircut on the redemptions. Their choice was to either reject the proposal to list and continue getting back 20-25% of their portfolio values each quarter at NAV, or approve and get 100% back, but at a potentially large discount to NAV.

Not a great choice set.

The shareholders overwhelmingly agreed to choice one, likely not knowing that the fund’s share price would immediately crater to a 40% discount to NAV. Had they known that they likely wouldn’t have voted for it. But 81% of the votes that came in did want the daily liquidity.

The proposal¹, recommended by independent proxy advisory firms Institutional Shareholder Services Inc. and Glass Lewis & Co. and the Fund’s Board of Trustees, was overwhelmingly approved by shareholders at the Fund’s special meeting held on September 25th, with over 81% of votes cast in favor of the initiative.

Of course, just because you vote for the listing, doesn’t mean you were intent on selling. Even if you were a long-term shareholder who did not want to sell, a listing would likely be more favorable to you since it would lock in the capital and prevent further asset sales, reducing asset prices, and continuing in that downward spiral.

The Opportunity Is Now

The approval came in September and the shares formerly listed on December 16th. Shares debuted at $14.70 per share, a whopping 40% discount to the prior days’ NAV for TIPWX of $24.36. Legacy investors saw an immediate and sudden 40% drop in the market value of their positions.

What did investors think would happen? If a quarter of the investors in a $4 billion fund all hit the sell button at the same time, the price had to adjust.

We saw a similar outcome with two FS / Future Standard funds that converted in the last few years. The first was FS Credit Opportunities (FSCO) which listed in late 2022 converting from an unlisted, non-traded, business development company (“BDC”) to a closed-end fund. They did so for many of the same reasons that the Bluerock fund did.

And just a month ago, FS Specialty Lending (FSSL) converted from a non-traded BDC to a CEF.

In both of those instances, the discounts blew out beyond a 30% discount to NAV.

Many journalists and others are pointing to these three conversions as a bug of private credit and private assets in general. They are saying that it means the REAL VALUE of these private assets are far below what is stated by the fund accountants and custody banks.

WE BELIEVE THIS IS NOT THE CASE.

This is not a problem with the private assets in the fund but the wrapper that houses them along with investor behavior. As we stated earlier on, any housing of illiquid assets in even a semi-liquid wrapper (interval fund) is likely to eventually run into problems.

This is simply a problem with pent-up liquidity demand from existing shareholders. Those investors who wanted out and were submitting 100% redemption requests each quarter and only getting 20%-25% fill rates. They had had enough and wanted out at any price right away.

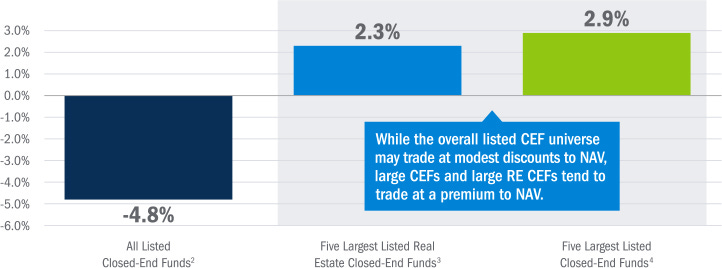

For one, a typical real estate CEF trades at a premium to NAV, not a 40% discount. This points to the buy-sell imbalance rationale for the discount.

Let’s Get into the Weeds of the Portfolio

BPRE has total assets of $4.27B and net assets of $3.06B.

Computed leverage metrics (as of 9/30/2025):

Debt / Total Assets: 665.0 / 4,276.7 = 15.55%

Debt / Net Assets: 665.0 / 3,601.9 = 18.46%

Managed assets multiple: Total assets / net assets = 1.187x (i.e., assets are ~118.7% of NAV, consistent with “Total Investments (117.85%)”).

Asset coverage (1940 Act framing): The fund discloses Asset Coverage Per $1,000 of Line of Credit = 6,416 at 9/30/2025 (i.e., ~$6.416 of asset coverage for each $1 of debt, or ~641.6% coverage).

Trend-wise, this coverage is down versus prior years (9,395 in 2024; 9,567 in 2023) while borrowings remained large ($535mm in 2024; $680mm in 2023).

The borrowings are based on two secured credit facilities:

Term Loan (Raymond James Bank): 1M SOFR + 4.0%, stated maturity 6/30/2026 (subject to extension); $85mm outstanding at 9/30/2025. Weighted avg rate 8.59%, interest expense $7.303mm

Bank LOC (JPMorgan Chase + RBC): SOFR + 3.45%, stated maturity 7/25/2026 (subject to extension); $580mm outstanding at 9/30/2025; includes 0.75% unused commitment fee on undrawn amounts. Weighted avg rate 7.85%, interest expense $40.797mm.

At the fund financial-statement level, interest expense in the Statement of Operations is $69.266mm (this will generally include stated interest plus other financing-related items captured in that line).

Collateral: both facilities are secured by a first-position security interest in select securities in a designated collateral account (i.e., asset-based borrowing secured by fund-held positions, rather than property-level mortgages).

Overall, leverage AT THE FUND LEVEL is modest at 15.6% of assets. However, the funds held in the BPRE portfolio have leverage themselves. This is a structure that I’ve railed against many times in the past. Leverage on leverage is typically not a good combination.

In the table below, the LTV is the inherent leverage of each holding. If we use the formula below for the weighted average loan-to-value to find the underlying leverate at the portfolio level, we get 42.2% (assuming Jadian, a 0.22% position, is 0% LTV).

Portfolio LTV=∑wi∑(wi⋅LTVi)

Thus, the leverage on leverage produces total leverage of 51.2%.

Debt / Equity = approx 1.05x

Assets / Equity = approx 2.05x

The real question is what are those underlying properties worth? Price discovery in the real estate market, especially in industrial, office, and non-residential sectors, can be extremely difficult to assess. We’ve seen in recent years office buildings get sold for a fraction of what they were purchased for maybe ten or fifteen years prior.

The loan to values (“LTVs”) of these funds/properties are fairly low suggesting a conservative approach. However, if you apply a reasonable discount to their values, LTVs could be above 50% or 60%. Not as conservative any longer.

From the fund’s Statement of Operations (FY ended September 30, 2025), management explicitly discloses the PIK (paid-in-kind) components of both dividend and interest income:

Dividend income: $85,950,004 total, of which $14,134,816 is PIK

Interest income: $40,922,415 total, of which $32,050,107 is PIK.

Total PIK investment income

Total PIK = $46,184,923 (= $14,134,816 + $32,050,107)

Total investment income = $126,872,419

PIK as % of total investment income = ~36.4% (46.185 / 126.872)

PIK as % of dividend income: ~16.4%

PIK as % of interest income: ~78.3%

Additionally, as of their fiscal year report, the company was reporting $127mm in investment income. Out of that, $86mm was dividends and another $41mm came from interest. The one issue is that paid-in-kind (“PIK”) accounted for the majority of that interest income and is nearly one-third of all investment income.

In the latest fiscal year ended September 30, 2025, the fund:

Paid cash distributions of $148,561,178 (shown as “Cash distributions paid” in the Statement of Cash Flows).

Declared total distributions of $210,434,855, of which $148,561,179 was elected to be paid in cash and $61,873,676 was reinvested via the dividend reinvestment policy.

The yield on the latest price is approximately 9.5%. This is in the realm of the sector average and slightly higher than the closest competitors from Cohen & Steers (RFI)(RLTY)(RQI).

If we are to assume that BPRE should trade in the same ballpark as those funds, that would mean nice upside to the valuation of the fund itself.

What Investors Should Think About

Hard assets: This fund is not a fund stuffed with loans to small and middle-market private companies with no visibility by an investor as to their profitability. This is a fund that holds high-quality real estate assets in the industrial, and primarily the logistics industries and multi-family housing.

No office or retail: While commercial real estate has had its problems in recent years, those problems have centered on retail (see malls in 2017) and then office (following Covid), not the areas that BPRE is focused on.

Mistargeted media: The articles in the news media, for instance, the Jason Zweig article in the WSJ discussing this fund, a journalist I actually like and respect, is getting this mostly wrong. This is not an issue with private assets, but of the housing of private assets in liquid and semi-liquid vehicles, especially when performance turns.

Action: This is a fund that you can now buy at a 40% discount. If these assets are really worth 40% less, which is something I have a hard time believing, then you are even -Steven. If, however, the discount is merely a function of the converting of the WRAPPER of those assets from a semi-liquid to fully liquid wrapper, and investors all rushing to the door at the same time, then that spells opportunity to me.