April 2023 Newsletter | Back To Soft Landing Scenario But Recession Now Far More Likely

Summary

The markets are really dispersed at the moment with tech shares, primarily mega tech, up 19.7% in the first quarter. Banks down 15.2%.

IG bonds, still the best place to be, were up 4.5% in the quarter with little in the way of volatility. We think this is a golden opportunity.

The Fed raised rates by 25bps again this month to a policy rate of 4.75% to 5.0%. The Fed Funds futures markets are pricing in one more hike.

The Fed pivot is gaining more clarity as inflation continues to come down, albeit slowly, but a banking crisis has partially unfolded capping future Fed movements.

Core trades include swapping NEA for NMCO, MMD for ETX, reduce WDI and adding to FFC. Mini Core swaps NEA for NMCO, reduce WDI, add to FPF.

"Nothing too good or too bad stays that way forever, because great times plant the seeds of their own destruction through complacency and leverage, and bad times plant the seeds of their own turnaround through opportunity and panic-driven problem-solving."

– Morgan Housel

Headwinds Mounting And The Inevitable Hasn't Changed

A month ago, we stated that a recession was coming and that the hotter data that came in February (January data) meant that the landing would just be harder. Amid the recent banking debacles, that is looking more likely as loan growth is likely to slow dramatically.

Small banks make a large portion of the loans to businesses in this country. We already had credit tightening and this will cause a massive deceleration in loan origination.

Think of banks making loans as the oil in the engine. As that oil dries up, the engines slows and eventually seizes without that lubrication. And credit is the ultimate driver of economic growth.

Thus, we think the hard landing scenario just got a lot harder.

However, the market may summarily rally on this outcome. For one, the markets are oversold on a technical basis. CAPE ratios are cheap and there is a growing narrative of equity returns looking brighter over the long term.

Two, bear markets are not linear meaning they do not go straight down. Behavioral investing shows us there are many phases of thought that drive markets up and down. Overall trends, however, tend to be in that negative direction.

Three, markets are pricing in a post-banking crisis environment as the VIX moves back below 20. In the past two years, selling equities when the VIX has been below 20 and buying above 30 has produced great results. In 2023, VIX prints below 20 have been short-lived.

Four, the narrative is shifting towards a rate pause environment (even if there is one more hike). There is greater clarity to the terminal rate than ever. This is allowing investors a bit of a sigh of relief allowing them to enter longer-duration trades.

We think this is the last hurrah in equities and have taken steps to reduce overall risk exposure.

Most are now expecting one additional hike and then a pause. However, the narrative shifts this year- and the subsequent volatility in the bond market ("MOVE Index") has been incredible. That narrative of one hike and then a cuts starting sometime in the back half of the year was far different just 30 days ago.

If hard data comes in much hotter than expected over the next 30-60 days, you can expect that narrative to shift again. If that is the case, I would expect a stagflationary setup to really take hold, and the potential for a much harder landing.

That scenario is where inflation stays high and the Fed is forced to raise rates more than one additional time. But we've already seen something break - a few banks - so more hikes means more banks and potential broken pieces to the economy.

That means lower growth while inflation is still sticky-high. That's the stagflationary regime. The Fed will have to walk a VERY fine line so the risk of making a mistake grows as time passes and with each hike.

It's also not linear meaning that with each additional hike, the added risk to the economy is exponential. This is why we think the chances of a hard landing have really increased- especially with the banking issues that have been happening in short order.

However, if the data is in line or cooler, which I think is my base case given the retrenchment in the banking system, then a pause is more likely. Inflation will cool quickly under this scenario.

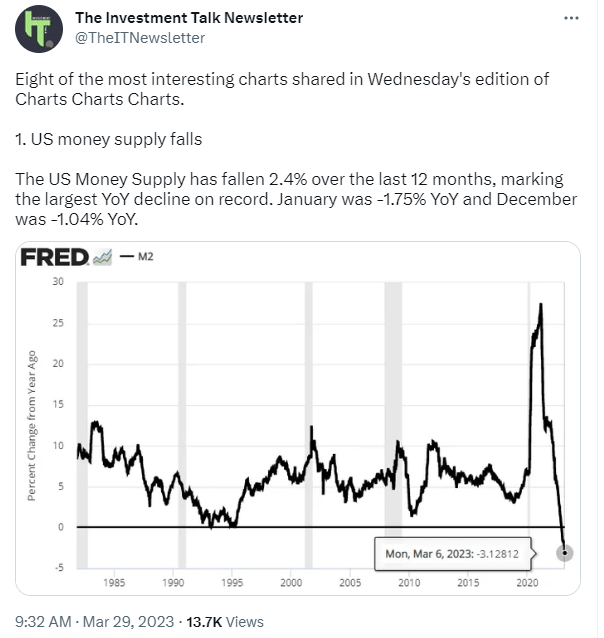

The money supply falling by this amount is helping to offset a lot of the liquidity that was injected into the economy during and after Covid. However, it will take some time to work through the system.

The question is, what does that pause/pivot look like? And what does it mean for investors?

A Light At The End Of The Tightening Tunnel

Keep reading with a 7-day free trial

Subscribe to Yield Hunting to keep reading this post and get 7 days of free access to the full post archives.